High-Stakes is a unique series that focuses on dissecting the investments of venture capital and private equity firms to gain insights into the portfolio of companies they’ve invested in, industries they focus on, and their investment process. In this edition of High-Stakes, we’ll be focusing on SoftBank’s Vision Fund.

Legendary investor Masayoshi Son led SoftBank Vision Fund is the largest tech fund in history. Launched in 2017, the Vision Fund has raised more than $100 billion (USD) across two funds, the latest of which was announced in Jul 2019. Vision Fund I, raised $98.6 billion (USD), with a majority of it coming from the Public Investment Fund– Saudi Arabia’s sovereign wealth fund and Mubadala Investment Company– UAE’s sovereign wealth fund. The fund’s other notable investors include the SoftBank Group itself, which has poured in $33 billion (USD) and is also backed by the likes of Apple, Foxconn and Qualcomm. The fate of the Vision Fund II, which aims to raise a staggering $108 billion (USD), hangs in the balance as its predecessor posted a record $18 billion (USD) loss as it wrote down the valuations of companies like WeWork and Uber. Vision Fund II, which is solely aimed at investing in artificial intelligence (AI) has just managed to raise $38 billion (USD) and is backed entirely by the SoftBank Group.

The Vision Fund is just one part of the sprawling SoftBank group, which includes 47 branches of investing and holding companies. The group has additional funds, namely-

- SoftBank Innovation Fund: The fund is focused on tech in Latin America.

- SoftBank Venture Aisa: It is a $1.1 billion (USD) collection of 12 funds, all focused on investing in tech in Asia.

Founders seeking investments visit SoftBank’s offices located in San Carlos in San Francisco or in Mayfair, London, and less than 5% of them receive funding. Masayoshi, or Masa as he is fondly called believes in the power of capital and the potential for unlimited synergies among his portfolio of companies. Masa is infamous for providing more funds than required by the startups, and when questioned about the excess funds, Masa threatens to invest in the startup’s rivals, leading the startups to accept the funds. A majority of the external contributions (60%) to Vision Fund I are in the form of debt which earns 7% semi-annually.

Team

Leading members of the team:

Masayoshi Son– Chairman & CEO, SoftBank Group Corp

Son founded SoftBank in Sept 1981 to distribute personal-computer software in Tokyo. Driven by Son’s ambitions, SoftBank ended up distributing 80% of PC software in Japan. The company grew into a global conglomerate by picking up stakes in companies like Yahoo, and in the early 2000s, Son’s personal wealth briefly overtook that of Microsoft’s founder-Bill Gates, and then the Dotcom crash happened, which wiped out 99% of SoftBank’s market value. One of Son’s most rewarding investments is the $20 million (USD) that he poured into Alibaba, and SoftBank’s 28% stake was said to be worth $140 billion (USD) in 2018.

Rajeev Misra– CEO, SoftBank Investment Advisers

Rajeev, Son’s close confidante, was instrumental in securing investments from Saudi Arabia’s crown prince- Muhammad bin Salman who pledged $45 billion (USD) to the fund as he wanted to diversify Saudi Arabia’s economy and move away from oil. The MIT Sloan School of Management grad has held several top positions over the years, serving as the Managing Director and Partner at Fortress Investment Group and Global Head of Fixed Income, Currencies and Commodities at UBS. He built the global fixed income business of Deutsche Bank from scratch, recruiting and mentoring employees while serving as the Global Head of Credit and Emerging Markets.

Ron Fisher– Vice Chairman, SoftBank Group Corp and Head of SoftBank Investment Advisers US Activities

Ron joined SoftBank as Director and President in Oct 1995 after serving as CEO of Phoenix Technologies and President of Interactive Systems Corp. Ron later went on to hold board positions in SoftBank Investment Advisers, Brightstar Global Group, ARM Holdings and most recently, T-Mobile US Inc.

Analysis

A total of 156 investments across 115 startups have been considered for this analysis, and the analysis is based on data from Crunchbase. The startups included are those for which adequate information exists, and this is by no means an exhaustive list of all the investments made by the Vision Fund. The total funding raised indicates the total amount of funding raised by the startups from Vision Fund and various other investors across the different rounds that SoftBank Vision Fund has participated in. The estimated revenue range was available for 102 startups, and the funding amount was available for 151 investments.

The startups have been classified according to various industries based on data from Pitchbook, and the sector classification is based on Global Industry Classification Standard (GICS). The sector classification is subjective and has been made considering the sector/industry that the startups closely resemble.

Around 79% of the startups are private, and 6% have been acquired/merged, and 13% have gone public. Two startups, namely Zymergen and Grofers, have filed for an IPO. Grofers is a Gurgaon, India-based e-grocery startup led by Albinder Dhindsa. Founded in 2013, the startup has raised $410 million (USD) across three funding rounds between 2015 and 2019. It is backed by prominent investors such as Sequoia Capital India, Tiger Global Management and Softbank Vision Fund. Zymergen is a US-based biofacturing company that recently got listed on Nasdaq and raised $500 million (USD). The company designs, develops and manufactures bio-based products by combining biology, chemistry, software and automation. The company has raised $700 million (USD) across two rounds, with its most recent one in Sep 2020.

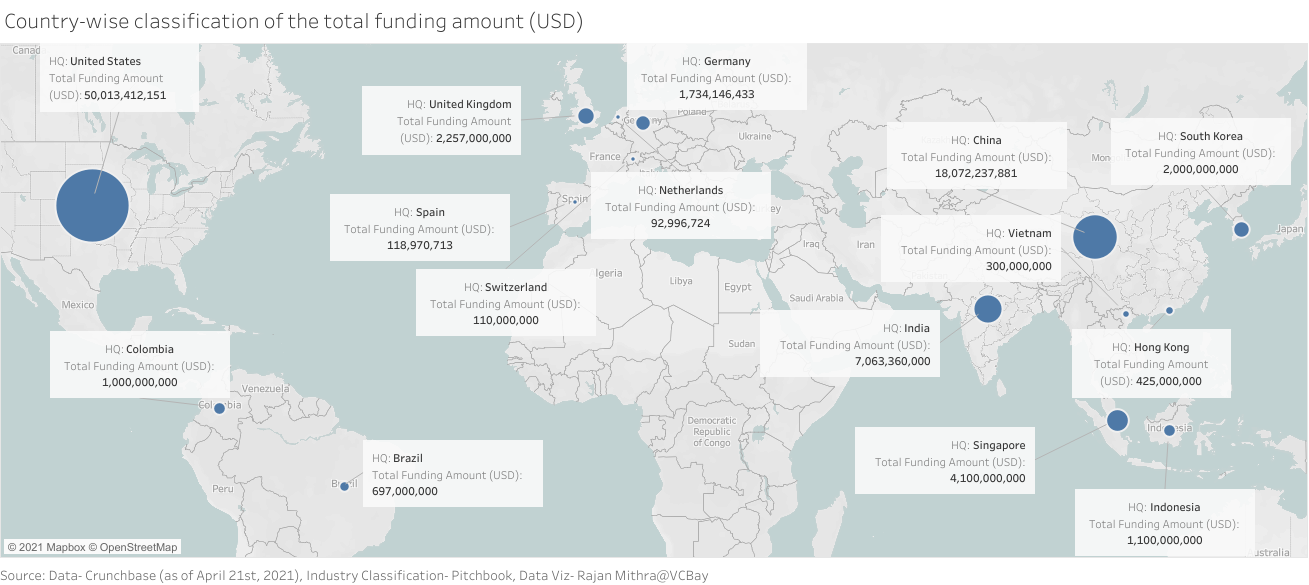

More than half of the funding amount (USD 50 billion) has flowed towards US-based startups, followed by China with 20% of the funds or $18 billion (USD) and India with 7.9% or $7 billion (USD).

The consumer discretionary sector is home to 23% of the startups and has attracted nearly 30% of the funds or $26.6 billion (USD). The most prominent industries in this sector include internet retail, other restaurants, hotels & leisure and educational software. Together they constitute 59.2% of the funds flowing to this sector. India-based Oyo Rooms, dubbed as India’s Airbnb, offers a branded network of hotels designed to provide standardized stay experiences. Founded in 2012, the startup has raised a staggering $1.65 billion (USD) (the amount includes funds raised by Oyo’s Singapore subsidiary) between 2017 and 2019. The startup is backed by Sequoia Capital India and Lightspeed Venture Partners, among others. Tempo is a smart at-home fitness platform that utilizes a 3D vision camera to give accurate real-time reporting of posture, form etc., enabling fitness enthusiasts to get live training from human trainers. The startup recently raised $220 million (USD) in Series C funding from investors such as General Catalyst, DCM Ventures and Norwest Venture Partners, to name a few. Other prominent startups in this sector include Unacademy, DoorDash, Coupang and Flipkart.

Startups in the industrial sector have attracted 23.5% of the funding or $20.9 billion (USD) and constitute 13% of the total number of startups. The automotive industry alone constitutes 62% of the funds flowing to this sector, followed by logistics with 23.4%. Founded in 2016, Manbang Group is a Chinese logistics startup that offers a mobile application for truck-hailing services. The app matches merchants and truckers for transporting cargo and offers other services such as stored-value toll cards and diesel cards. The startup has raised $3.6 billion (USD) between 2018 and 2020. It is backed by the likes of Sequoia Capital China, Lightspeed China Partners, Fidelity and Tencent, among others. Nuro is a US-based startup that develops fully autonomous, on-road vehicles for autonomous delivery. The startup’s efficient fleet of autonomous electric vehicles can deliver anything from pizza to prescriptions. The startup has raised more than $1.4 billion (USD) in Series B and Series C rounds. Other interesting startups in this sector include ShipBob, Grab and View.

The information technology sector and the real estate sector together constitute 25% of the funding and 30% of the startups. More than half of the funding in the IT sector has gone towards the computer, parts and peripherals industry and the business/productivity software industry. Founded in 2017, Standard Cognition develops an autonomous checkout technology to streamline the checkout process for brick and mortar retailers. By using AI, the startup allows consumers to shop and pay without scanning items or stopping to pay. The startup raised $502 million (USD) in Series B funding from Horizons Ventures, Andreessen Horowitz and SoftBank Vision Fund. By utilizing AI-based software, Brain Corp develops autonomous machines that can navigate safely in public indoor spaces like airports and stores. To achieve this, the startup utilizes a cloud-connected operating system that enables the robots to avoid obstacles and adapt to changing environments. Other prominent startups in this sector include NVIDIA, Katerra and Trax.

Conclusion

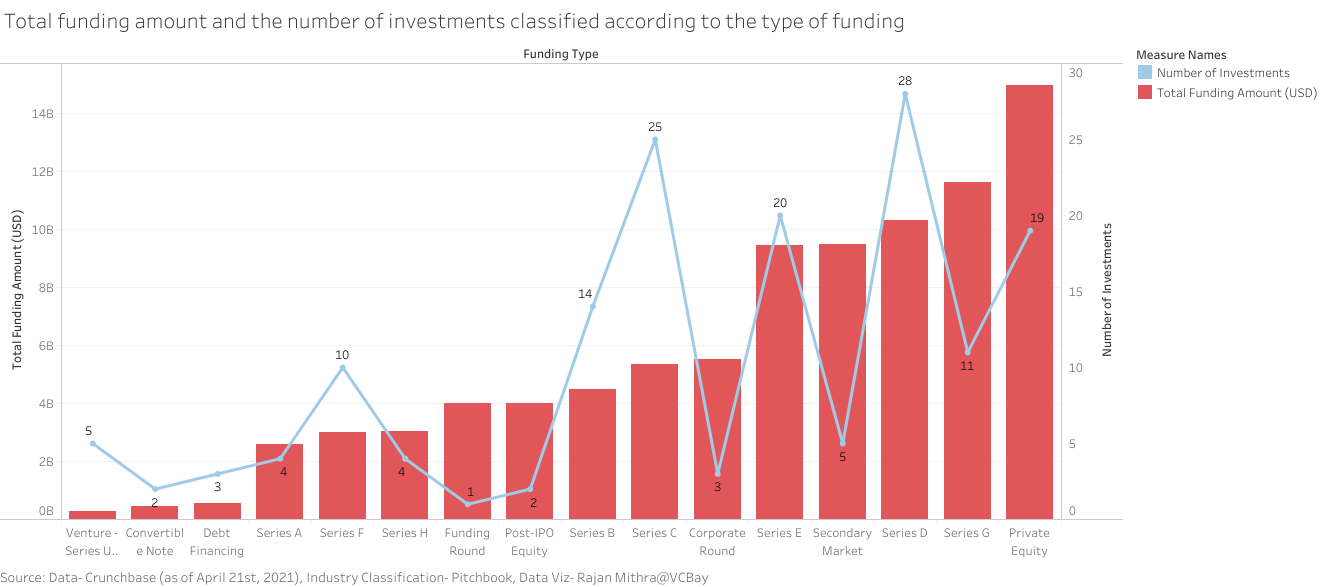

Overall, the Vision Fund has participated in funding rounds exceeding $89 billion (USD). The fund’s most preferred funding type in terms of number of investments is Series D (28) and in terms of the amount of funding it’s private equity (USD 14.97 billion). Vision Fund’s most active year was surprisingly 2020, in which it made 37 investments marginally beating the previous high- 2018 with 36 investments. A majority (55%) of the startups were founded between 2011 and 2015. With the Vision Fund’s investment amounts ranging from $100 million (USD) to $5 billion (USD), it runs the risk of stuffing the startup with more money than it actually needs leading to inefficiency and wastage of resources. Venture capital firms place a range of diversified bets knowing full well that many of the startups will fail but expect a small portion of them to generate an extraordinary windfall. This is what Softbank aims to do; if it manages to find another Alibaba, it can more than compensate for the loss sustained by its bets on WeWork and Uber.

For more extensive analysis and Market Intelligence reports feel free to approach us or visit our website: Venture Capital Market Intelligence Reports | VCBay.

We try our best to fact check and bring the best, well-researched and non-plagiarized content to you. Please let us know

-if there are any discrepancies in any of our published stories,

-how we can improve,

-what stories you would like us to cover and what information you are looking for, in the comments section below or through our contact form! We look forward to your feedback and thank you for stopping by!

Next Article

[…] High-Stakes: SoftBank Vision Fund […]

[…] High-Stakes: SoftBank Vision Fund […]

[…] High-Stakes: SoftBank Vision Fund […]