New Delhi, India-based consumer electronics startup boAt has bagged US$ 59.8M in a Series B funding round held in December 2020, from Cayman Islands-headquartered South Lake Investment. South Lake Investment now holds a 21.05% equity stake in the startup, while other investors have a 7.25% stake in it.

The latest round brings the popular startup’s post-money valuation to almost US$ 285.4M.

boAt was also in the news recently for engaging in talks with private equity firm Warburg Pincus, since the latter intends to acquire a 40% stake in boAt.

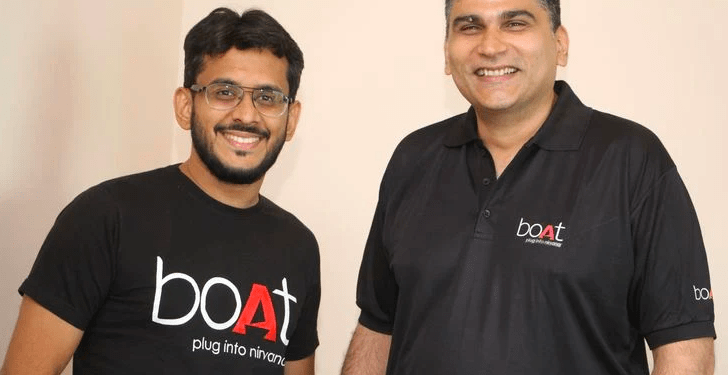

Founded in 2016 by Aman Gupta and Sameer Mehta, boAt is a lifestyle brand that deals in fashionable consumer electronics products including headphones, earphones, speakers, travel chargers, and premium cables. The startup sells its products via its e-commerce platform, in addition to Amazon and Flipkart. boAt’s products blend perfectly into the customer’s day-to-day routine, practically to the point of being a fashion accessory and a seamless fit to their ambient environs.

Post the Series B funding round, the startup’s co-founders Sameer Mehta and Aman Gupta now each own 35.4% shares in the startup, decreasing their shareholding from 90.72% to 70.8% in total.

The firm claims that it has generated over US$ 67.9M in gross revenue in March 2020 (end of the year) and its objective is to double this figure by March 2024.

boAt had earlier raised almost US$ 3.4M in a debt financing round held in September 2020, from venture capital firm InnoVen Capital. Before that, the startup had obtained US$ 2.1M again in a debt financing round from InnoVen Capital itself. In 2018, it had secured US$ 2.7M in venture debt from BAC Acquisitions, the fund of Flipkart co-founder Sachin Bansal and US$ 0.8M in a venture round from Fireside Ventures.

About South Lake Investment

Texas-based South Lakes Investment is a quantitative investment management company trading in international financial markets and devoted to generating exceptional returns for its investors by strictly sticking to mathematical and statistical methods. It aims to identify statistically substantial market inefficiencies through theory formulation, testing, and corroboration based on practical knowledge of markets and cutting-edge computational approaches.

The firm also gives a large share of its attention to flexible investment activities based on the discovery of possibly profitable chances by its experienced workforce. These tactics depend mainly on human analysis to identify and capture, pricing inefficiencies.

We try our best to fact check and bring the best, well-researched and non-plagiarized content to you. Please let us know

-if there are any discrepancies in any of our published stories,

-how we can improve,

-what stories you would like us to cover and what information you are looking for, in the comments section below or through our contact form! We look forward to your feedback and thank you for stopping by!

Next Story

[…] Next Story […]