Indonesia-based SaaS startup, iSeller has raised an undisclosed amount in Series A funding in November 2020, from Mandiri Capital and Openspace Ventures.

Proceeds from the funding round will be used for business expansion, increasing the number of merchants partnering with the startup and hiring individuals. The startup is also developing its platform to add new features and solutions to it.

iSeller was founded in 2017 by Intersoft Solutions, a leading visionary tech company that helps businesses turn themselves into e-businesses. Intersoft has created many pioneering web and mobile technologies used by NASDAQ, Medco, Boeing, Airbus, Accenture, Microsoft, Citibank and thousands of international companies in 35 countries.

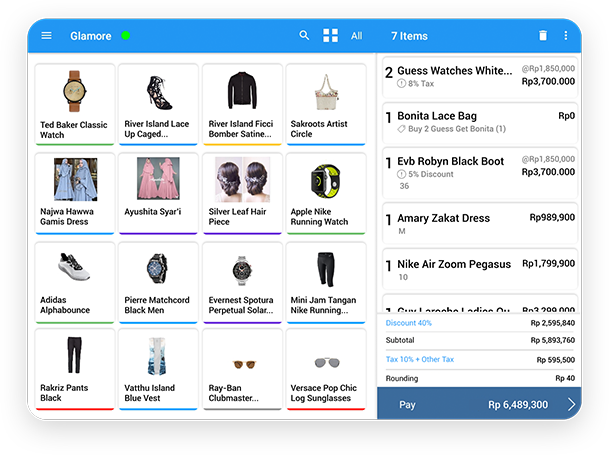

The startup provides a cloud-driven platform for omnichannel businesses by combining in-store point of sale, online storefront, payment processing, order completion and record management within a single interface. iSeller’s CEO is Jimmy Petrus. iSeller’s objective is to empower entrepreneurs to operate and manage their business with confidence and develop them easily and quickly. It also claims that it has increased its revenue and merchant pool twofold, propelled mainly by an amplified volume of online transactions during the COVID-19 period. It presently processes more than 5 million transactions a month.

Kevin Ventura, iSeller’s chief commercial officer said that since the onset of the COVID-19 lockdown in March, the startup witnessed an instant surge in demand, predominantly for its online solutions such as retail online stores, F&B online ordering and e-menus. He further added that the pandemic has increased cognizance among retail and F&B businesses on the importance of having apt technologies to sustain and grow their businesses.

About Mandiri Capital

Mandiri Capital Indonesia (MCI) is the corporate Venture Capital arm of Indonesia’s largest financial institution, Bank Mandiri. MCI acts as a bridge connecting investors and entrepreneurs to the continually-developing fintech sector. It seeks to invest in groundbreaking fintech startups, and help them scale quickly by leveraging Mandiri’s profound financial know-how, combined with access to an extensive network of merchants and customers. MCI strives to sustain Mandiri’s leadership in Indonesia through creativity and meaningful partnerships.

About Openspace Ventures

Formerly known as NSI Ventures, Openspace Ventures focuses on Series A and B investments in technology companies based in Southeast Asia. Primary sectors in which Openspace looks to invest include fintech, healthtech, edtech, consumer applications and cloud-based solutions. Openspace Ventures is presently investing its third fund and has over US$ 350M in total assets under management. It has funded over 25 companies, including Go-Jek, CXA Group, FinAccel, Tradegecko, HaloDoc, Biofourmis and Tanihub.

We try our best to fact check and bring the best, well-researched and non-plagiarized content to you. Please let us know

-if there are any discrepancies in any of our published stories,

-how we can improve,

-what stories you would like us to cover and what information you are looking for, in the comments section below or through our contact form! We look forward to your feedback and thank you for stopping by!

Next Story