e-Grocery Wars

In the world of fruits and veggies, there’s a mini-war brewing between startup giants BigBasket and Grofers, who are fighting to dominate the e-grocery space. BigBasket and Grofers accounted for 80% of the online groceries segment in 2019. The competition is set to intensify further with the entry of JioMart and the e-commerce giants Flipkart and Amazon aggressively expanding their offering.

Making up 60% of the Indian retail market, groceries are a $380 billion (USD) industry (as of 2019) while online penetration stands at a meagre 0.5%. The Indian e-grocery market was worth $1.9 billion (USD) in 2019 and is expected to be worth $18 billion (USD) by 2024, growing at 57% CAGR.

With more companies promising same-day deliveries of groceries, there has been an increase in demand for in-city warehouses which are 5000-10000 sq ft in size. Most warehouses in top Indian cities are located in the periphery away from most of the customer base, which has increased delivery times and transportation costs.

The pandemic fundamentally altered many industries, e-grocery being one of them, the industry benefited from the pandemic as more people started ordering groceries online. According to a report by RedSeer and BigBasket, the industry’s Gross Merchandise Value (GMV) in 2020 is estimated to be 70% higher than its level in 2019. Fresh vegetables and fruits recorded a 144% growth, and FMCG products grew at 150% in the initial days of the lockdown. The increased online orders even attracted players like FoodTech giants – Zomato and Swiggy, who wanted to cash-in on the opportunity but have since scaled down their grocery operations. Swiggy which operates food delivery services in 500 cities, has restricted its grocery operations to just 20 cities, and Zomato has scaled down its Zomato Markets feature. But the pandemic had its downsides too.

Amidst the utter chaos and confusion during the initial days of the lockdown last year, e-grocery businesses struggled to keep their operations running. There was a massive difference between the guidelines issued by the central government and the state’s interpretation of it; this resulted in e-commerce delivery personnel being stopped and even beaten up by the police. Both startups faced difficulties in keeping up with the massive influx of orders and had to manage with a reduced workforce resulting in delivery disruptions. Due to the uncertainty surrounding the situation, the startups resorted to salary cuts for the workforce and offered stock options instead.

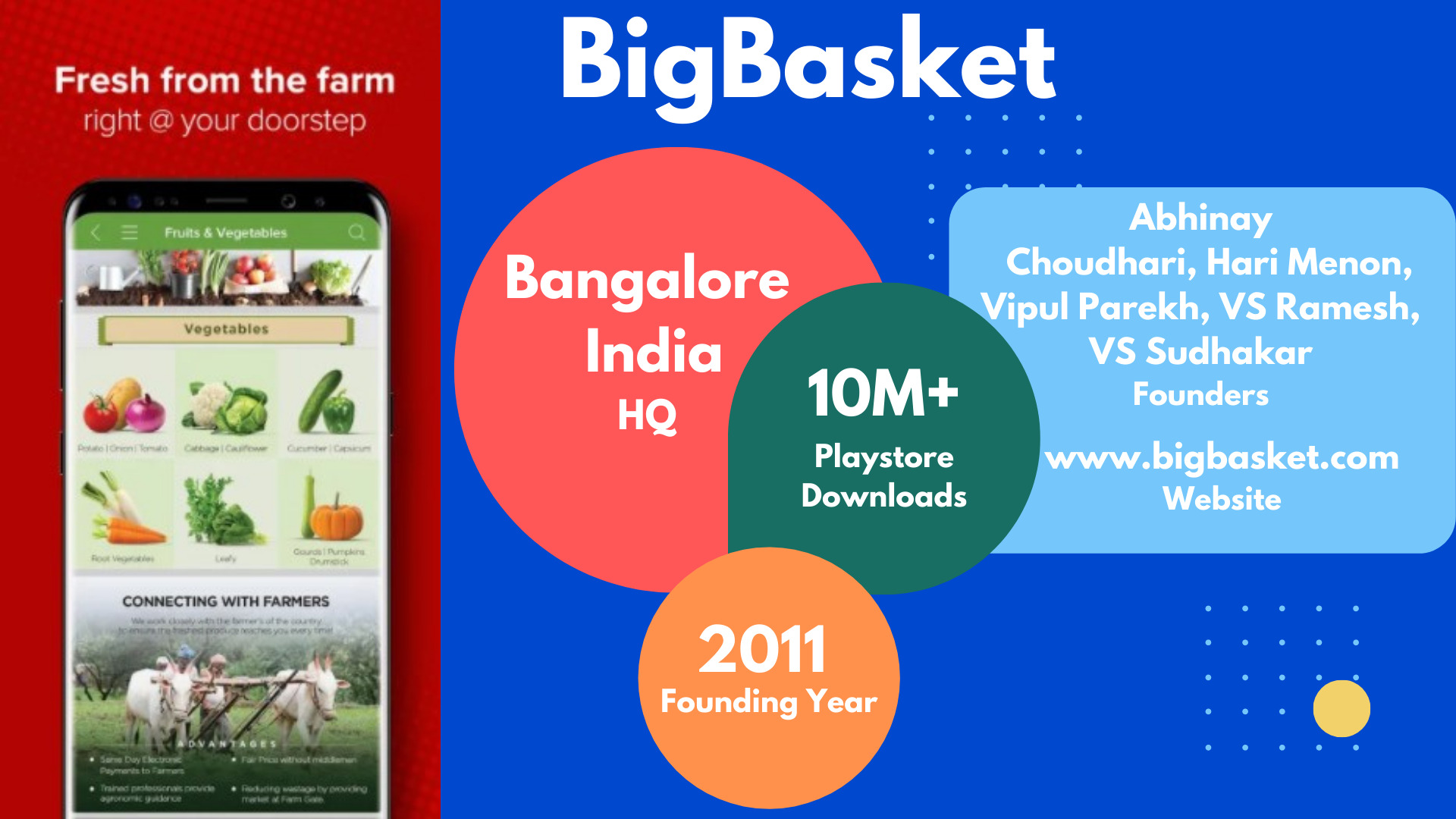

BigBasket

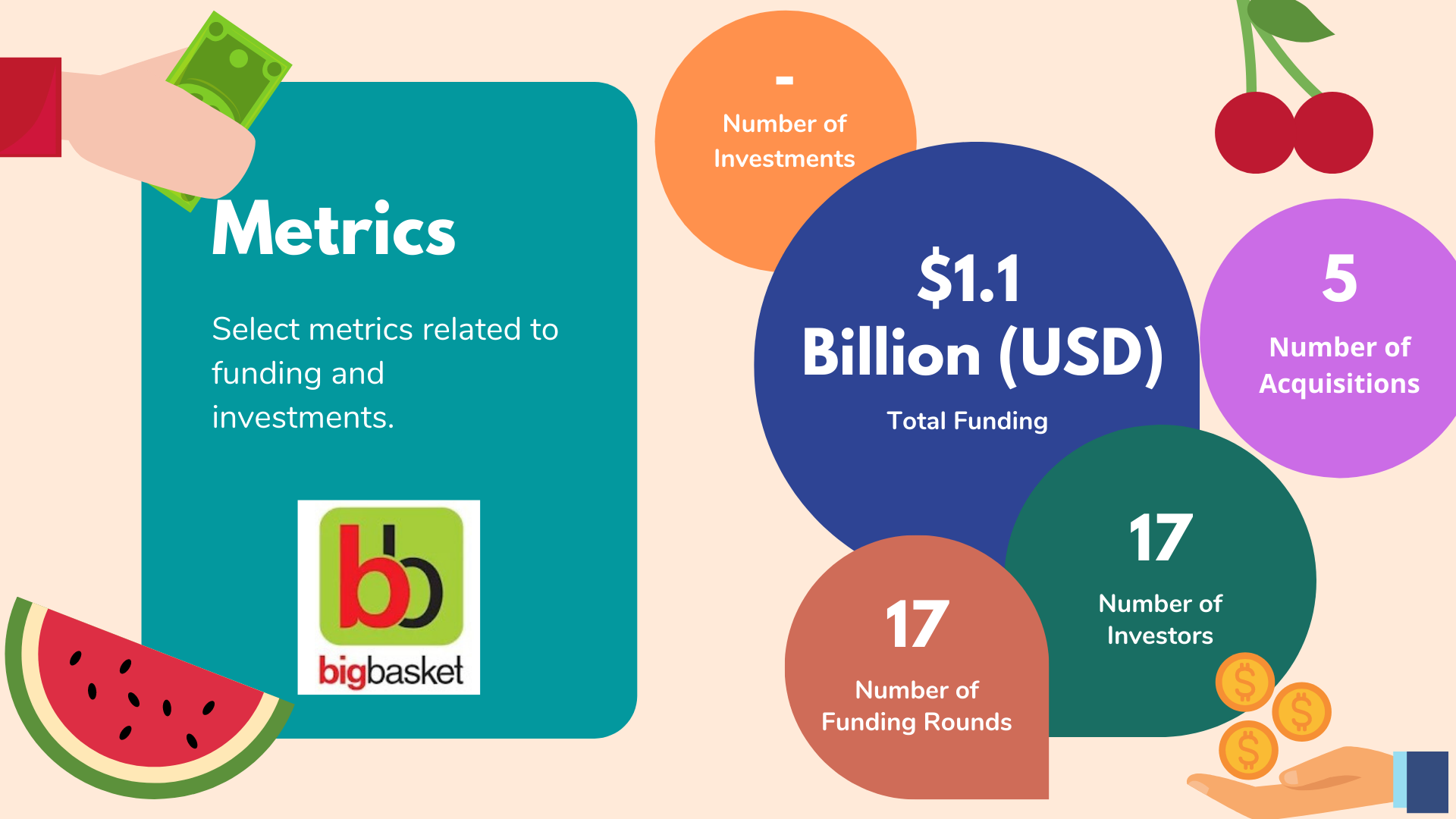

The Alibaba backed startup has come a long way from its humble origins in a small office in Bangalore (located in the southern part of India). Currently operating in 24 cities across the nation and boasting a massive workforce of 25,000, the Hari Menon led startup is recording 20 million orders per month and recently achieved a $1 billion run-rate in annual revenues. According to Crunchbase, the startup has raised $1.1 billion (USD) to date in 17 funding rounds from acclaimed investors like Alibaba Group, Helion Venture Partners and Trifecta Capital Advisors among others; the startup has acquired five companies – DailyNinja, Raincan, KWIK24, Delyver and Morning Cart between June 2015 and March 2020.

The startup’s current strategy is to go deeper into the markets rather than expanding and spreading itself thin. Over 80% of BigBasket’s vegetables and fruits are directly procured from farmers, and the startup aims to shift to entirely organic produce in the next 3 to 5 years. It is also trying to go green with its last-mile delivery fleet going electric and its warehouses powered by solar energy.

Aided by the pandemic, the startup saw an 84% increase in new customers along with 50% higher retention over pre-COVID levels. Apart from fresh fruits, food items such as chocolates, savoury snacks, and cup noodles recorded 50% to 140% growth over their levels in February 2020.

The e-grocery giant has an extensive array of items on its storefront totalling 30,000 stock keeping units (SKU) with total sales of Rs 3250 crore (~ USD 440 million) for the financial year ended March 2019. It is estimated to record revenues of Rs 5,000 crore (~USD 680 million) in FY20 and Rs 7000 crore (~USD 950 million) this year. The Bangalore based startup has significantly expanded its offering-setting up dark stores, collection centres at farm locations and installing vending machines at offices and apartments. BB Daily is a unique service which allows customers to subscribe to daily delivery of milk, bread and other essentials. Clocking 160,000 deliveries per day, BB Daily got an additional boost from BigBasket’s acquisition of DailyNinja– a hyper-local delivery platform with a network of 2000 milkman partners across the nation.

The startup’s formidable position in the e-grocery business has caught the attention of Tata group which is said to be in advanced talks to buy 80% stake valuing the startup at a staggering $1.6 billion (USD). The salt to software conglomerate is altering its strategy to counter the influence of Reliance Industries Ltd led by Asia’s richest man-Mukesh Ambani. The Tatas want to bring their diverse businesses into an all-in-one e-commerce app featuring their jewellery stores-Tanishq, Titan watch showrooms, Star Bazaar supermarkets and their chain of the Taj hotels among others.

But the startup’s journey in 2020 hit a roadblock in November when details of 20 million of its users were put on sale on the Dark Web. According to the cyber intelligence firm Cyble, a hacker had put the details of the users on sale for $40,000 (USD), which included details of names, email IDs, password hashes, contact numbers (mobile and phone), addresses, date of birth, location, and IP addresses of login. BigBasket filed a police complaint with the cybercrime cell in Bengaluru and assured that privacy of its customers is paramount and that it doesn’t store financial data including credit card numbers.

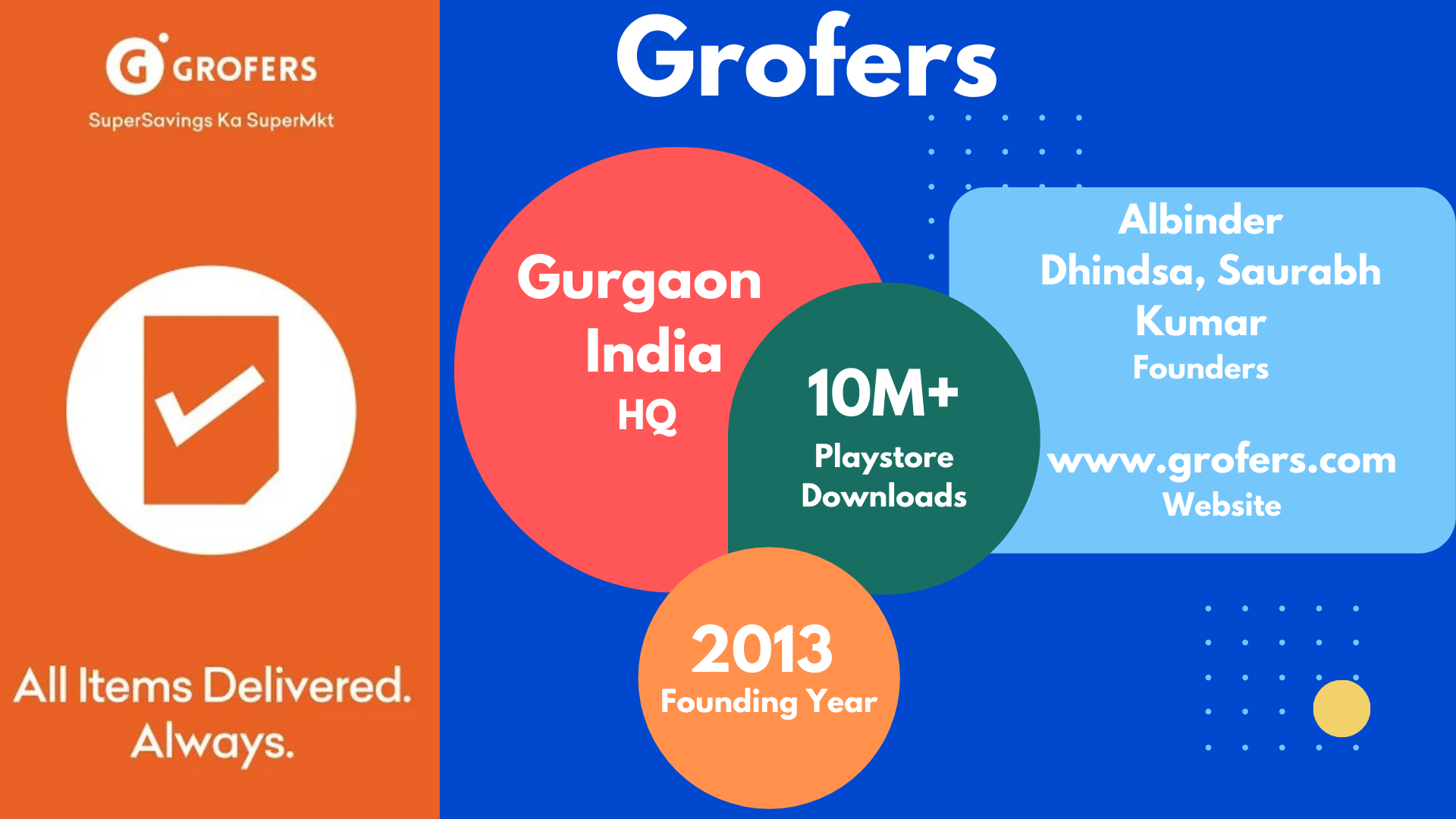

Grofers

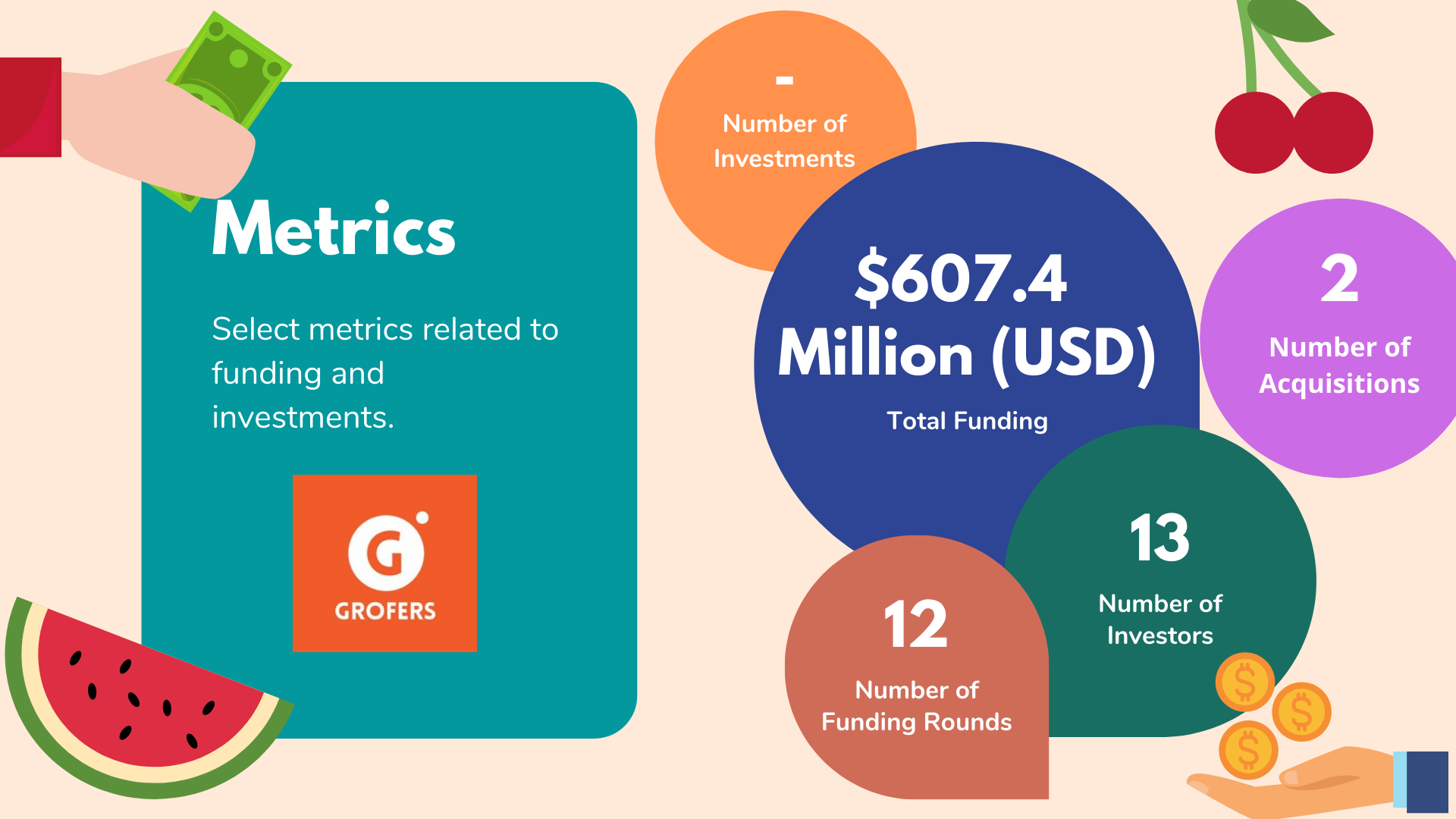

Albinder Dhindsa led Grofers, currently operating in 27 cities is a Gurgaon, Haryana (located in the northern part of India, close to the national capital of Delhi) based startup which has raised approximately $607.4 million (USD) to date. Started in 2013, the startup has raised funding in 12 rounds from prominent investors like Tiger Global Management, Sequoia Capital India, SoftBank and Trifecta Capital Advisors. According to Crunchbase, it has made two acquisitions- Mygreenbox and Townrush.

Dhindsa who served as the Head of International Operations for Zomato was faced with a setback in 2016 when Grofers which experienced two years of hyper-growth had to scale down its operations in nine cities and modify its business model as it was losing more money than it was making. The startup was struggling to raise money between 2015 and 2018 as competition from BigBasket and others intensified, and when it finally raised money in March 2018, its valuation had eroded by 35%. This forced Dhindsa to tweak the business model further, shifting his focus to the price-conscious middle-income consumer, launching private labels, concentrating on fewer cities and finally moving from a pure-play marketplace to a stock-keeping model and it paid off. Recording $1 billion (USD) in Gross Merchandise Value (GMV) in FY 2020, the startup has projected that its GMV will double every year to reach $4 billion (USD) by 2022. The Gurgaon based startup also benefited from the post-lockdown increase in online orders, acquiring 1.8 million new customers post lockdown with a 54% rise in orders from Tier II/III cities.

It has increased its focus on private labels which make up 40% of its sales, set to rise to around 60%-65% in the future. Private label products being cheaper are favoured by the customers and provide a higher margin of approximately 5-10% for Grofers. To accommodate the increased demand, Grofers is planning to hire 3000 to 4000 people in the coming months to strengthen its supply chain.

With grocery being a tough business with low margins, Grofers is looking to enter new categories such as fashion and lifestyle products, winter assortment category which includes blankets, comforters, room heaters etc.

The SoftBank backed startup is currently selling low-priced items in apparel, footwear, non-clothing and travel accessories again concentrating on private labels. According to RedSeer, the growth of online fashion at 32% CAGR dwarfs that of the fashion market as a whole growing at 11% CAGR. But with competition from Flipkart led Myntra and Reliance Industries’ Ajio, it could be tough to gain market share.

The Behemoths

Reliance Industries led JioMart is the latest entrant in the e-grocery business. Launched in May 2020 (beta launch in December 2019), JioMart is already shaking up the industry with a million daily active users and 2.3 million active users every month according to a report by JP Morgan. The Mukesh Ambani led initiative already has a presence in over 200 cities across the nation, which is around seven times more than the number of cities that BigBasket and Grofers are operating in. The company has adopted an Omni-channel distribution model using both online and offline distribution channels. With an offline network of 11,784 stores, the company has integrated its vast customer database from Reliance Fresh and Reliance Smart into JioMart.

Within 2 months of its launch, the company was already clocking 250,000 orders per day while BigBasket was doing around 220,000 orders per day and comparable figures for Grofers and Amazon (through Amazon Pantry) were 150,000 orders.

Given its progress in its first year of operations, Reliance’s e-commerce business is projected to record annual revenues of over $59 billion (USD). The ten million mom-and-pop stores in the country account for 90% of grocery retail, and JioMart has partnerships with them in 20 cities. Reliance’s acquisition of Future Retail which runs a network of hypermarkets- BigBazaar, for close to Rs 25,000 crores (~USD 3.4 billion) gives it further access. But the deal has been challenged by Amazon in India and abroad. JioMart is also set to use WhatsApp to connect local grocery stores with customers.

Walmart led Flipkart is also aggressively making inroads into the e-grocery space and launched its hyperlocal delivery service- Flipkart Quick in July 2020, which enables customers to order grocery, fresh vegetables, meat and mobile phones and get them delivered in 90 minutes. Initially available in select locations in Bangalore, the service is expected to be expanded to six more cities. To offer the service, the company is leveraging its partnerships with delivery startups Shadowfax, Ninjacart and its own logistics arm-Ekart.

Conclusion

e-Grocery has rapidly evolved in a relatively short period, with industry giants Amazon, Flipkart, Reliance competing with the likes of startup giants BigBasket and Grofers. The victor will be the one with the deepest pockets and the one who offers the most value to the price-conscious Indian consumer.

We try our best to fact check and bring the best, well-researched and non-plagiarized content to you. Please let us know

-if there are any discrepancies in any of our published stories,

-how we can improve,

-what stories you would like us to cover and what information you are looking for, in the comments section below or through our contact form! We look forward to your feedback and thank you for stopping by!

Next Story

[…] Next Story […]

[…] Two startups, namely Zymergen and Grofers, have filed for an IPO. Grofers is a Gurgaon, India-based e-grocery startup led by Albinder Dhindsa. Founded in 2013, the startup has raised $410 million (USD) across […]

[…] in 2011, BigBasket is an e-grocery giant that allows users to buy anything from fruits and veggies to gardening and […]