The Indian food delivery giant- Zomato recently filed its draft red herring prospectus (DRHP) with the Indian securities market regulator-SEBI, seeking to raise Rs 8250 crore (~USD 1.1 billion) through its IPO. The IPO will be the biggest since the listing of SBI Cards & Payment Services, the country’s second-largest credit card issuer, in March 2020. Of the total issue size, Rs 7,500 crore (~USD 1 billion) will be through a fresh issue of equity shares and the rest will be through an offer for sale by Info Edge, the startup’s earliest backer. The Tiger Global Management-backed startup has stated that it may raise Rs 1,500 crore (~USD 200 million) prior to its listing.

The startup, which initially launched as a restaurant discovery platform more than a decade ago now operates across 23 different countries from New Zealand to Slovakia and has raised more than $2 billion (USD). The startup has chosen to list on the Indian stock exchanges- National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). Zomato’s IPO will be a bellwether for other Indian startups that will get listed in the next couple of months, such as Delhivery, Policybazaar, and Nykaa.

Financials

The Indian foodservice market is composed of three segments: food delivery, takeaway, and dine-in, with food delivery expected to see the fastest growth in coming years according to CLSA. Aided by a growing population, higher-order frequency from existing customers, expansion to new markets, and increasing smartphone penetration, the foodservice market size is set to increase from $3.5 billion (USD) in FY20 to $11 billion (USD) by FY26.

Zomato is a behemoth in every sense of the word:

- 161K+ active delivery partners

- 350K+ active restaurant listings on the platform

- In FY20, in India, on average, 10.7 million customers ordered food every month with an average monthly frequency of more than three times.

The initial days of the pandemic took a heavy toll on Zomato, with its gross order value (GOV) falling 59% from its level in Q4 2020. But the startup has since bounced back, reporting a GOV of Rs 29,810 million (~ USD 405 million) in Q3 2021, the highest in any quarter till December 2020. Despite operating in 23 foreign countries, Zomato generates 90% of its revenue from India.

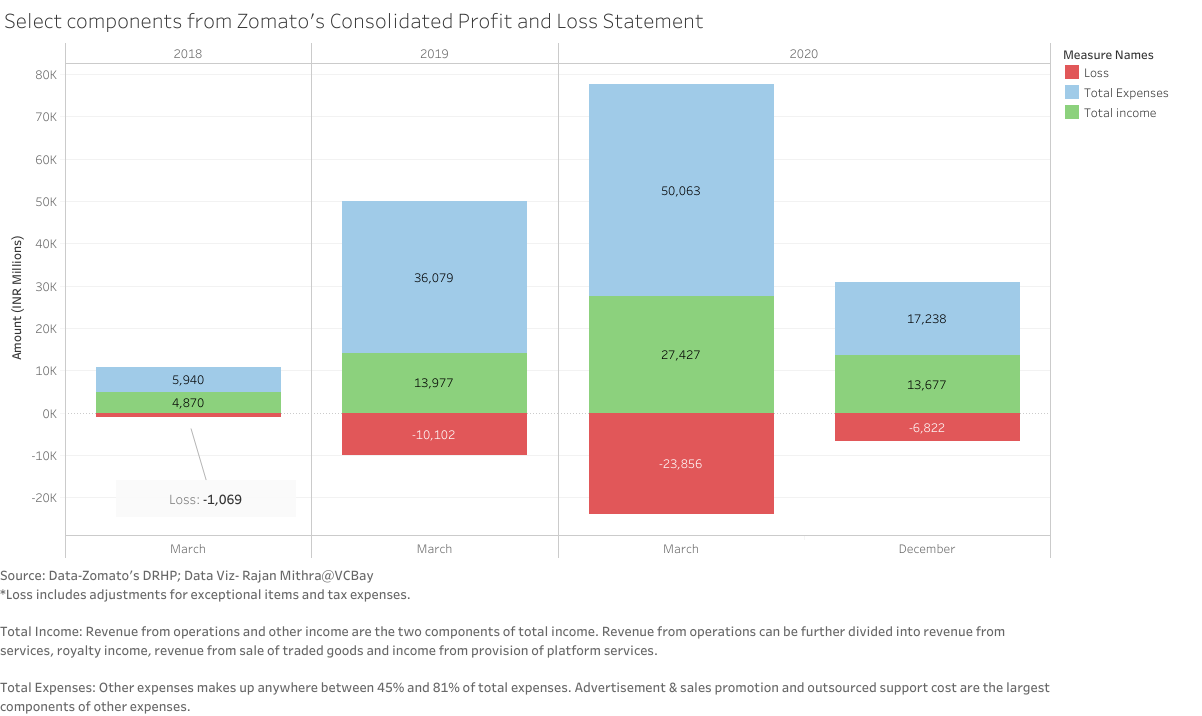

Zomato’s revenue from operations that, on average accounts for 95% of the total income, has increased 5.5x times in the past three years from Rs 4,660 million (~ USD 63 million) in FY18 to Rs 26,047 million (~ USD 354 million) in FY20. But at the same time, Zomato’s total expenses have increased from Rs 5,939 million (~ USD 81 million) to Rs 50,063 million (~ USD 681 million), signifying an increase of 8.4x times, thereby leading to losses. The losses are in part due to costs associated with marketing, employees and other fixed operating costs. The startup’s employee costs are approximately 42% of its revenue, in part due to the ESOPs given to its employees, without which it would come down to 34%. The advertising and sales promotion expenses as a percentage of its total income peaked in FY 2019 at 88.43% and have since fallen, making up just 48.80% in FY20. Advertisement and sales promotion expenses are composed of discount coupons given to customers, refunds made to restaurant partners, platform-funded discounts, marketing, and branding costs.

The soon-to-be listed company has said that it expects its expenses to increase in the future.

What will the IPO proceeds be used for?

The Deepinder Goyal-led startup has said that it would allocate 75% of the gross proceeds from the IPO in funding organic and inorganic growth initiatives for 5 years from its listing.

Organic growth initiatives:

- Building its technology infrastructure

- Customer and user acquisition

- Investing in its delivery infrastructure

As part of its inorganic growth initiatives, Zomato has said that it would continue to evaluate opportunities for acquisitions and strategic initiatives.

The startup pointed out that it had benefited from acquiring Uber Eat’s India business in FY20 and hyper-local logistics startup Runnr in FY18. It further went on to say that it would not invest more than 25% of its net proceeds for general corporate purposes.

More than just food delivery

Commission from restaurants is no longer the main revenue stream for online food services platforms. Zomato earns revenue through a multitude of ways-

- Advertisement fees charged to restaurants for enhanced visibility in the food delivery business.

- Membership fees through Zomato Pro– a subscription service where customers can access special discount deals from select restaurants across food delivery and dining-out offerings. As of December 31, 2020, the service had 1.4 million members and over 25k+ restaurant partners in India.

- Hyperpure– a subsidiary of Zomato, which is involved in supplying raw materials to restaurants. The service, which was started in 2019, has over 6k restaurant partners across six cities in India. It helps Zomato better forecast demand and source raw materials such as fruits and vegetables on a larger scale.

- It also earns through commission from delivery charges which are being charged to the user.

Who are the largest shareholders?

The largest shareholders, along with their percentage shareholding-

- Info Edge- 18.55%

- Ant Financial- 16.53%

- Uber BV- 9.13%

- Tiger Global Management- 6%

- Sequoia Capital- 5.98%

- Deepinder Goyal- 5.51%

Among these, the largest shareholder- Delhi-based internet services firm Info Edge, which invested Rs 6 million (~USD 82K) in Zomato in 2010, has made 77x returns from its total equity investment of Rs 1443.1 million (~USD 20 million). Post the IPO, Info Edge will continue to hold a 15.14% stake in the startup. As a part of the acquisition of Uber Eat’s India business, Zomato offered a 9.9% stake in its business to the ride-hailing giant.

Conclusion

Zomato has a first-mover advantage given that it is the only online food delivery platform to list in India, combined with the fact that it’s a familiar brand and a technology-driven startup. These factors can help Zomato achieve a favourable listing but certain factors could pose as headwinds. The entry of Amazon into the food delivery space last year is bound to hurt the duopoly of Swiggy and Zomato. Despite Amazon’s operations being limited to one-fourth of one city, it will eventually resort to undercutting its rivals in a bid to acquire customers leading to another lengthy period of cash burn for the existing players. Another factor working against Zomato is the fact that it’s still a loss-making startup; while the US markets are not averse to loss-making companies, Indian investors may not be that welcoming.

For more extensive analysis and Market Intelligence reports feel free to approach us or visit our website: Venture Capital Market Intelligence Reports | VCBay.

We try our best to fact check and bring the best, well-researched and non-plagiarized content to you. Please let us know

-if there are any discrepancies in any of our published stories,

-how we can improve,

-what stories you would like us to cover and what information you are looking for, in the comments section below or through our contact form! We look forward to your feedback and thank you for stopping by!

Next Article

[…] Next Article […]