Update: On July 28th, Robinhood listed on the NASDAQ and sold 55 million shares at US$ 38 apiece, raising US $2.1 billion in the process.

On July 1st, Robinhood-the zero-commission investing app filed to go public. The company aims to list on the NASDAQ under the ticker “HOOD” and is seeking to raise US$ 100 million, considered to be a placeholder figure that’ll change with future filings. It did not disclose how many shares it would offer or their price range. That information is expected to be revealed in future filings. Robinhood has pledged to reserve up to 35% of its IPO for its customers. Goldman Sachs and JP Morgan have been listed as the lead underwriters for this issue.

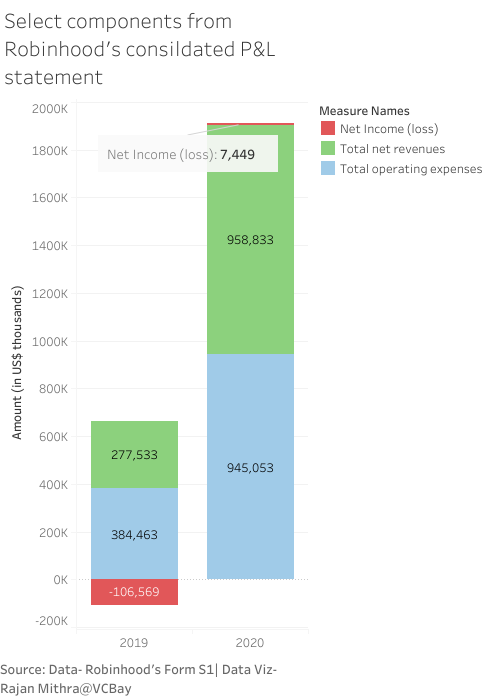

The online broker has revolutionised the investing landscape and has successfully capitalised on the increasing consumer interest in investing in both stocks and cryptocurrencies. Robinhood has witnessed rapid growth in the past year, with its revenues rising 3x from US$ 277.5 million in 2019 to US$ 958.8 million in 2020. But this phenomenal growth has come at a cost. Robinhood’s filing comes on the heels of the US$ 70 million fine by the Financial Industry Regulatory Authority (FINRA) for the significant harm caused to its app users. In December last year, the online broker settled a probe with the SEC for US$ 65 million for misleading customers though it did not admit to wrongdoing. Robinhood has also come under scrutiny for trading restrictions imposed during the meme stock saga. Will the IPO garner enough attention? How does Robinhood make money? What are the major risks it faces?

Brokerage Industry

Robinhood was founded by Vladimir Tenev and Baiju Bhatt, who said they were inspired by the Occupy Wall Street movement, which set them on the path to “democratize finance”. Robinhood primarily competes against brokers such as Charles Schwab, TD Ameritrade, E*Trade, Fidelity Investments and the Interactive Brokers Group. While “democratizing finance” is a great sales pitch, it has been used by brokerages for decades.

While the online broker has followed a well-trodden path of cutting fees, targeting a new generation of traders and preaching financial democratization, the speed at which it has grown has sent shockwaves across the industry. Robinhood cutting its commissions to rock bottom set off a price war, leading industry bigwigs such as Charles Schwab and Morgan Stanley to go on an acquisition spree. Morgan Stanley acquired E*Trade, and Charles Schwab acquired TD Ameritrade. US stock trading has gotten cheaper in the past decade as it became more electronic and automated, leading to increased trading volumes.

Robinhood is rapidly gaining on established players, accounting for around half of all new retail funded accounts opened in the USA in the past five years. Charles Schwab had 32.1 million active retail accounts as of the end of the first quarter, partly due to its acquisition of TD Ameritrade and the rapid growth during the pandemic. Fidelity had around 29 million retail accounts at the end of the first quarter, with 83.4 million total accounts.

According to FINRA, Robinhood’s users are about 31 years old on average, younger than those at more established brokerages, and the median Robinhood customer had US$ 240 in their account, and the average had about US$ 5,000 as of February. That’s significantly less than established brokerages like Charles Schwab, where the estimated average account size is more than US$ 100,000. While Robinhood has been growing, other brokerages have not been stagnating. Schwab reported US$ 4.7 billion in revenue in the first quarter, an 80% increase y-o-y. The company is also more adept at making money from its users than Robinhood. While the zero-commissions broker has 60% as many customers as Schwab, it’s bringing in just 11% as much revenue.

Business and Financials

Financials: Within the first three months of this year, Robinhood managed to rake in US$ 522.2 million in revenues and is theoretically operating at a run rate of more than US$ 2 billion in revenues for 2021. This justifies Robinhood being valued at more than US$ 20 billion, given that other fast-growing fintech stocks often trade at more than 10x revenue. The company posted about US$ 7.5 million in profit last year against a US$ 106.5 million loss in 2019. The company’s most recent quarter includes US$ 1.49 billion expense relating to change in fair value of convertible notes and warrant liability, leading to a staggering net loss of US$ 1.44 billion in an otherwise impressive quarter. So how does a zero-commission stock trading app make money?

Robinhood derives 80% of its revenue from payment for order flow. Payment for order flow is a mechanism whereby Robinhood gets paid to direct its customer orders to market makers such as Citadel Securities, which execute the orders and generate revenues by exploiting the bid-ask spread. This business model depends on high trading volume. As the gap between the bid and ask price increases, profits for the market makers increase. The less informed Robinhood customers are the ideal target audience for market makers compared to other sophisticated traders who can trade assets more efficiently.

Cryptocurrencies are also a major driver of its revenue, accounting for 17% of its revenue in the first quarter this year, more than a 5x increase from 3% in 2020. Dogecoin, the meme cryptocurrency, accounted for 34% of the company’s crypto transaction revenue in the first quarter of this year.

The zero commission broker’s most lucrative segment has been options trading, which accounted for 38% of its transactions revenue or US$ 197 million in Q1 2021.

Robinhood also earns revenue through other ways:

- Net interest revenues, primarily from the securities lending program.

- Interest earned on margin lending and cash deposits.

- Subscription revenue from Robinhood Gold, its premium offering with access to professional research and Level II market data.

Funding: Robinhood has raised US$ 5.6 billion to date in 23 funding rounds. The company raised close to 83% of its funds in the past year, raising around US$ 1.26 billion in 2020 and US$ 3.4 billion this year. Prominent investors include DST Global, Ribbit Capital, New Enterprise Associates and Index Ventures, with each having more than a 5% stake in the company.

Shares: The company has three classes of common shares. Class A shares with one vote, which will be held by the public, Class B shares with ten votes, held by the founders and Class C shares with no votes likely to be linked with employee incentives or stock-swap acquisitions.

Users and Assets Under Custody (AUC): As of March 31st, 2021, Robinhood had 18 million net cumulative funded accounts and 17.7 monthly active users (MAU). According to FINRA, Robinhood had 31 million accounts in total, indicating that many of its users do not have any money in their account and are probably using the app to track the markets. Both MAU and funded accounts have almost grown 10x since Dec 2017. Between Dec 2020 and March 2021, Robinhood has added 5.5 million funded accounts. AUC has increased to a whopping US$ 80.9 billion in Q1 this year, a 5.7x times increase from their level in Dec 2019. A majority of the assets are in equity- US$ 65 billion followed by cryptocurrencies at US$ 11.6 billion, cash held by users at US$ 7.6 billion and options trailing last at US$ 2 billion.

Risks and Controversies

- Payment for order flow (PFOF): PFOF is a business model that depends on high trading volume and is attracting a lot of negative attention from the regulators, including the SEC. While PFOF is not unique to Robinhood, the practice remains controversial. With Citadel Securities being Robinhood’s most important partner and source of revenue accounting for more than half of the US$ 71 million in order flow payments for stocks and options in December last year, this could lead to a conflict of interest.

- Cryptocurrencies: With the ballooning of cryptocurrency assets and with a major portion of the crypto transaction revenue derived from meme cryptocurrencies like Dogecoin, Robinhood’s revenue could become as volatile as the cryptocurrencies themselves.

- Gamestop Saga: The company faces 49 class action suits due to the trading restrictions it imposed earlier this year, despite Robinhood claiming that it was forced to resort to trading restrictions as it could not come up with the US$ 3 billion requested by the Depository Trust & Clearing Corporation (DTCC).

- Gamification: Robinhood has come under increasing scrutiny for not having sufficient guardrails for trading highly risky securities and making stock trading seem like a game.

To an extent, Robinhood has democratized finance, exposing a new generation to trading and investing and pioneering a zero commission model, which has forced other brokerages to slash their commissions. While the company’s overall financials and user growth are impressive there are many concerns such as the reliance on few clients, dependence on payment for order flow, increasing regulatory scrutiny into different segments of its business, small average account sizes, and the impact of cryptocurrencies on revenue. So until Robinhood sorts out some of these issues, investors will be wary.

For more extensive analysis and Market Intelligence reports feel free to approach us or visit our website: Venture Capital Market Intelligence Reports | VCBay.

We try our best to fact check and bring the best, well-researched and non-plagiarized content to you. Please let us know

-if there are any discrepancies in any of our published stories,

-how we can improve,

-what stories you would like us to cover and what information you are looking for, in the comments section below or through our contact form! We look forward to your feedback and thank you for stopping by!

Next Article

[…] Everything you need to know about Robinhood’s IPO […]

[…] Everything you need to know about Robinhood’s IPO […]