Introduction

Will Facebook’s new currency be stopped in its tracks?; If Facebook or Google create their own currency, they can control our lives; Payment firms back out in painful blow to Facebook’s cryptocurrency Libra; Facebook’s Diem stablecoin is an existential threat to traditional banking; Facebook sued over Calibra’s look-alike logo; Would you trust this man with your money?

Those were some of the headlines of articles covering Facebook’s Diem (formerly known as Libra). Facebook has opened a Pandora’s box-battling on several fronts and to say that the social media giant’s crypto project is facing setbacks, is an understatement. From economists to privacy experts to regulators-everyone is alarmed at the possibility of Facebook launching its own currency. While this might seem like an extreme reaction to some, it is totally warranted- the ever-expanding power of Big Tech and the numerous scandals that Facebook has gotten itself into over the years has depleted the public’s trust. So what exactly is at stake? What does the entry of Diem mean for the economy? The second and final part of this series will focus on these questions and more.

New Name, New Me

In June 2019, Facebook unveiled its plans for Libra and its digital wallet subsidiary- Calibra. Soon after the launch, Calibra’s logo, which is a wave-like pattern, quickly ran into trouble as it resembled the logo of an already existing Fintech company- Current.

The New York, USA based Fintech startup which aims to make banking more accessible and affordable did not let the issue slide and filed a lawsuit against Facebook, alleging trademark infringement. The suit named four defendants- Calibra, Facebook, a Facebook subsidiary that owns the IP related to Calibra and Character- the design studio that made the logo. The peculiarity, in this case, arises from the fact that both the logos were designed by the same studio- Character, 3 years apart with Current claiming that it started using its logo from August 2016.

Upon realizing that its cryptocurrency initiative was widely “disliked” by almost everyone especially the regulators (more on that later), Facebook changed the name of the cryptocurrency to Diem (meaning day in Latin), Libra Association- the independent organization which heads the project, to Diem Association and the digital wallet subsidiary- Calibra to Novi.

But its problems didn’t end there, Facebook faces a potential lawsuit from another Fintech firm- Diem, due to the use of its name. The London, UK based startup which acts like a digital pawnbroker, allows customers to sell their possessions without waiting for bidders on eBay. Geri Cupi, the founder and CEO of Diem, was naturally concerned by the fact that there are now two Diems in financial services which will confuse customers and may hamper its growth.

Messy Breakup

Realizing that Facebook still has many issues that are yet to be sorted out and with regulators threatening to investigate companies involved in the project, six founding members of the Diem Association pulled out. But they didn’t rule out the option of getting involved in the project in the future. The companies that ended their association were some of the biggest names in the digital payments industry- Visa, MasterCard, PayPal, and Stripe followed by companies from other industries like eBay, Mercado Pago and Bookings Holdings. With this messy breakup, Diem has lost out on domain expertise, authenticity and strategic relationships that it desperately needs.

Visa: Visa’s ubiquity and brand value could have lent immense credibility to Diem. With its departure, Diem can potentially have a weaker presence in brick-and-mortar stores.

MasterCard: With their combined presence,- Visa and MasterCard brought credibility and unmatched expertise to the project. But now they can potentially work against the interests of Diem, which is aiming to eliminate transaction fees altogether.

PayPal: Diem finds itself in a situation that is similar to when PayPal initially launched in the early 2000s. The massive network of online merchants that accept PayPal combined with the popularity of its peer to peer payments app- Venmo could have immensely benefited Diem. PayPal could have also helped Diem gain the trust of the public, similar to how it successfully convinced the public to adopt digital payments.

Stripe: Diem could have leveraged the popularity that Stripe has with e-commerce vendors. Together, Stripe and PayPal process a significant portion of the transactions outside of China.

eBay: Being one of the largest e-commerce platforms with millions of users, eBay could have provided the massive reach that Diem needed.

Mercado Pago: Argentina based financial services company-Mercado Pago offers services to help merchants receive their payments through email or instalments. Mercado could have guided Diem on how to increase the penetration of financial services in underserved areas, a central tenet of the Diem project.

Bookings Holdings: It is the parent company of Booking.com, Kayak, and Priceline- websites that facilitate travel reservations. Travel reservations being one of the segments where credit cards are used to spend thousands of dollars- Diem could have potentially cut the transaction fees making Bookings’ products more competitive.

A Wakeup Call

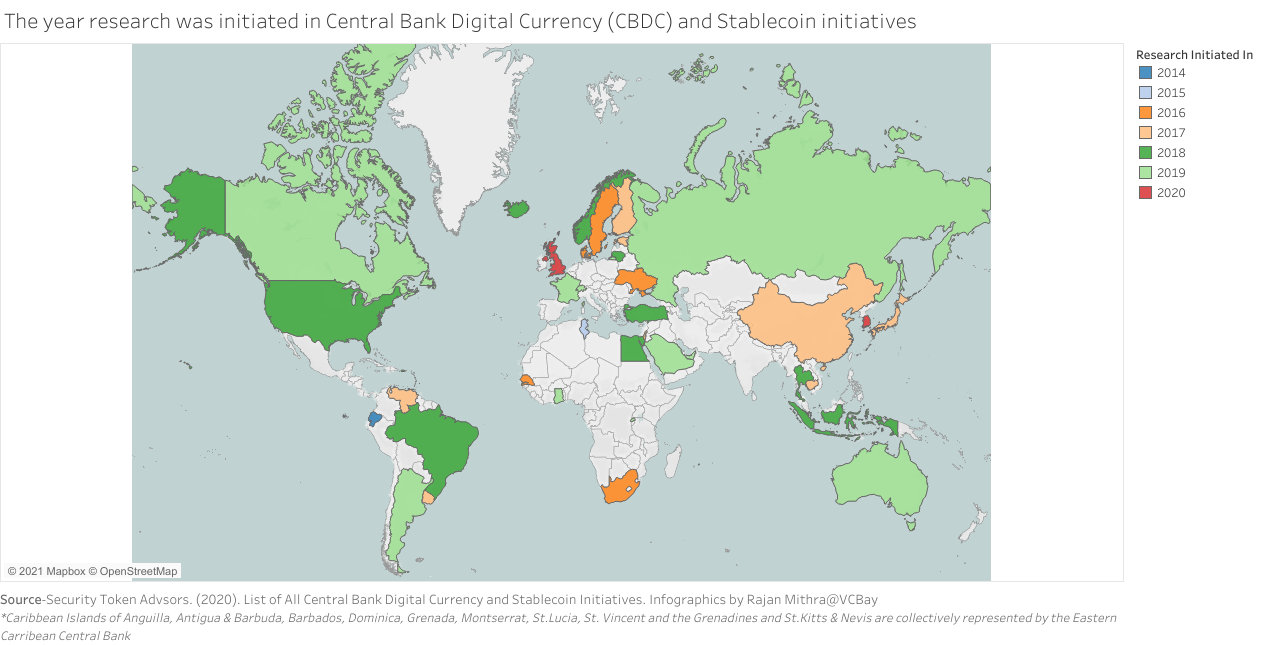

Facebook’s entry into digital currencies accelerated the ongoing research of central banks into the viability of Central Bank Digital Currencies (CBDC) and stablecoins. Central banks are well aware that if they fail to create their own digital currencies, they risk being disrupted by Diem with potentially far-reaching consequences.

CBDC is essentially a blockchain-based digital form of the fiat currency of a country. Similar to regular currency, it will be issued and regulated by the monetary authority of a country. Stablecoins, as the name suggests are cryptocurrencies that have a relatively stable value because they are backed by a reserve of a single fiat currency or a basket of currencies. Diem being a Stabelcoin can act as a store of value, and with Facebook’s 2.7 billion monthly active users (MAU), Diem can instantly become a medium of exchange for large swathes of the population.

Successful launch of a stablecoin has a multitude of requirements-

- Secure wallet storage

- Good corporate governance

- Data protection

- Tax compliance

- Cybersecurity

- Anti-money laundering measures

- An adequate amount of reserves

The working paper on stablecoins issued by the G7 in Oct 2019 states that while stablecoins can facilitate faster and cheaper global payments, they can pose a risk to monetary policy, fair competition, financial stability and the international monetary system.

The stakes are higher when Diem attains widespread adoption with numerous threats to the financial system-

- Diem’s reserve: Though Diem will be backed by low volatility assets, an unexpected rise in the interest rates can lead to a reduction in the value of the government bonds held as a part of the reserves. This results in the reserves being inadequate to redeem the Diem in circulation, potentially leading to a bank run of sorts.

- Economic policies: When a sizable portion of a country’s population replaces the national currency with Diem, it can potentially undermine the power of the country’s monetary authority and the government. The monetary policy will not work as well, and the nation would be fully exposed to the vagaries of unregulated international capital flows that can wreak havoc on its economy.

- Banks: Providers of stablecoins can possibly dethrone banks as the intermediaries between the central bank and the consumers. Despite Diem Association stating that they aren’t a bank, they are engaging in bank-like transactions, and if Diem attains global adoption, it can essentially become a global bank posing global risks.

There are multiple organizations already working on the objectives that Diem has set out to achieve, and they’ve made quite some progress over the years without posing a threat to the financial system. Ripple, the real-time gross settlement system, currency exchange and remittance network based in San Francisco, USA, facilitates transfers between commercial banks at a fraction of the cost using distributed-ledger technology and proprietary cryptocurrency. Society for Worldwide Interbank Financial Telecommunication (SWIFT) which facilitates interbank transfers has ensured faster transfer of funds between banks in Asia, North America and Europe through its Swift gpi Instant system. Other examples include revolutionary mobile phone-based money transfer service- M-Pesa and Project Stella– a joint initiative of European Central Bank (ECB) and the Bank of Japan in exploring the use of distributed-ledger technology in domestic and cross border payments.

Conclusion

Big Tech and Facebook, in particular have already encroached into almost every sphere of our life. With Diem, Facebook can potentially get unprecedented access to our finances, harvesting data from millions of people across the globe and further strengthen its position as a tech giant. Considering the current trend, digital currencies are inevitable, but they should not come at the cost of what we hold dear-privacy.

We try our best to fact check and bring the best, well-researched and non-plagiarized content to you. Please let us know

-if there are any discrepancies in any of our published stories,

-how we can improve,

-what stories you would like us to cover and what information you are looking for, in the comments section below or through our contact form! We look forward to your feedback and thank you for stopping by!

Next Story

[…] Next Story […]

[…] premium compared to the broader benchmark of the S&P 500. To make matters worse, companies like Facebook have even welcomed the deal. One of the possible solutions to make the deal more effective is to […]