If Furniture is an all-pervasive category, why haven’t we seen much of startup and VC action in this area? What are the challenges which restrict this category from new and high profile entrants? In part - 1 of a three part series, I build a landscape of the global furniture market to explore the new business ideas possible in this category.

The Market

Furniture, an important component of homebuilding, has a direct correlation with economic growth. As household incomes start hitting national medians, close to 1.3% to 1.5 % of the household income is invested in the home furniture. Here we are referring to the classical definition of furniture, which means objects meant to support human activities.

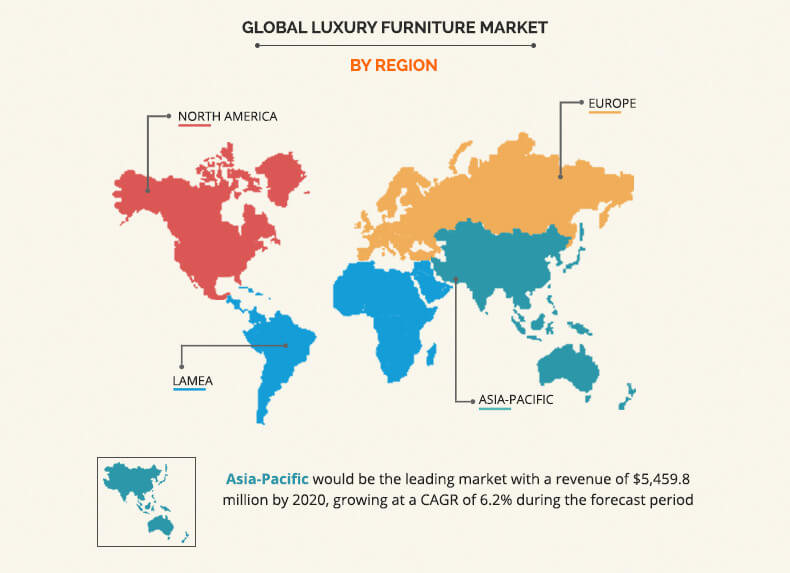

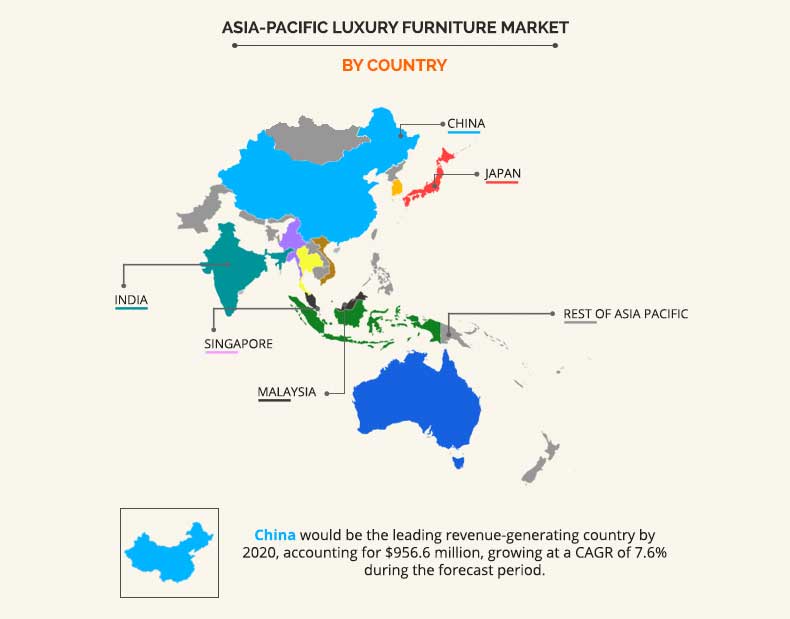

The global furniture market size is projected to reach USD 650 billion by 2027, from USD 509 billion in 2020, at a CAGR of 4.1%. India is currently a small market but is expected to grow at a CAGR of 12% by 2023 to cross the 50 billion mark. With innovations continuing and fashion trends being as lively as the ones in the wearables segment, this category will continue to grow with economic prosperity.

| Parameters | 2021 | World | USA | China | Japan |

| Market Size | USD Billion | 509.8 | 233.04 | 158.57 | 103.2 |

| CAGR % | 2021-2025 | 2.17 | 6.61 | 3 | |

| Furniture spend/Capita | USD | 744.44 | 109.23 | 818.78 | |

| Online buying % | 19 | 52 | 13 |

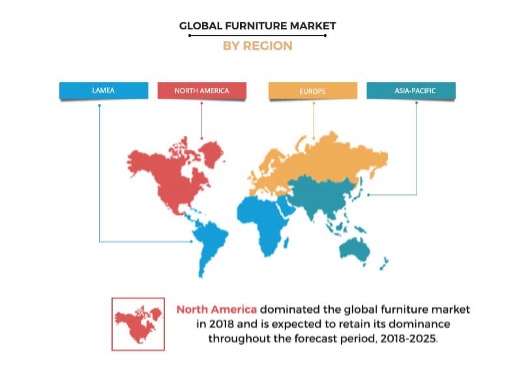

As in most of the consumption sectors, here too, the US market is the largest, followed by the EU, within which Germany is the largest. While furniture consumption has a direct link to the per capita income levels of countries, culture does have its impact, an example being Japan, where home sizes and traditions tend to impact the limited and smaller sized furniture bought there.

Segments

The furniture market is segmented in multiple ways;

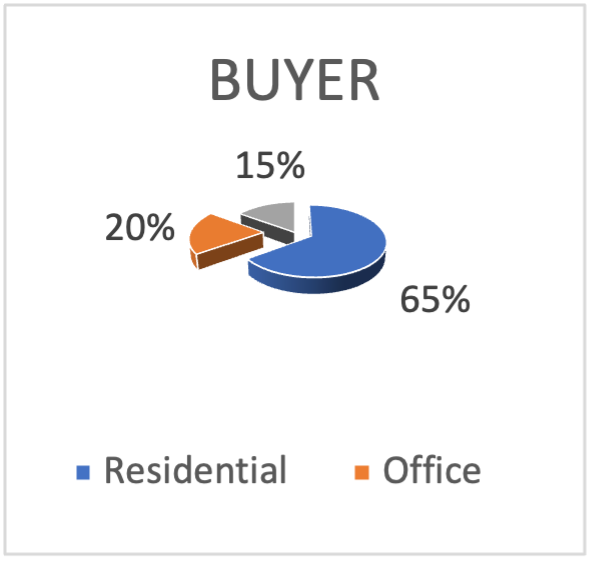

- The buyer – Home, Office, Other Contracts, and Street Furniture

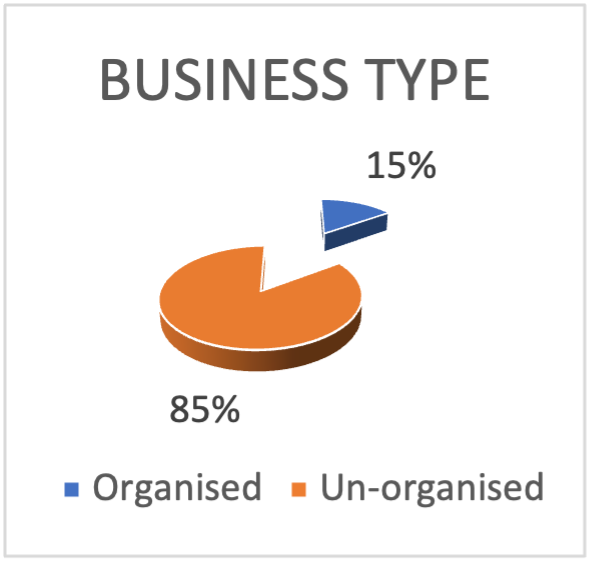

- The business type it is produced – Organised, Un-organised, and Turnkey

- Product type – Seating, Sleeping, Storage, Dining and Working

- Raw material used – Wood, Glass, Steel, Fibre and Plastics and the latest 3D printing

- Final destination where it will be used – Bedroom, Hotel, Retail and Streets

- Geography – by Cities, Zones and Global regions

Consumers

Home and Garden Furniture

This is the largest segment of the furniture market, which is significantly impacted by work from home and flexible work styled organizations. According to research conducted by Furniture Today, more than 40% of consumers are spending significantly more time at home for a wide range of activities; working at home – 47.4%, child activities – 41.4%, family dining – 47%, outdoor living spaces – 45.4% and living/lounging room activities – 44.2%.

Consumers tend to make large pieces of furniture (bought like long term assets) in retail stores. While retail stores dominate the market with the likes of Home Depot, Ikea, Steinhoff, XXXLutz, yet there are still local retailers who operate out of furniture strip malls and high streets.

Most of these households tend to furnish their houses at the time of acquisition and then end up buying small individual pieces as the family needs grow. Renovation on a regular basis is limited to around 1% of the population. While design and quality influence because of TV, magazines and social media has piqued interest, budgets tend to play a critical role in the buying process. Pride in heirloom furniture is a part of our culture which primarily centres around boasting about how long a piece of furniture has survived. The average life of a piece of furniture is about 20 years, and some craftsmen’s pieces are used for as long as 50-70 years. There has been a shift in this with the availability of particle board furniture as they have made furniture costs cheaper.

Office Furniture

The office furniture segment catering to the commercial and office space is worth USD 15.2 billion and is projected to grow at a compound annual growth rate of 4.81 per cent till 2025 as per Statista. Technavio, a global market research company, estimated that this segment is 20.45 per cent of the furniture market. Office furniture market includes products such as stacking chairs, ergonomic chairs, stools, and benches. The office furniture segment caters to commercial and office space.

Contract Segment

The contract segment caters primarily to hotels, and its growth is consequently linked to growth in tourism and the development of new hotels. There are many more large institutional buyers like educational institutes, retail chains, hospitals, who contract large scale furniture requirements to a single vendor. China has established a huge lead in manufacturing bulk furniture, which can be shipped and installed at the final location. The market size has been estimated to be around USD 7 billion.

Behavioural Trends

- As income levels go up, homemakers tend to extend their identity through the look and feel of the house they live in. They hence look for inspiration and ideas which will help them create their distinct signature. While the segment looks for inspiration through all the influences mentioned above, a very large segment doesn’t take the help of professional interior designers as they don’t find value in it. In the quest to achieve the visualisation of how their home should look like, they end up spending a lot of time scouring the internet, television, magazines, furniture retail stores, and discussions with their carpenters.

- Interestingly, while they do seek ideas from the above-mentioned sources they abhor the value of a designer (this surely wouldn’t be true of the richer class). Many a time, siblings, mother, etc; are the bouncing board, and the man of the house is typically the financier and executor rolled into one. Some clients tend to get drawings done but end up not paying the full value to the interior designer for some reason or the other. The key pain point is always in being able to translate the visualised idea into reality, either because of poor translation or because of poor quality workmanship.

- While it may seem like a trivial purchase to many, buying furniture, is a special occasion for many adults & families. What was considered a luxury a few decades earlier among most households in India quickly became a necessity in most households & with the boom in e-commerce and e-tailing, in particular, several furniture startups have come to light.

Summary

The size of the market is a single big reason as to why new ideas should be attempted to enter this market. Some of the potential spaces to create new business models are listed below.

- Work from home – Home offices

- Contemporary Furniture – to ensure that health and comfort is given prime purpose.

- Flexible Workspaces – Because employees aren’t relegated to a desk in a set location.

- Eco-Friendly Consciousness – United States’ eco-friendly furniture market grows.

- The Number of Single-Person Households are Increasing – single-person households are on the rise.

- Augmented Reality as a marketing tool.

- Customers are furniture shopping and trying to envision what each piece might look like in their space- Augmented reality tools

- Easy Financing

- Smart Furniture – activities, such as charging mobile devices, browsing the internet, listening to the news or radio.

Conclusion

Having set the category context we will examine the stakeholders and business models in the second part of this series. As stated earlier, the market is very large, yet it is fragmented in the way it reaches its end consumer. The distribution channels are still dominated by large brick and mortar retailers with one-on-one selling and heavy customisation. The innovation opportunities lie in creating new ways to reach this large customer base without loosing the charm of personalising a purchase that is bought infrequently.

Disclosure- Rahul is an early-stage investor in a furniture startup called Victus Retail Private Limited.

For more extensive analysis and Market Intelligence reports feel free to approach us or visit our website: Venture Capital Market Intelligence Reports | VCBay.

We try our best to fact check and bring the best, well-researched and non-plagiarized content to you. Please let us know

-if there are any discrepancies in any of our published stories,

-how we can improve,

-what stories you would like us to cover and what information you are looking for, in the comments section below or through our contact form! We look forward to your feedback and thank you for stopping by!

Next Article

[…] Furniture Retail […]