Toronto-based FinTech startup Ledn has announced in February 2021 that is has bagged CAD 3.4 million in a seed funding round led by White Star Capital as part of its Digital Asset Fund. Other investors who participated in the round include Darrow Holdings, Coinbase Ventures, Global Founders Capital, CMT Digital, and Kingsway Investments. The latest round brings Ledn’s total funding to date to CAD 4.7 million.

The startup will use the fresh funds to fast-track its growth and expand into international markets. Capital raised will also be used to accelerate its regulatory compliance processes and its marketing and informative efforts around its products and the value of Bitcoin at large.

Adam Reeds, Mauricio Di Bartolomeo founded Ledn in 2018. The startup offers Bitcoin and US Dollar Coin (USDC) savings accounts and Bitcoin-backed loans (USDC is a stablecoin supported by Coinbase and pegged to the US dollar). Ledn also claims to have dispensed the first bitcoin-backed loan in Canadian dollars in 2018.

It offers Bitcoin and USDC savings accounts in partnership with Genesis Capital, which calls itself the globe’s largest digital asset lender. The accounts enable customers to earn interest on their Bitcoin and USDC holdings.

The startup states it is already profitable, and its sum of registered users is increasing 25 per cent month-over-month. It also claims that it serves thousands of customers located in about 100 countries, of which 60 per cent are from emerging economies. Ledn also noted that it offers the highest interest rates in the digital asset lending industry, at 6.1 per cent for Bitcoin and 12.25 per cent for USDC.

Ledn aims to remove the gap between conventional and digital asset-based financial services by focusing on regulatory compliance.

Independent accounting firm Armanino LLP recently did a formal proof-of-reserves attestation on the startup. Proof-of-reserves enables customers to confirm that service they are using does hold their crypto assets, on-chain. This tool helps digital trading companies earn and retain customer trust in an industry that faces a lot of ambiguity and chaos.

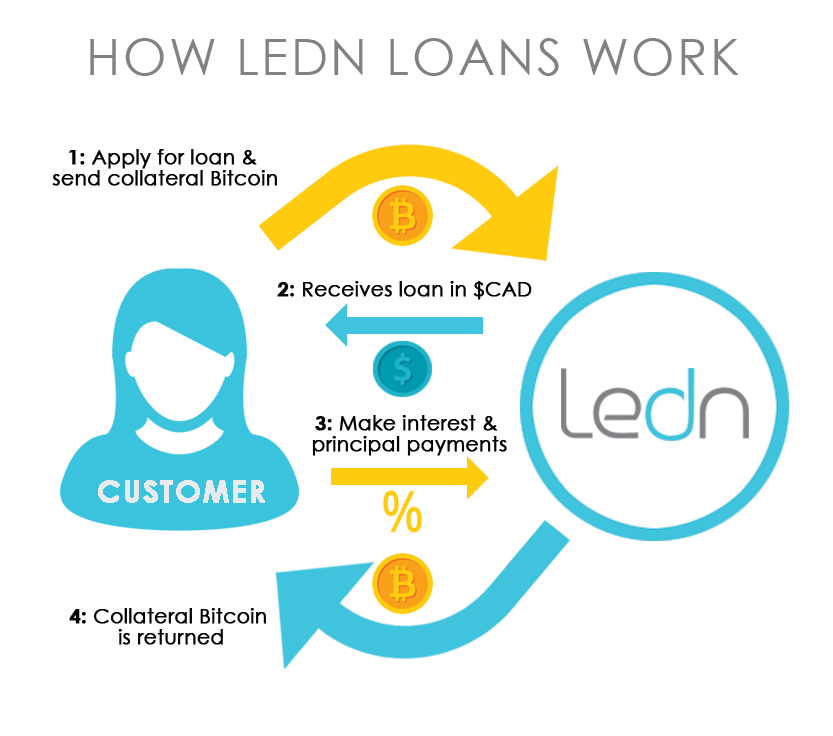

The fintech startup is on a mission to reinvent financial services around crypto-assets. In its Bitcoin-backed loans, customers can put up their Bitcoin and obtain fiat currency in exchange.

Mauricio Di Bartolomeo, Ledn’s co-founder and CSO was quoted to have said, “We believe that proof-of-reserves reviews that cover all assets and lending activities should be an industry standard across lending platforms”.

We try our best to fact check and bring the best, well-researched and non-plagiarized content to you. Please let us know

-if there are any discrepancies in any of our published stories,

-how we can improve,

-what stories you would like us to cover and what information you are looking for, in the comments section below or through our contact form! We look forward to your feedback and thank you for stopping by!

Next Story

[…] Next Story […]