Sovereign wealth funds (SWF), the titans of the venture capital world, command more than $8 trillion (USD) in combined assets or roughly 10% of the worldwide assets under management (AUM). The term sovereign wealth fund, which was coined in 2005, signifies a mechanism through which countries make investments. Usually, countries that use SWFs are overly reliant on one source of income, for example, oil revenues in the case of the Middle East. The income derived from oil or other commodities is used to invest in shares, bonds, infrastructure, real estate or other suitable areas in order to diversify and become less reliant on a single source of income. Despite sovereign wealth funds growing in size and number, the state-backed institutions are shrouded in secrecy, and their investments and motives are harder to decipher.

Sophisticated

SWFs are different from other institutional investors; they have a super-long term outlook and investment horizons with the aim of securing their country’s future for the next few decades. They can be broadly classified into:

- Stabilization funds: They are set up to assist commodity-rich countries avert the effects of the Dutch Disease. Typically invests in high-quality bonds and public equities.

- Maximization funds: These funds aim for greater returns than that of stabilization funds and make riskier investments to ultimately secure and grow the nation’s wealth.

- Development funds: Instead of focusing on international investments, development funds direct their investments inward, aiming to diversify their countries’ economies via partnerships with foreign institutions to attract foreign investment into key sectors.

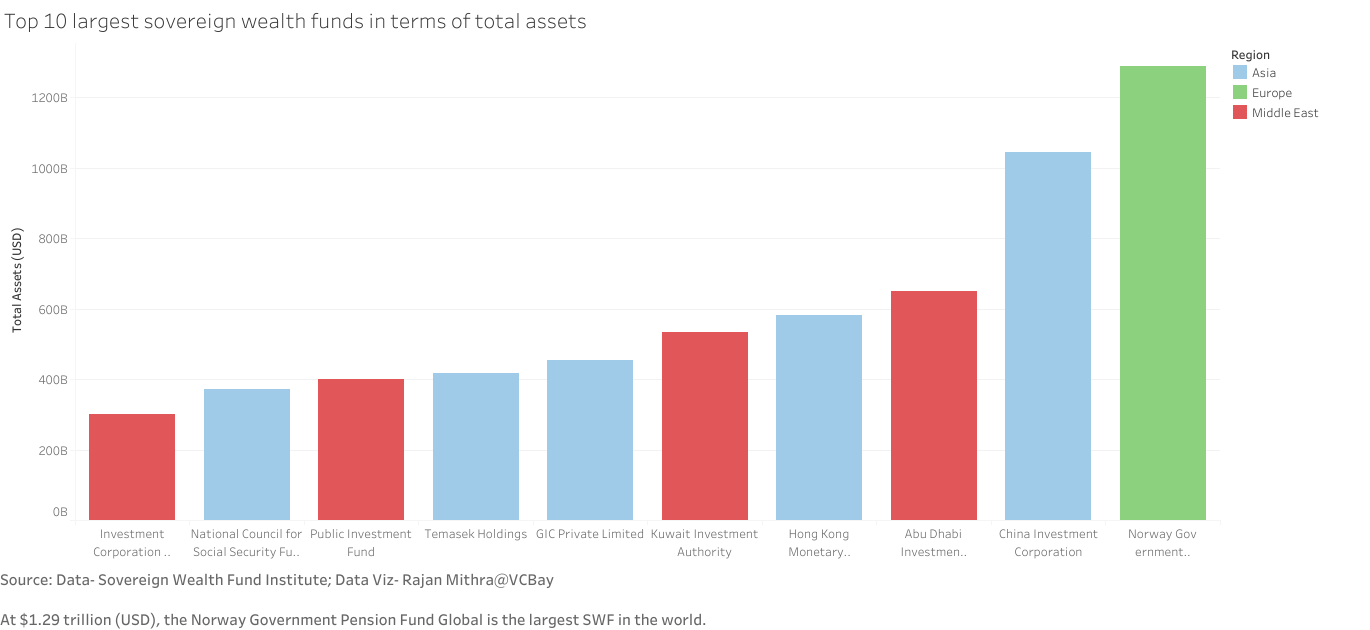

Founded in 1990, the Norway Government Pension Fund Global is by far the largest SWF with assets worth more than $1.29 trillion (USD) and 11k investments in 72 countries. The fund’s equity investments make up 72.8% or $928 billion (USD), with stakes in 9k companies. Since Norway is a significant producer of crude oil, it set up the SWF with a mission to build up wealth for when the oil and gas reserves are exhausted. Other prominent commodity-based SWFs include Abu Dhabi Investment Authority, Kuwait Investment Authority and Qatar Investment Authority. But not all SWFs are commodity-based; China Investment Corporation (CIC) and Singapore’s GIC and Temasek Holdings are notable exceptions. Founded in 2007, the CIC was set up to manage the massive foreign exchange reserves of China. GIC and Temasek Holdings were funded by taxing Singaporeans in excess of what the government needed for its budget and paying that surplus into the funds.

In the past decade, SWFs have evolved and increasingly become more sophisticated:

- Not long ago, SWFs were sleepy institutions pouring most of their cash into safe investments such as government bonds, external funds and index trackers, but with the prevailing low-interest environment, they’re now betting on riskier investments. The proportion of their assets allocated to alternative investments has doubled between 2013 and 2018, according to Invesco.

- In the past, SWFs were content with investing in venture capital funds and letting the manager decide what companies to invest in, but now they’ve changed their strategy, wanting to play a more active role in choosing where to invest their cash.

- In tandem with their dramatic assets’ growth, they’ve also professionalized considerably, scaling up their human capital, recruiting intelligent asset managers and bringing in expertise in areas such as AI and ML to help identify areas of opportunity.

- Usually, SWFs are passive investors with a focus on the long-term enabling startups to scale up in private without worrying about the short-termism of the public markets. They’re a boon for startups serving as an attractive source of money and providing access to new markets.

Pivot

As the pandemic forced the economy into a free fall, the SWFs were tapped by their sponsoring governments to stabilize budgets and shore up the economy. While the SWFs themselves faced estimated losses of $800 billion (USD), they had to pivot and adapt to the new normal:

- Looking inward: Some of the funds have chosen to favour domestic investment over overseas investment to help mitigate the pandemic’s economic fallout. The Russia Direct Investment Fund (RDIF) helped the Russian government in its vaccine development efforts. The Ireland Strategic Investment Fund (ISIF) established the Pandemic Stabilization and Recovery Fund (PSRF) and capitalized it with €2 billion from existing ISIF assets. In April 2020, Turkey passed emergency legislation allowing Turkey Wealth Fund to invest in distressed companies.

- Opportunistic: Some SWFs like Saudi Arabia’s Public Investment Fund used the coronavirus sell-off as an opportunity to pick up cheap stocks. The fund is said to have invested $10 billion (USD) in the US and European blue-chip companies when the stock market crashed in March 2020. It is also said to have made investments in four oil and gas companies- Royal Dutch Shell, Total, Suncor Energy and BP.

More than meets the eye

It has long been speculated that sovereign wealth funds do not invest for purely financial returns but have other ulterior motives. And those who say otherwise are either working for SWFs or making money from them. Saudi Arabia’s PIF and Abu Dhabi’s Mubadala openly make investments aiming to use that expertise to develop relevant sectors in their domestic economies.

SWFs continue to remain opaque, not disclosing their investments, performance and corporate governance practices leading to speculation that the investments could be for political rather than financial motives. There are also concerns regarding the sheer size of the funds as they could cause large price movements and destabilize the global financial markets.

Conclusion

Sovereign wealth funds are now larger than ever and are increasingly difficult to ignore. By sidestepping asset managers and becoming direct shareholders with voting power, SWFs are all set to become more active investors. But, as state-backed entities, they’ll continue to be seen with a sceptical eye.

For more extensive analysis and Market Intelligence reports feel free to approach us or visit our website: Venture Capital Market Intelligence Reports | VCBay.

We try our best to fact check and bring the best, well-researched and non-plagiarized content to you. Please let us know

-if there are any discrepancies in any of our published stories,

-how we can improve,

-what stories you would like us to cover and what information you are looking for, in the comments section below or through our contact form! We look forward to your feedback and thank you for stopping by!

Next Article