Introduction

Japan, with its USD 4.98 trillion economy, is the third-largest economy in the world, behind the US and China. Home to some of the most well-known companies in the world like Toyota, Sony, Mitsubishi and Nissan, the Japanese economy is unique and innovative. From manufacturing humanoid robots to offering on-demand artificial shooting stars, the land of Cherry Blossoms effortlessly combines the old with the new and has an exciting startup ecosystem.

Startups considered for this analysis are unlisted non-government entities that have raised more than $100 million (USD) of capital to date. Also included are start-ups which have been acquired but whose identity has largely been intact and subsidiaries of private/public companies. Overall, 24 startups have been considered for this analysis.

The startups have been classified according to various industries based on data from Pitchbook, and the sector classification is based on the Global Industry Classification Standard (GICS). The sector classification is subjective and has been made considering the sector/industry the startups closely resemble.

Analysis

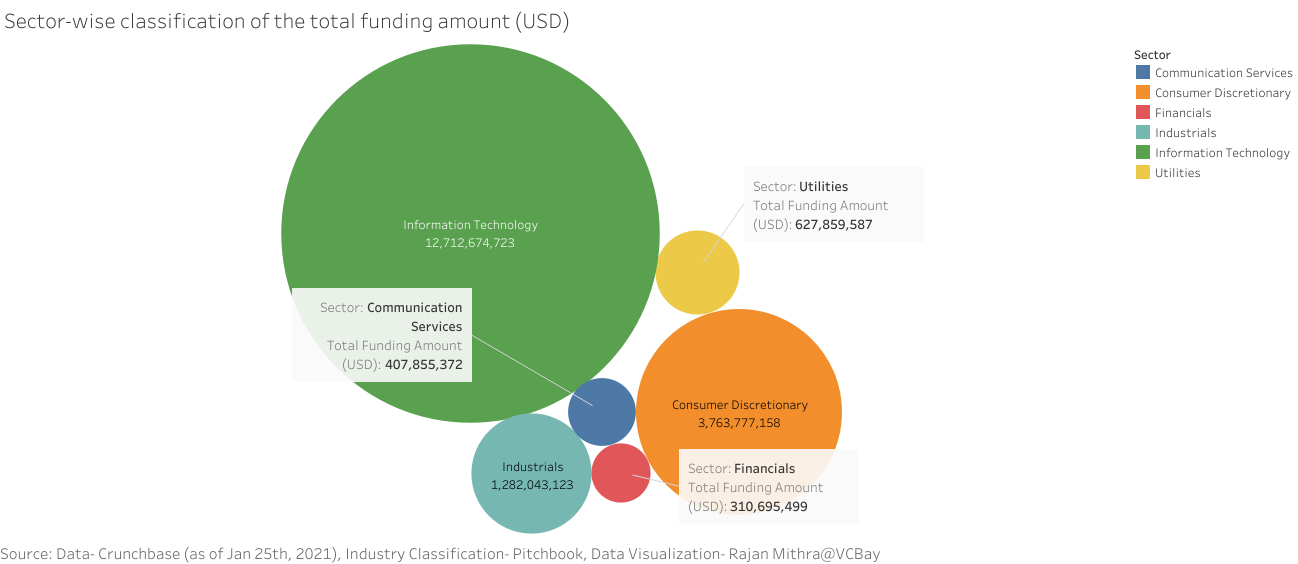

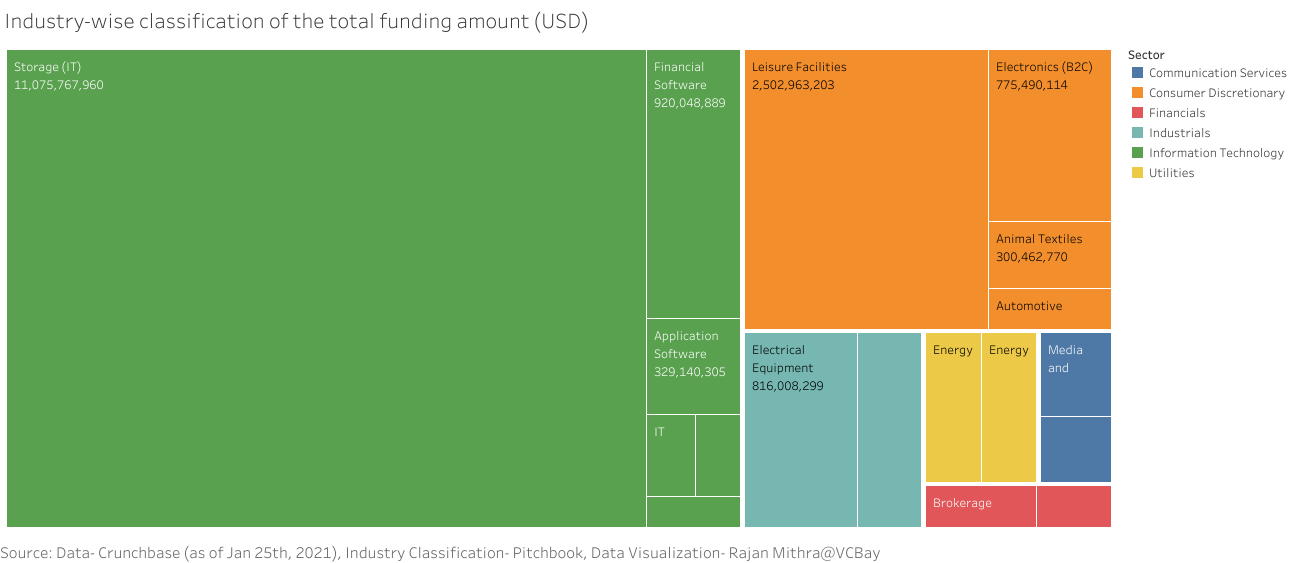

The total funding raised by startups in the information technology (IT) sector is by far the largest among all other sectors. The staggering $12.7 billion (USD) raised by the startups in this sector is roughly ten times the funding raised by those in the industrial sector. The sector is home to well-funded startups, with four startups making an appearance in the top 10 list based on the total funds raised.

The IT sector is ranked No.1, with 38% of the total number of startups. The sector is composed of predominantly software-based startups ranging from application software to business/productivity software.

Nearly 87% of the funds raised by the IT sector startups has flowed to a single startup- Kioxia, which has raised $11.07 billion (USD) till date. Kioxia manufactures semiconductor components used in various gadgets such as PCs, laptops, smartphones and tablets. The startup is backed by some of the largest banks in the world-Development Bank of Japan, Sumitomo Mitsui Banking Corporation, MUFG Bank and Mizuho Bank. PayPay is a mobile payment app that improves the shopping payment experience. The startup has raised $418 million (USD) and is backed by investors such as SoftBank, Mizuho Securities, and Mobile Internet Capital.

Startups in the consumer discretionary sector are ranked second in terms of the funds raised, as well as the number of startups (5). Around $3.7 billion (USD) has flowed to startups in various industries such as leisure facilities, electronics (B2C) and automotive. The Tsuruoka, Japan, based startup- Spiber which specializes in the synthetic production of materials such as spider silk has raised close to $300 million (USD) to date in 13 rounds from investors such as MUFG Bank, Toyoshima, The Yamagata Bank, Toyota Boshoku America, and Shinsei Bank, among others.

Softbank Robotics develops and sells autonomous humanoid robots which assist humans in their day-to-day activities. The robots have various use cases across different industries such as tourism, health, research and education. The startup has raised $236 million (USD) from acclaimed investors- Alibaba Group and Foxconn Technology Group.

The industrial sector which has attracted 6.7% of the total funds raised or $1.2 billion (USD) has some of the most exciting startups with 75% of them belonging to the aerospace and defense industry, a notable exception being JOLED which is in the electrical equipment industry. The manufacturer of organic light-emitting diode (OLED) lights, JOLED has raised $816 million (USD) and is ranked third among the top 10 startups based on the total funds raised. Astroscale is a truly unconventional startup which offers space debris removal services. Promoting sustainable space systems, the startup aims to mitigate the hazardous buildup of space debris and has raised over $204 million (USD) in 9 funding rounds from 28 investors.

Shooting stars have been romanticized by Hollywood for decades, but have you seen one in real life? If not, you are in luck- ALE provides on-demand artificial shooting stars and meteor showers. To create this effect, the company uses microsatellites packed with pellets which are released from outer space. Backed by investors like Horizons Ventures, SPARX Group and Shinsei Corporate Investment Limited, among others, the startup has raised $139.6 million (USD) in 4 funding rounds.

The utilities sector has raked in $627 million (USD) in funding, which is more than twice the amount raised by startups in the financial sector. ELIIY Power manufactures large-sized lithium-ion batteries and power storage systems for indoor and outdoor use. The startup has raised $310 million (USD) in 9 funding rounds from 23 investors.

Conclusion

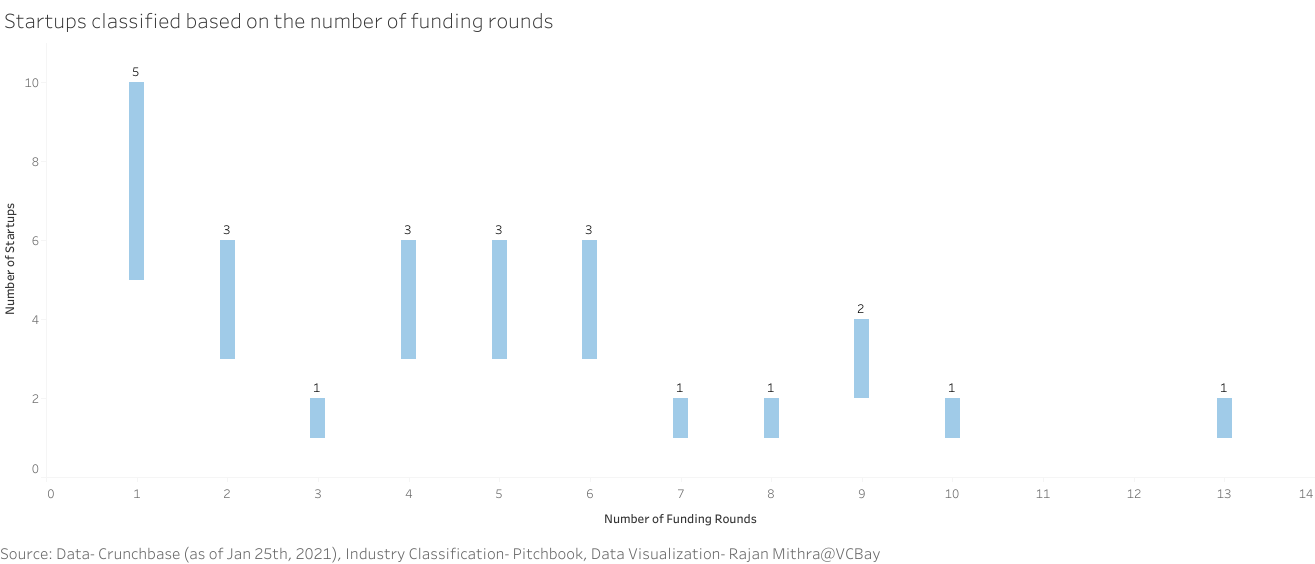

Overall the Japanese startups have raised more than $19 billion (USD), led by startups in the information technology sector. The IT sector is ranked first in terms of both the number of startups and the total funding raised, followed by the consumer discretionary sector, which is ranked second on both the metrics. A majority (62.5%) of the startups have raised funding in 1 to 5 rounds. A distinctive feature of the Japanese startup ecosystem is the active role played by Japanese banks in funding the startups.

We try our best to fact check and bring the best, well-researched and non-plagiarized content to you. Please let us know

-if there are any discrepancies in any of our published stories,

-how we can improve,

-what stories you would like us to cover and what information you are looking for, in the comments section below or through our contact form! We look forward to your feedback and thank you for stopping by!

Next Story

[…] The $100M+ Dollar Club of Japanese Startups […]

[…] of less than or equal to $50 million (USD). In stark contrast to other developed nations such as Japan, South Korea, and Canada, where the information technology or the consumer discretionary sector […]