Introduction

High-stakes is a unique series that focuses on dissecting the investments of venture capital and private equity firms to gain insights about the portfolio of companies they’ve invested in, industries they focus on, and their investment process. In this edition of High-stakes, we’ll be focusing on Matrix Partners India.

Matrix Partners, which was established in 1977 in Boston, USA, is an early-stage investor with investments of more than $4 billion (USD) across the USA, China and India. It has an impressive track record with successful exits in the form of 65+ IPOs and 110+ profitable acquisitions. Established in 2006, Matrix Partners India has made 60+ investments with $1 billion+ (USD) under management and actively invests across sectors such as Consumer Technology, B2B, Enterprise and Fintech, to name a few. The investments are usually in the funding rounds between Seed and Series B.

Team

Some of the prominent members of the investment team at Matrix Partners India:

Avnish Bajaj: Founder and Managing Director

The Harvard Business School alumnus has had an illustrious career working for some of the world’s top companies such as Apple, Goldman Sachs and McKinsey & Co. After selling Baazee-an e-commerce/auction site that he co-founded, to eBay for $55 million (USD), Avnish joined eBay India as its Chairman and Country Manager. Avnish worked with eBay India for one and half years, after which he co-founded Matrix India in 2006.

Rajat Agarwal: Managing Director

After graduating from the Indian Institute of Technology, Delhi, Rajat joined McKinsey as a management consultant, where he was tasked with developing insights for various sectors and specialized in Telecom and IT services. The Indian School of Business alumnus has hands-on experience in sales, operations and marketing. Some of his current investments include- Razorpay, Ziploan and Toddle.

Tarun Davda: Managing Director

Tarun started his career as a developer for the Indian IT giant- Infosys, where he was tasked with providing IT consulting and outsourcing services to Fortune 100 US clients. Post Infosys, Tarun established BigRock.com and served as its Business Head. The company provided domain name registration and other web services and was later acquired by Endurance International for $100M (USD) in Jan 2014. Later, Tarun co-founded StepOut.com, an online dating site that had over 5 million users and was acquired by Match.com in Sep 2013. Some of his current investments include MoEngage, DealShare and Ola.

Vikram Vaidyanathan: Managing Director

The Indian Institute of Management, Bangalore grad has held various roles over the years, working as a product developer, FMCG marketer, start-up team member and strategy consultant, to name a few. During his stint at McKinsey, Vikram worked across multiple sectors such as TV, retail, engineering construction, manufacturing and mobile media. Some of his current investments include Dailyhunt, Five Star and OfBusiness.

Analysis

A total of 114 investments across 71 startups have been considered for this analysis, and the analysis is based on data from Crunchbase. The startups included are those for which adequate information exists, and this is by no means an exhaustive list of all the investments made by Matrix Partners India. The figures for total funding raised represent the total amount of funding raised by the startups from Matrix Partners India and various other investors across the different rounds that Matrix Partners India has participated in.

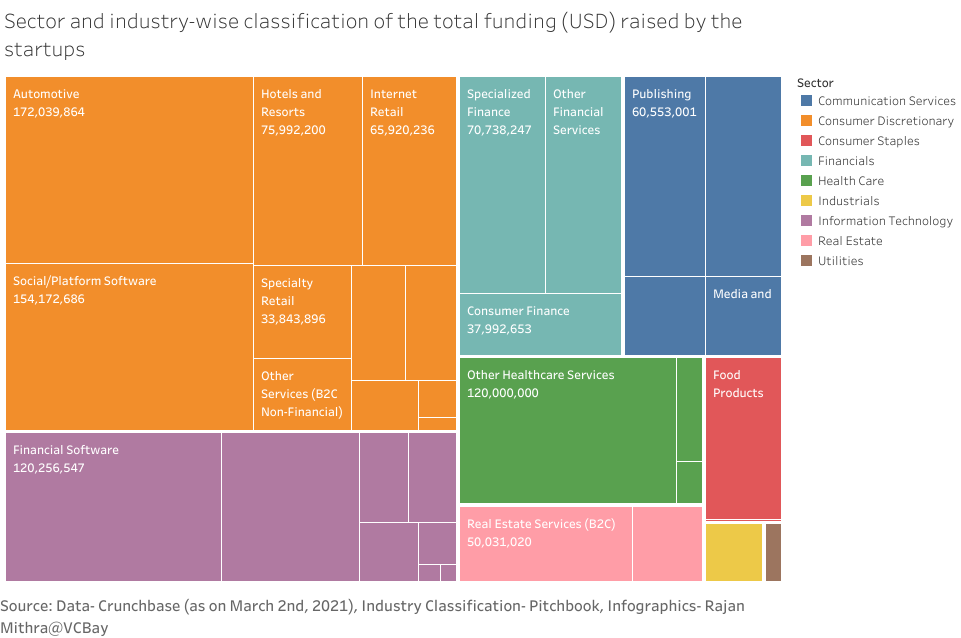

The industry classification is based on data from Pitchbook, and the sector classification is (classification of the startups are subjective and has been made considering the sector they closely resemble) based on Global Industry Classification Standard (GICS) developed by Morgan Stanley Capital International (MSCI) and Standard & Poor’s. According to GICS, startups are classified into 11 sectors, namely Energy, Materials, Industrials, Consumer Discretionary, Consumer Staples, Healthcare, Financials, Information Technology, Communication Services, Utilities and Real Estate. Examples of some of the industries present within the different sectors:

- Energy: Energy equipment & services and Oil, Gas & Consumable Fuels.

- Materials: Chemicals, Construction Materials and Metals & Mining.

- Industrials: Capital Goods, Transportation and Commercial & Professional Services.

- Consumer Discretionary: Automobiles & Components, Consumer Durables & Apparel and Retailing.

- Consumer Staples: Food & Staples Retailing, Food, Beverage & Tobacco and Household & Personal Products.

- Health Care: Health Care Equipment & Services and Pharmaceuticals & Biotechnology & Life Sciences.

- Financials: Banks, Diversified Financials and Insurance.

- Information Technology: Software & Services, Technology Hardware & Equipment and Semiconductors & Semiconductor Equipment.

- Communication Services: Telecommunication Services and Media & Entertainment.

- Utilities: Electric Utilities, Gas Utilities and Water Utilities.

- Real Estate: Equity Real Estate Investment Trusts and Real Estate Management & Development.

Across the 71 startups that Matrix Partners India has invested in, 55 are still active, and 16 of them have either closed down or have been acquired/merged. Among those that are active, 54 of them are private, and one has gone public. JustDial is an information services company that went public in 2013. The company provides local search-related services to Indian users through a variety of platforms and has also launched an end to end business management solution to support small and medium enterprises to efficiently run their business online.

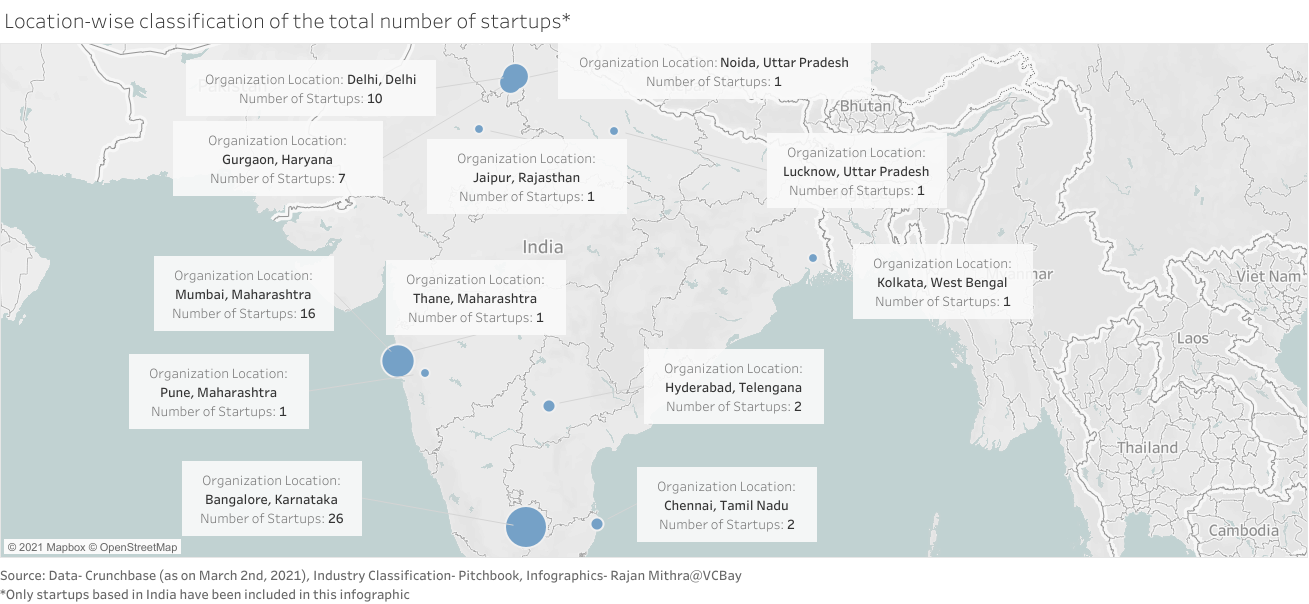

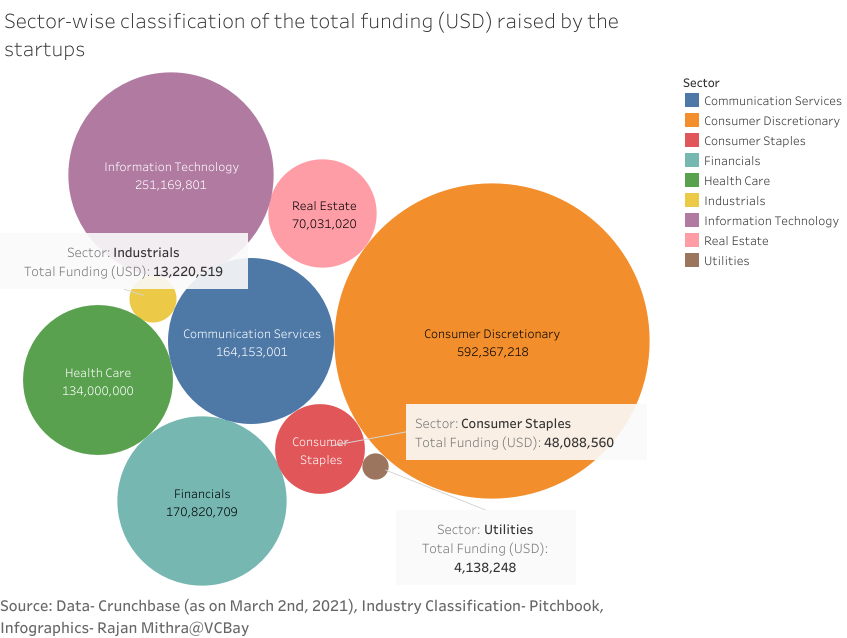

The Consumer Discretionary sector is the largest in terms of the total funds raised, with startups in the sector, raising a whopping $592 million (USD). The majority of the investments in this sector have flowed towards startups in the Automotive industry and the Social/Platform software industry. Quikr is an online classifieds platform that supports advertisements across a wide array of products such as automobiles, flats, furniture and tools, to name a few. It has cumulatively raised $154 million (USD) from Matrix Partners India and other prominent investors such as Omidyar Network, Warburg Pincus and eBay. Founded in 2016, Vogo is a Bangalore (located in the southern part of India) based online scooter renting platform that allows users to rent scooters for short one-way trips. Vogo has raised close to $76 million (USD) from Matrix Partners India, Lightrock, Kalaari Capital, Stellaris Venture Partners and Ola, among others. Chumbak is a lifestyle brand that operates retail stores with an extensive product lineup comprising apparel, home décor and stationery, to name a few.

Startups in the Information Technology sector are ranked first in terms of the total number of startups (23) and second in terms of the total funds raised (USD 251 million). Financial Software and Business/Productivity Software together constitute 79% of the investments in this sector. OfBusiness is a Gurgaon, Haryana (located in the northern part of India) based financing platform that helps small and medium enterprises to get secured and unsecured credit lines. It has cumulatively raised close to $79 million (USD) from Matrix Partners India and other acclaimed investors such as Norwest Venture Partners, Zodius Capital and Falcon Edge Capital, among others.

The Financial and Communication Services sector together constitute 23% of the total funds raised or $334 million (USD). The majority of the investments in the Financial sector have flowed towards startups in the Specialized Finance and Other Financial Services industry. Five Star Business Finance is the largest recipient of investments in this sector, raising more than $55 million (USD) from Matrix Partners India and other investors across 2 rounds- Series A in 2014 and Series C in 2017. The second-largest recipient (USD 38 million) is Bangalore, India based Avail Finance, which offers a mobile financing application providing low-interest personal loans within a few minutes. Ola Money, the digital payments arm of the Indian cab aggregator, allows users to pay for cab fares, electricity and gas bills enabling speedy, secure and hassle-free transactions. Ola Money raised approximately $27 million (USD) in a Series A round led by Matrix Partners India in May 2020.

The total funds raised by startups in the Health Care sector (USD 134 million) is roughly 3 times that of the Consumer Staples sector (USD 48 million). The $120 million (USD) investment in Practo represents 90% of the investments in the Health Care sector. Founded in 2008, the startup provides an online doctor consultation platform with automated appointment scheduling and storage of health records.

Conclusion

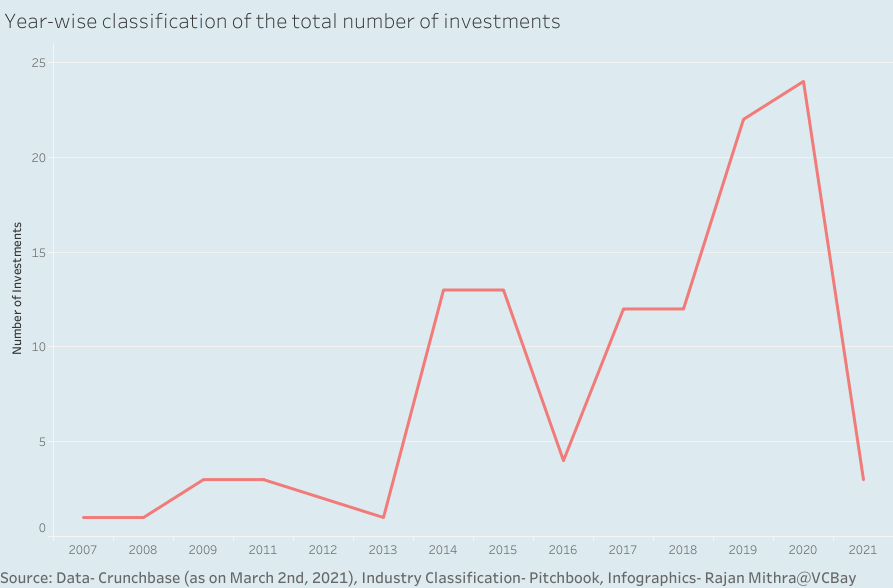

The Consumer Discretionary sector and the Information Technology sector are two of the prominent sectors representing 58% of the total funds raised and 60% of the total number of startups. Investments in funding rounds between Seed and Series B constitute 67% of the total number of investments. Despite the pandemic, 2020 has been the most active year for Matrix Partners India, with 24 investments, followed by 2019 with 22 investments. Overall, Matrix Partners India has participated in funding rounds totalling $1.44 billion (USD).

For more extensive analysis and Market Intelligence reports feel free to approach us or visit our website: Venture Capital Market Intelligence Reports | VCBay.

We try our best to fact check and bring the best, well-researched and non-plagiarized content to you. Please let us know

-if there are any discrepancies in any of our published stories,

-how we can improve,

-what stories you would like us to cover and what information you are looking for, in the comments section below or through our contact form! We look forward to your feedback and thank you for stopping by!

Next Article

[…] High-Stakes: Matrix Partners India […]

[…] startup has raised close to $13.2 million (USD) between 2015 and 2018. It is backed by the likes of Matrix Partners India, Exfinity Venture Partners and […]

[…] startup has raised close to US$ 66 million across four rounds and is backed by investors such as Matrix Partners India, Stellaris Venture Partners and […]