If the distribution is still dominated by brick and mortar retail channels, big box retail chains, and unorganised players, why haven't we seen large scale disruption the way we have seen in categories like books and grocery. Has innovation been stymied because of the value chain structure or inherent challenges in the product category itself? Is this category less prone to technological changes? We will evaluate some of these questions in this article!

Stakeholders

This category has a variety of players with different sizes and skills. These service providers are fragmented, and the levels of penetration are a function of the evolving economy. Higher the per-capita GDP of the country lesser availability of self-employed entrepreneurs and skilled labourers are costlier. Small unorganised local players thus form a large chunk of the supplier base for residential furniture and capture around 85% of the furniture market in middle income countries like India.

High-cost skilled labour prevents the average consumer in richer countries use labour for bespoke furniture, poorer countries can’t afford furniture, while the mid-income countries sit at the best of both worlds.

- Carpenters

- Small-time contractors

- Interior designers

- Architects

- Retailers

- Modular furniture producers

Most of these players are unorganised and bring their expertise in designing, sourcing and constructing the requirements, customising as per requirements. Contract and institutional buyers, buy from factories which can customise as per the design provided by the buyer. The high volume, assembling at the point of installation requires specialised skills which these factories provide.

Designers / Interior Architects

A designer is used to provide bespoke solutions for the whole portfolio of a customer’s requirements. Households with large furniture portfolio, or businesses which lack internal expertise, use the services of designers to customise as well help in sourcing the right material.

Customers who operate with tight budgets, do seek ideas from designers but, abhor the value/payment to be made to a designer (this surely wouldn’t be true of the richer class). Many a time, siblings, mother, etc; are the bouncing board, and the man of the house is typically the financier and executor rolled into one. Some clients tend to get drawings done but end up not paying the full value to the interior designer for some reason or the other. The key pain point is always in being able to translate the visualised idea into reality, either because of poor translation or because of poor quality workmanship.

Carpenters

This category is largely unorganised and found in middle-income countries where carpenters are hired to build bespoke furniture within the residential premises. These are highly skilled workers and available for work across the spectrum of size and cost. In developed economies carpenters are not so easily available, and even if available tend to add substantial cost. Hence buying ready-made furniture works out as a better commercial choice unless a customer is very keen to get bespoke furniture made.

Manufacturer / Branded Suppliers

There has been an increase in organised players over the last decade, with large chain retailers trying to source from independent manufacturers. While IKEA is now a globally recognised brand, it manufactures large scale Ready to Assemble furniture for its own retail points. Companies like Ashley Furniture Industries retails its branded product through wholesalers such as Febland in the UK and mass-retailers like Sears and its own chain of stores Ashley HomeStore. These brands have successfully managed to reorient the middle class from heirloom furniture to affordable, fashionable and long-lasting furniture.

Urban Office Interiors, Heritage Home, Furniture Concepts, Herman Miller, Inc., Furniture Services, Inc., Okamura Corporation, La-Z-Boy, Humanscale Corporation, HNI Corporation, Godrej & Boyce Manufacturing Co., Global Furniture Group., Urban Office Interiors, Renaissance Furniture, Haworth, Inc., Inter Kohler CO., Ashley Furniture Industries, Inc., McCarthy Group, and The Home Depot, Inc. among many others are some of the key players operating in the furniture market.

There appears to have been somewhat natural limits to the scale of furniture factories and the full automation of manufacturing processes. It is therefore rare to encounter furniture factories with more than 500 workers under one roof in almost any country. So, on average, the furniture industry is composed of fairly small, labour-intensive units, or groups of small individual companies under one banner.

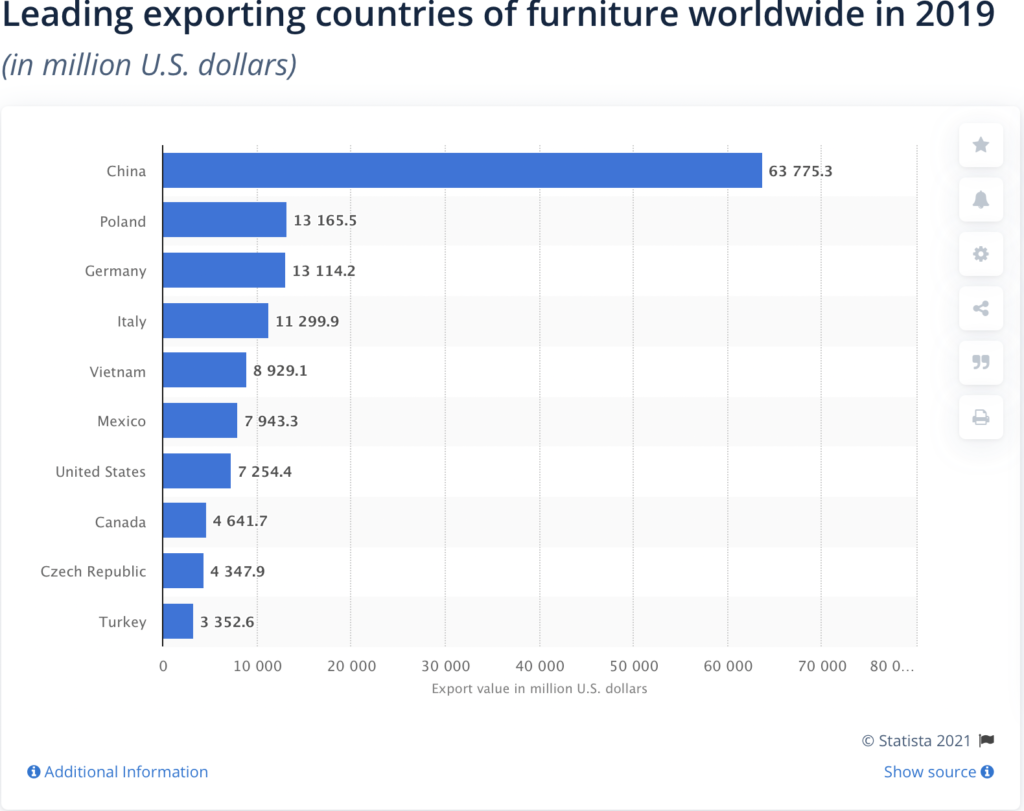

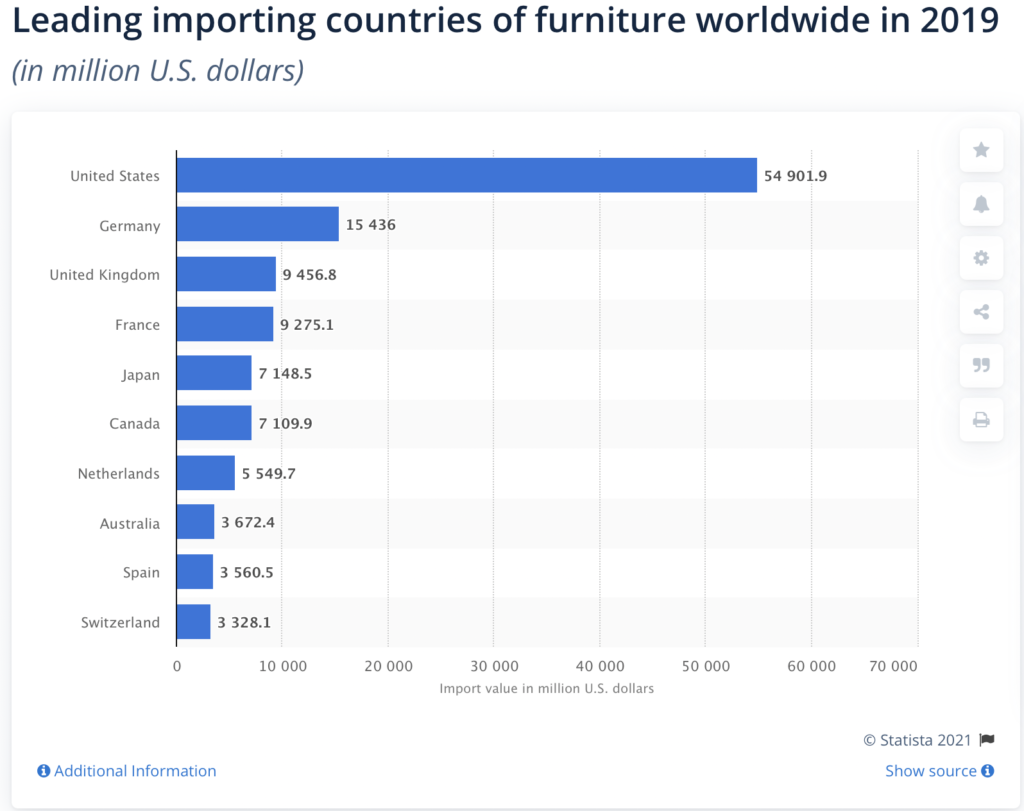

Import / Export

As explained in part I of this series, the furniture market, is estimated to surpass a USD 538 billion valuations by 2026. Wooden furniture forms 11 per cent (USD 152 million) of furniture imports and continues to grow at 50 to 60 per cent every year. The commercial application segment is expected to grow at a CAGR of more than 5.8% over the forthcoming time period. On the geographical front, the Middle East furniture market, in terms of revenue, will account for 5% of the global industry share.

A total of 10,476 importers shipped furniture to India during this period, mainly from Italy, Germany, Spain, China, Korea, Malaysia, Indonesia, Philippines and Japan. Source: IBEF

Distribution

The way furniture is sold makes a dramatic difference to its penetration. A look at a developed market like France shows that e-commerce is still small for this category and brick and mortar furniture distribution and specialty stores dominate. Strip malls and specialty stores for affordable furniture in the developed countries, large furniture malls in China and high streets tend to be the go-to points for furniture buying.

Brick and Mortar Retailers

One of the biggest aspects working in favour of brick and mortar retailers is the immersive physical experience of shopping. The current technology available, cannot replace actual visualisation of a large piece of furniture in a physical space along with its attendant emotional connect and sensory appeal. In the markets of North America and Europe, independent physical stores, flea markets and the ubiquitous Ikea still dominate furniture shopping while in China, large furniture malls with multiple wholesalers and brand shops provide consumers with large variety and customisation, along with delivery and installation. In developing economies like India, each city is dominated by high streets, with all retailers crowding that street.

- 27,595 furniture stores businesses as of 2021 and they have remained steady between 2016–21.

- Costs for business as a percentage of revenue are wages (13.5%), purchases (50.8%), and rent (5.2%).

- The stores are more labour intensive and less reliant on capital.

- The stores industry in the US has a low market share concentration and the largest business is Inter IKEA Systems BV.

Source: Ibisworld for the US Market

Internet First Businesses

E-commerce has its impact on the furniture business, too, similar to all other consumer-facing categories. But there are major challenges that are unique to this category that limits its penetration. The earlier chart of France shows that, even in a developed market, e-commerce in furniture continues to be small as compared to its penetration in other categories. The e-commerce market would be a battleground in the B2B business with tight competition between supply chain channel partners, including manufacturers, wholesalers, and distributors of home furnishing goods.

Benefits of E-commerce

- Width – One of the biggest limitations of brick and mortar retail is the range of products that can be put up on display.

- Convenience – Shopping from the comfort of home.

- Multiple Brands – Instead of moving from shop to shop, you can see all of them on the same device.

- Comparison – Easy to compare different choices.

Challenges

- Online’s biggest limitation; does not allow consumers to touch and feel items and hence one can’t visualise the look and feel.

- Shipping – Furniture needs to be packed diligently and shipped delicately to ensure that it doesn’t get damaged during shipping. Touchup’s and repair at customer’s end is very costly.

- Assembling at home for flat-packed items.

- Shipping cost as a percentage of product cost is high for furniture because of bulk and cost of packaging.

- Returns are tough both for customer and shipper.

- Delay from purchase to actual receipt of goods and delays caused in transit.

- Trust – Not being able to physically see and interact with the vendor, keeps the buyer sceptical until final receipt of the product in pristine condition.

- Advance payment is always a risk many customers are wary about.

Work Around

- Free home trails for certain product categories, so returns are possible.

- Cash on Delivery.

- Holding customer’s money in escrow till post-purchase satisfaction is ascertained. Speedy response at customer touchpoints like call centres or live chats etc.

- Finance fears are reduced through EMI options, customer reviews and an active feedback system.

- Physical touchpoints to ward of fear of virtual vendor.

Conclusion

The need for customers to get a physical sense before making a purchase decision of a product which will stay at their homes for a long period of time has ensured the need for brick and mortar presence in this category. Even though pre-purchase influence through social media, shortlisting products over the internet is becoming the norm, e-commerce is yet to crack this business fully. The other stakeholders continue to remain fragmented and unorganised and hence we haven’t seen as yet major startups flourishing in this category. While companies like Wayfair, Ikea itself and Maisons DuMonde are innovating the game seems more to be in the omnichannel space rather then pureplay brick and mortar or e-commerce alone.

We will explore some more models and certain companies to shortlist the potential successes of the future.

Disclosure- Rahul is an early-stage investor in a furniture startup called Victus Retail Private Limited.

We try our best to fact check and bring the best, well-researched and non-plagiarized content to you. Please let us know

-if there are any discrepancies in any of our published stories,

-how we can improve,

-what stories you would like us to cover and what information you are looking for, in the comments section below or through our contact form! We look forward to your feedback and thank you for stopping by!

Next Article