Overview

The Fintech sector in Nigeria (and Africa as a whole) is beginning to witness significant acknowledgment and recognition in the global startup ecosystem today. This traction is, however, not due to the activities of commercial banks, as one may initially believe, but can be credited to the development and progress of innovative private companies with cutting-edge product offerings, revolutionizing the industry today.

One such company is the highly reputed Fintech giant, Paystack. Officially founded in 2015, the growth of Paystack has been more than impressive and inspiring to startups of the world. From being an unknown establishment to becoming a Y Combinator-backed, multi-million dollar company worthy of being acquired by SaaS unicorn, Stripe, let’s observe their journey and tenacious growth in the Fintech industry so far.

Breakdown of Paystack’s milestones

Fintech startup Paystack has seen some pretty good days in the short six years since it was established. What better way is there to tell this story than by breaking down their significant achievements into milestones?

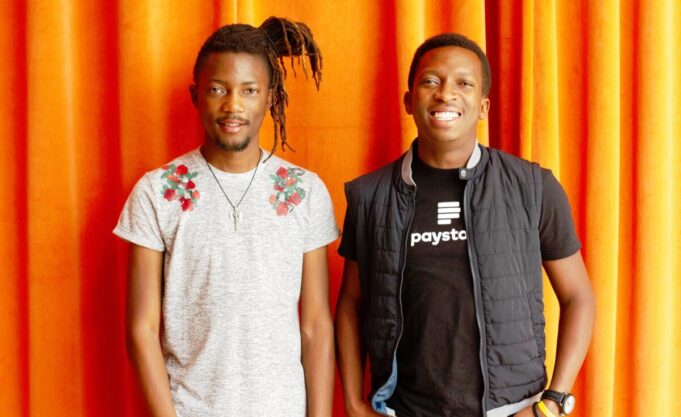

- Founded in 2015: Upon seeing the incompetence of payment processing in Nigeria, Co-founder and CTO of (what is now) Paystack, Ezra Olubi, saw the potential for a disruptive online payments platform. The software enthusiast and his co-founder, Shola Akinlade, met at a software exhibition when they were both still computer science undergraduates from Babcock University, Nigeria. A decade later, they teamed up to establish and launch the Paystack platform in 2015.

- Admission into Y Combinator accelerator program: Paystack went down in the history books as the first Nigerian company to be accepted by the world-renowned tech accelerator, Y Combinator, in November 2015, an accelerator known for incubating reputable startups like Dropbox, Coinbase, DoorDash, and Airbnb.

- Public launch: After its private beta launch in November 2014, Paystack hosted its public launch on January 11, 2016. Through both launches, Paystack has been describing itself as the “Stripe for Africa.”

- Securing seed investment: Another huge milestone of Paystack is its procurement of seed investment on December 19, 2016, in a round led by Tencent, Comcast Ventures, and Singularity Investments. The value of the seed investment stood at US $1.3 million.

- The official launch of “Pay with bank”: In July 2017, Paystack introduced a new feature in its product offerings, giving customers the ability to pay for transactions using only a bank account number.

- Obtaining Series A funding: On August 28, 2018, Fintech company Paystack secured Series A investment amounting to US $8 million led by payments leader Stripe and was joined by global payments company Visa, with follow-on investments from Tencent and Y Combinator.

- Acquisition by Stripe: Although the terms of the deal were not entirely disclosed, sources indicate that payments leader Stripe acquired Paystack on the 15th of October, 2020, for over US $200 million. This also goes down in the history books as the largest acquisition (to date) to come out of Nigeria, as well as Stripe’s biggest acquisition so far.

The road ahead

According to Ezra Olubi, “Our vision today is the same as when we started. When we launched Paystack, our vision was to make it easy for businesses to accept online payments in Nigeria. That was the mission we originally set out to achieve, and it’s still our mission today. Despite already surpassing our goal in so many ways, the core problem we’re solving is still the same.”

Company profile

Paystack is a developer of a payment processing platform designed to make online payments easy, secure and affordable. Paystack empowers businesses in Africa to accept payments by anyone, anywhere in the globe via debit card, credit card, money transfer, and mobile money on their websites or mobile apps. Backed by its parent company, Stripe, and a pool of high-profile investors such as Visa, Y Combinator, and Tencent, to mention a few, Paystack is empowering businesses to offer a seamless and secure payments experience to clients. Founded by Ezra Olubi (CTO) and Shola Akinlade (CEO) in 2015, Paystack has its headquarters in Ikeja, Lagos, Nigeria.

For more extensive analysis and Market Intelligence reports feel free to approach us or visit our website: Venture Capital Market Intelligence Reports | VCBay.

We try our best to fact check and bring the best, well-researched and non-plagiarized content to you. Please let us know

-if there are any discrepancies in any of our published stories,

-how we can improve,

-what stories you would like us to cover and what information you are looking for, in the comments section below or through our contact form! We look forward to your feedback and thank you for stopping by!

Next Article