Introduction

Pharmacy retail is a unique category where buying is done more due to compulsion than done willingly, with retailers carrying a variety of names like pharmacy, apothecary, drug stores etc. These retail outlets that provide access to medicines are ubiquitous globally with many years of existence and penetration. They continue to remain the main channel for buying anything related to health and wellness.

With time the pharma products have evolved into sub-categories viz; preventive, curative and wellbeing, with each category developing its own nuances and consumption drivers. While medical practitioners are the ones who route the prescriptive (Rx) medication, with an increase in common knowledge, over the counter (OTC) and consumer health drugs, have also gained immense traction. Consumer health has many sub-categories like dietary supplements, wellbeing and sports nutrition driven by non/para medical experts.

The prescriptive medicine category continues to be regulated heavily and hence sold through only licensed outlets while the other categories have managed to penetrate regular retailers.

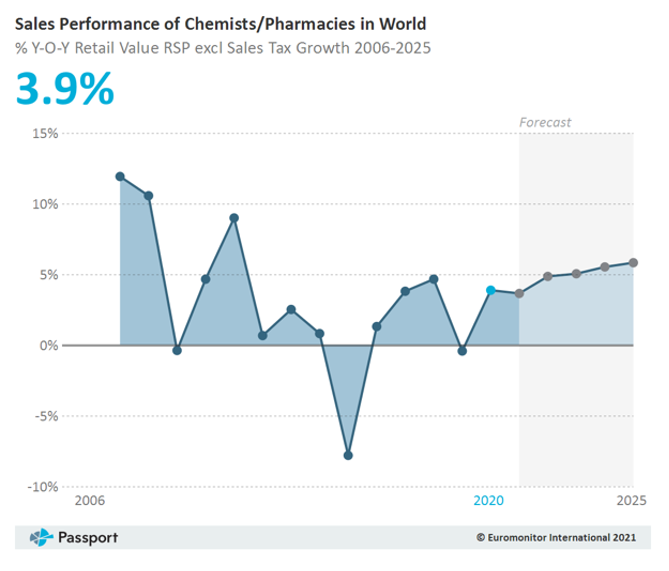

Pharma retail is seeing the Covid-19 event as a once in a lifetime event that has pushed the importance of health, medicines and self-care on top of the life management list. While this has spurred growth it will bring in competitors who will aim to disrupt the current business models.

The challenges in this category are not just affordability but also availability. Stock-outs of medicines, brands and duplicates in developing countries add to the challenge. Availability is incumbent on a vast network of distributors, sub-distributors, wholesalers, importers etc. With expiry date being a critical parameter in pharma dispensation, tracking batch numbers, tracing the source of the drug, and minimum order quantities impact the whole distribution and consequently availability at stores.

As in everything else in the world today, technology is impacting both the back end as well as the consumer-facing propositions of the retail pharma industry. It is removing inefficiencies, reducing unavailability, minimising expiry losses and improving forecasts. In combination with mobile phones, drones and IoT, re-ordering and batch tracking can reduce losses incurred in fragmented supply chains and time to market. Leveraging technology, pharmacies are innovating on last-mile deliveries, personalised services and Covid protocols.

Pharmaceuticals Market Size

As economic wellbeing and the global population continue to grow, the demand for medicines will grow faster than population growth. To add to this demand driven upwards by generic population growth, the richer countries also have a larger share of citizens above 60 who consume lifestyle medication daily. Pharma requirements thus will continue to outpace all other product consumption due to longer life spans and passive lifestyle medication.

The graph of global pharmaceutical use and expenditure as collated by IFC shows that treating people will need 4.5 trillion doses in a year. Treating everyone who needs hypertension medicine daily will in itself need an estimated 474 billion pills per year.

Source: IFC

With increasing access to healthcare and growing incomes, pharmaceuticals are today a USD 1.27 trillion market as per Statista, which is a significant increase from 2001 when the market was valued at just USD 390 billion. It has been growing at a CAGR of 30% over the last five years, of which 36% of the revenue comes from emerging markets, whose share will continue to grow with the rising population.

While hospital bills tend to be significant in singular events, pharmaceuticals are the more significant spends because of regular and mass consumption. They consume up to 67 per cent of the healthcare budget. Consumption has been on the rise driven by;

1. Drop in prices with the usage of generic medicines and government regulated pricing for critical drugs.

2. Ability to pay out of pocket has increased due to higher income levels.

3. Government support through Universal Health Care programmes or donor-funded programmes like Covid vaccinations.

4. Insurance support

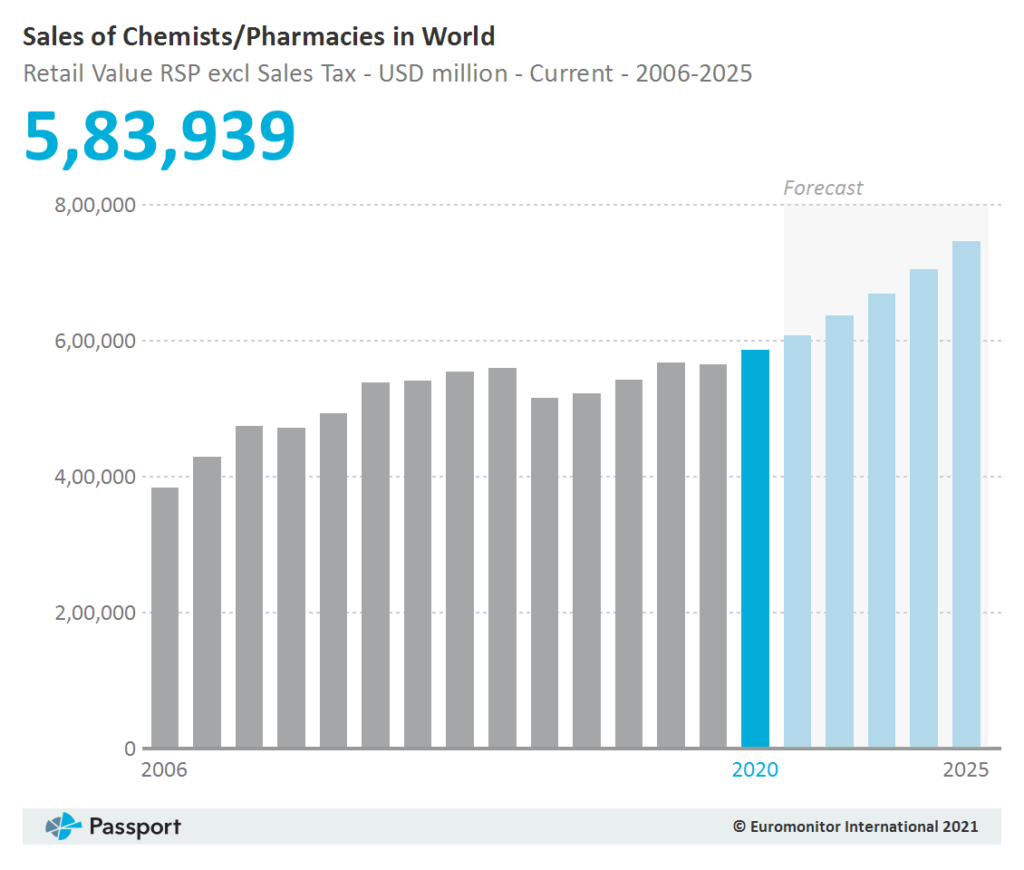

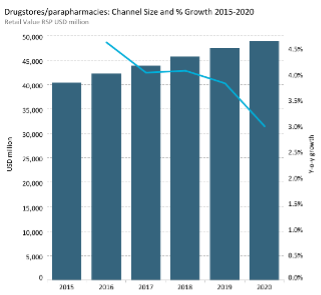

Retail Pharmacy Market Size

The IFC study from 2015 estimates that the global pharmacy market generates USD 683 billion in revenues and USD 68 billion in profits. Of this, USD 280 billion of revenue comes from markets outside the US, Europe and Japan with USD 28 billion in profits.

Source: IFC

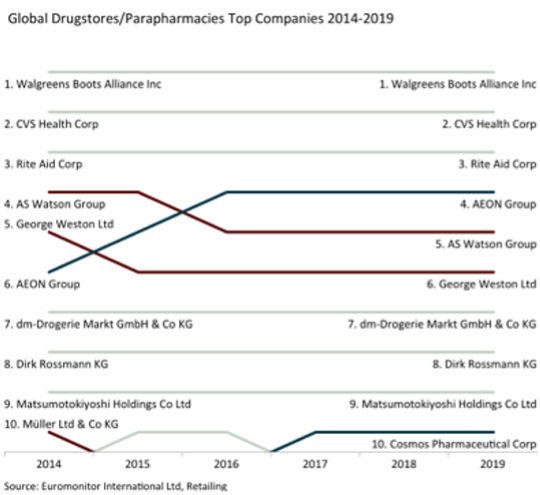

Similar to other categories, the retail pharmacy sector also has sizeable retail pharmacy chains like Boots and Watsons to independent mom-and-pop retail outlets.

Most of these shops tend to sell a mix of medicines and consumer goods to broaden their gross margins and leverage on their real estate. In some countries, patients can also receive their medicines through the dispensary or pharmacy associated with health clinics or hospitals; this is the dominant means of dispensing medicine in markets, such as China.

Factors impacting margins and profitability:

Medicines as a category are constantly under pressure to not reap enormous profits, given their link to human morals. This creates pressure on the whole ecosystem and challenges business models. Some of the challenges which the IFC study identified were;

- Corruption – Large buyers like hospitals can force wholesalers to bribe them to want exclusive relationships. Emerging markets where governments are buyers, especially in generic medicines, can have an impact on profitability.

- Regulation – Medicine pricing markups, pricing of critical drugs, and record maintenance impact costs and margins.

- Fragmentation – many players are split both vertically and horizontally which does not allow for consolidation. This keeps gross margins low and competitive by strengthening the seller and margin erosion through customer discounts.

- Margins – Health Action International notes from its survey and analysis of medicine prices that margins in this category hover around the 30-50 per cent range in countries where drug pricing is not regulated, but mostly these are the underdeveloped ones. So in the middling countries where regulations are in place but government intervention is low, the margins are in the median range of 25%, while in the Nordic countries and UK the margins could range from 2-24% depending on whether it is distributed through the government network, reimbursed, generic or privately prescribed. In the competitive but highly consolidated US market, where the top three companies cover 85-90 per cent of the pharmaceutical market have wholesaler/distributor markups averaging 3 percent. Thus, increased competition and potentially regulation in the retail pharmacy sector are also critical to ensure the consumer benefits through lower prices and better service and market consolidation.

- Counterfeits – This is a scourge in low and middle-income countries. As per WHO, over 110 nations had around 10% of either substandard or falsified drugs. This can happen for several reasons, such as manufacturing errors, medicine degradation through poor storage, or deliberate and fraudulent manufacture and/or labelling.

Attempts Made to Improve Margins

Many attempts are being made to improve margins at the retail outlets;

A. Private Label

A private label could be sold in OTC drugs (68%) and vitamins and dietary supplements (29%). Figures in brackets represent the contribution of these categories to private label products. Consumers have understood the efficacy of active ingredients and are willing to use private label products in OTC drugs if the product combination is identical to similar branded products. Products such as single or multivitamins, minerals, calcium, glucosamine, fish oil supplements and probiotics, among others, have established ingredients that can be replicated by private label brands with similar levels of efficacy as branded products, that too, at lower prices.

With drugstores and supermarkets open even during the lockdown, these retailers offered discounts for their own labels to attract price-conscious customers. Growing economic uncertainty resulting from the pandemic means that customers will likely continue to trade down to lower-priced alternatives for similar formulations.

B. Add more categories

Pharma retail outlets sell a limited range of home consumables to bolster their margins and capture a larger share of the customer’s spending. Breakfast items, hygiene products, snacks and cold drinks are typically found in these outlets.

C. New revenue streams

Retailers are adding new revenue streams like diagnostics, insurance products, vaccination, consultation etc. These are more service delivery products and help leverage on the dedicated customer footfalls to these outlets.

Retail Networks

Because of their existence within the community, pharmacy stores and chains tend to have an emotional connection with their regular customers, especially the neighbourhood mom-and-pop stores. While developed countries have retail chain outlets, most of the underdeveloped world is dotted with mom-and-pop stores. Supermarkets and hypermarkets have added pharmacies to their outlets. It has benefitted the customer as they don’t have to make an additional stop for a regular product category purchase.

Effect of Covid-19 on Pharmacy Retail

Consumer health industry respondents to Euromonitor International’s COVID-19 Voice of the Industry Survey have emphasised the shift to online shopping as a key consumer behaviour that will be a permanent change due to the pandemic.

Consumer health industry respondents to Euromonitor International’s COVID-19 Voice of the Industry Survey have emphasised the shift to online shopping as a key consumer behaviour that will be a permanent change due to the pandemic.

Salient features from the study-

▪Reduced in-store shopping is likely to be a permanent change expected in consumer behaviour.

▪ As a response to the pandemic, the Russian government legalised online sales of OTC drugs. However, this regulation is not expected to result in a high rate of penetration of e-commerce for OTC products, as Russian consumers are used to buying their OTC drugs in chemists/pharmacies via click and collect. These outlets have a high density across the country.

▪ In GCC countries, online pharmacies only appeared in 2016 and started selling OTC drugs and Rx medicine from 2018. However, the penetration of this channel has been limited. The pandemic benefited established online pharmacies such as Al Nahdi, Al Dawaa and Aster Pharmacies, which have had the right infrastructure in place. 2020 made these pharmacies emphasize more on online channels to meet the customer’s quick and seamless delivery needs, wider product variety, and competitive pricing leading to higher demand.

▪ Sales of consumer health products via e-commerce witnessed a growth of 29% in current terms in 2020, while direct selling declined by 3% even though more direct sellers have started investing in and building their online presence. E-commerce growth is led by Asia Pacific, North America and Western Europe. Latin America and, to a certain extent Eastern Europe, have a higher share of direct selling as consumers in the region prefer the interaction with direct sellers and place more trust in direct sellers as this involves a personal transaction as opposed to using a website.

▪ Amazon has tried various strategies to break into the prescription medicine landscape in the US-dominated by drugstores, from launching its private-label OTC products in 2017 to the acquisition of pill dispenser PillPack in 2018. Amazon Pharmacy online store was launched in India in August 2020 and November 2020 in the US.

The Counter to E-commerce

As e-commerce has been disrupting the traditional pharmacy retail stores for decades, they are trying to counter by not just offering over the counter medicines but doing much more. Some examples are;

A. Added benefits

Like free testing, vaccinations, waiver of home delivery charges, drive through deliveries, virtual clinics for telehealth. All of these were done to keep up with social distancing norms.

B. Personalised customer service

- Using data analytics sourced from social media behaviour, pharmacies are sharpening their customer offers, understanding shopping cycles and behaviours and easing the buying process through a presence on Facebook, mobile apps etc.

- Personal counselling in-store for regular shoppers has tightened the bond between the store and its patrons like the one LloydsPharmacy provides as support service with Dementia Connect.

- Patients taking cardiac medicines can now have personal consultations with their pharmacists about their prescriptions as part of a publicly funded program called Medisinstart, in Norway.

- Walmart incorporated Johnson & Johnson’s digital SkinID technology for customers to answer a few questions before the correct acne remedy is recommended to them.

- Rite Aid, focused not only on holistic medicine but also on enabling and educating its pharmacists so that they offer personalised suggestions and recommendations to customers even for alternative medicines.

C. Direct delivery

- In the US CVS and Walgreens deliver through DoorDash. Sam’s Club also announced its partnership with DoorDash to provide same-day delivery for prescription drugs to its customers. Similarly, in Malaysia, Watsons launched a click-and-delivery service only in Klang Valley when customer movement was restricted due to the pandemic. Through Grab’s delivery service, customers could get same-day or next-day delivery, based on when they place their order. Caltex Australia, a forecourt retailer chain, also started trialling the delivery of OTC drugs via Uber Eats. Announced in August 2020, this trial is focused on OTC drugs delivery within 30 minutes of ordering.

- CVS is starting to offer same-day delivery of prescriptions. Both CVS and Walgreens intend to provide medical services in more stores. Walgreens aims to roll out blood tests for medical conditions.

- Walmart+ already offers subscribers free two-day shipping on groceries and other items, similar to Amazon Prime.

D. Going omnichannel

- Most of the pharmacy retail chains have started their own online channels with both web and app-based ordering features supported by home delivery. GoApotik, an online pharmacy aggregator in partnership with Tokopedia, an e-commerce retailer in Indonesia, does the verification and packaging of orders placed online.

- USANA in Asia used live sales broadcast events to launch new products to its customers. If the consumer placed orders during the live call, USANA offered additional discounts or rewards. Livestreaming is an increasingly popular option for direct sellers to engage with their customers in Asian countries. The company also created a one-day pop-up online store where traffic from the social media page was diverted to its e-commerce site. Similar initiatives were undertaken by Herbalife and Amway, which opened stores on WeChat.

- Direct selling companies in Asia also provided training to sales representatives on various topics, including digital selling to support the move online. Though the business model is quickly transforming to digital, the person-to-person selling model will still exist and benefit sales.

- Similar activities were seen in Latin America, a market with the second-highest share of consumer health direct sales. Direct selling representatives increased WhatsApp usage to stay connected to their client base, used social media platforms and e-commerce, and provided home deliveries as an added-value service.

- Walmart+ members can now access select medications at zero cost and thousands of additional prescriptions at an 85% discount, dubbed Walmart+ Rx.

- Both the Co-operative Group and Boots offer drug pick-up at the customer’s location of choice or prescription collection locker services after placing their order online.

Startups Ushering in Competition

- True-Pill is a dedicated digital startup in the pharmacy retail industry. While it calls itself a direct to patient platform, the startup is a B2B company offering its services to other pharmacies extending its reach to consumers shopping on the digital platform. It takes care of the logistics and shipping operations for many retailers, specialised clinics, employees etc.

- Dedicated online-only players like Capsule, GoApotik, are niche startups broadening their platforms to include various digital health services.

- Robotics startup Fabric has partnered with Israeli pharmacy chain Super-Pharm to implement Fabric micro-fulfilment centres. Here robots pick items ordered online from warehouse shelves, using a customised AI-enabled order fulfilment technology. These are then delivered to the final labelling station before they are hand-delivered to the customer’s location.

- Tracking and tracing in pharmaceuticals is critical, and technology has made the process completely risk free. Single source serialisation solutions from Covectra can do the whole process on the manufacturing line itself and loading the whole numbers on the cloud, which can be used to track across the supply chain.

- Health Mart – Health Mart in the US runs its outlets with the focus on personalised service with the motto “Caring for you and about you”. They pride themselves in being local and offering personal care to every customer, trying to know them by their name and tracking them through performance data.

- AAP, a cooperative network backed by the American Association for Pharmacies with 2,115 retail locations, launched “AAP Specialty” in 2014 for pharmacies to be trained in-house and receive tools to become a speciality pharmacy. The company also provides a centralised hub to manage the clinical, financial, prior authorisation, data aggregation, medication safety and adherence services for all emerging speciality pharmacy outlets.

My Take

The pharmacy retail industry will continue to grow given the long life conditions as discussed above. This category is a routine buy with limited choice to customer shifts within the prescribed product. As consumers adapt to online buying, e-commerce will bite into physical retail for the Rx category of products. Companies building leadership here will follow the similar pattern of “winner takes all” model seen in other categories and here chances of startups surviving the onslaught of Amazon and Walmart will be fairly slim.

Chains like Health Mart with their personalised and wide range of service should occupy one end of the pharma retail chain as consumers who prefer human touch will continue to patronise them.

Technology companies like True-Pill and Covectra should be able to leverage their IP and generate wealth for their investors as their technology will play a large role in making e-commerce companies succeed in this regulated and kosher category!

For more extensive analysis and Market Intelligence reports feel free to approach us or visit our website: Venture Capital Market Intelligence Reports | VCBay.

We try our best to fact check and bring the best, well-researched and non-plagiarized content to you. Please let us know

-if there are any discrepancies in any of our published stories,

-how we can improve,

-what stories you would like us to cover and what information you are looking for, in the comments section below or through our contact form! We look forward to your feedback and thank you for stopping by!

Next Article