Background

Music has been one of the oldest forms of entertainment, leading to the building of cultures, revolutions and socialisation. Technology has constantly disrupted the form in which it has been consumed. The latest disruption in the Online Music industry has democratised music to the extent that it can be consumed virtually free by every single individual with access to the internet crashing, language, geography and medium boundaries.

Music listening has taken multiple forms based on individual or group listening, indoor or outdoors, recorded or live, etc. It reaches consumers through radio waves, world radio channels, internet music, access-based music, radio feeds etc. has over the years made music far more democratised.

From being forced to buy and listen to whole albums, hearing pirated singles using Napster, to finally being able to make our own list, has been a big leap in entertainment. This has given a leg up on the concept of free music which while being free was actually the choice of a Radio Jockey who played it free on radio waves.

Industry Definition

The music industry is primarily an entertainment industry driven by creative activities and consumed by listeners in various times, forms and social settings. The individual creative process involves composers and songwriters who create songs. Artists then arrange and perform either live on stage or record for distribution to consumers, or licensed for use as background in other media like advertising, television and as background songs in films, etc. Businesses in this industry is then focussed on three core portions; 1. Recorded music, 2. Live Music and 3. Licensing.

Recorded music is where the bulk of the action is. From the whole creative process of creating a final song, packaging it into an album, distributing and marketing it and tracking it for payments at public places, this part of the industry is the largest.

The Live Music businesses focused on producing and promoting live entertainment, such as concerts, tours, etc. has very high glamour and cult value. This part of the industry is highly artistic centric and revenues tend to be dis-proportionately skewed towards the core performer.

Licensing compositions and arrangements to businesses contribute around 2% to the industry revenue. Peripheral businesses like instruments, software, stage equipment, music merchandise, etc. do add up to this industry but do not form a large portion of the revenue mix.

Industry Size

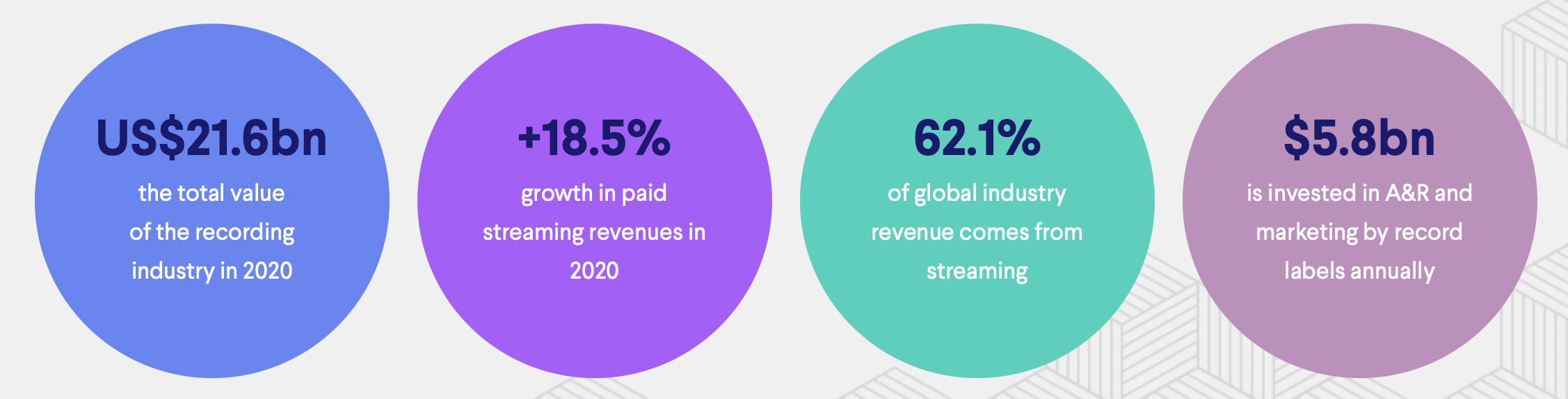

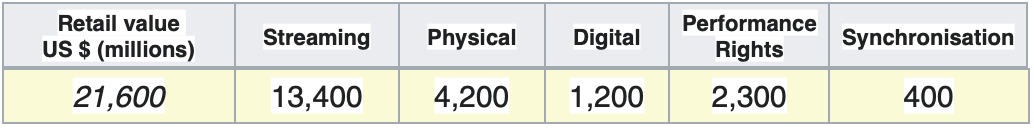

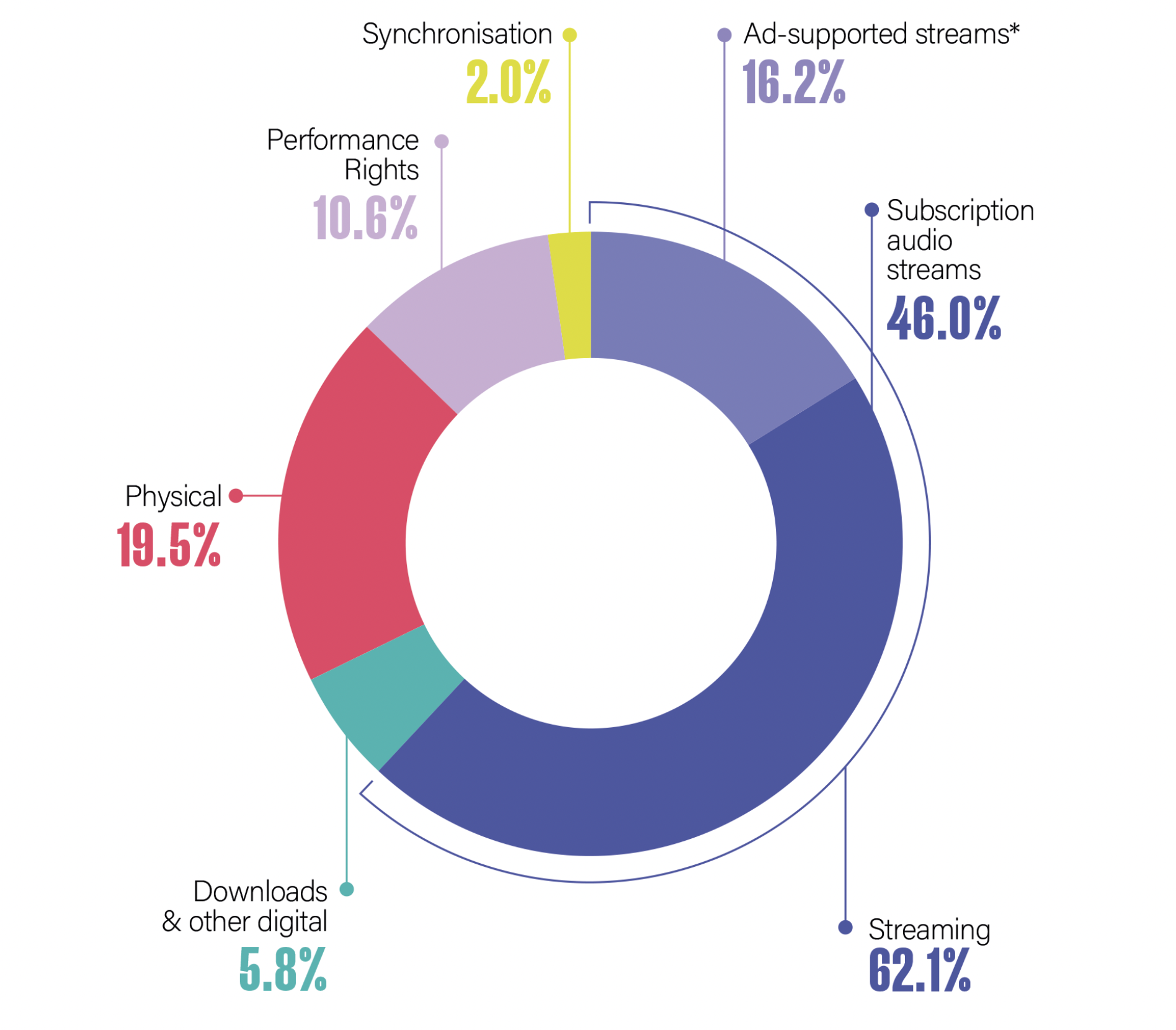

The 2020 revenue for music across the globe is USD21.6 billion, which has been a substantial growth from USD14 billion in 2014 . This revenue was a 7.4 percent growth from the previous year’s total of USD20.2 billion. The recorded music industry which was declining continuously for two decades, had rebound to grow for six consecutive years starting 2014. This was the year when revenues hit rock bottom because of piracy when digital consumption of music facilitated consumption without ownership. Piracy lasted for two decades and the music industry in its fightback was aided some fundamental changes like pricing of singles instead of having to buy albums, music storage and consumption devices like iPods becoming a part of lifestyle and then finally aided in large part by streaming from 2015. Paid subscription streaming revenues, which increased by 18.5% drove growth in streaming.

Move to Digital

In the 1990s CDs ruled the roost. Music was typically sold as albums, marketed by large record labels who decided the trend of music and the fate of musicians. Digital disruption was initiated by the technology called MP3, which converted music into digital form. The MP3 data form could be stored in devices 1/10th the size of a small CD player, played on a computer and could be transferred electronically at the press of a button killed the control held by big music houses over music consumption. File sharing reduced physical music CD sales by 60 percent with a loss of USD 14 billion in annual revenue between 2001 and 2010. While physical sales dropped, MP3 file sharing ushered in the word music piracy, which meant that digital music grew during the same period only to USD 4 billion, reducing the total revenue.

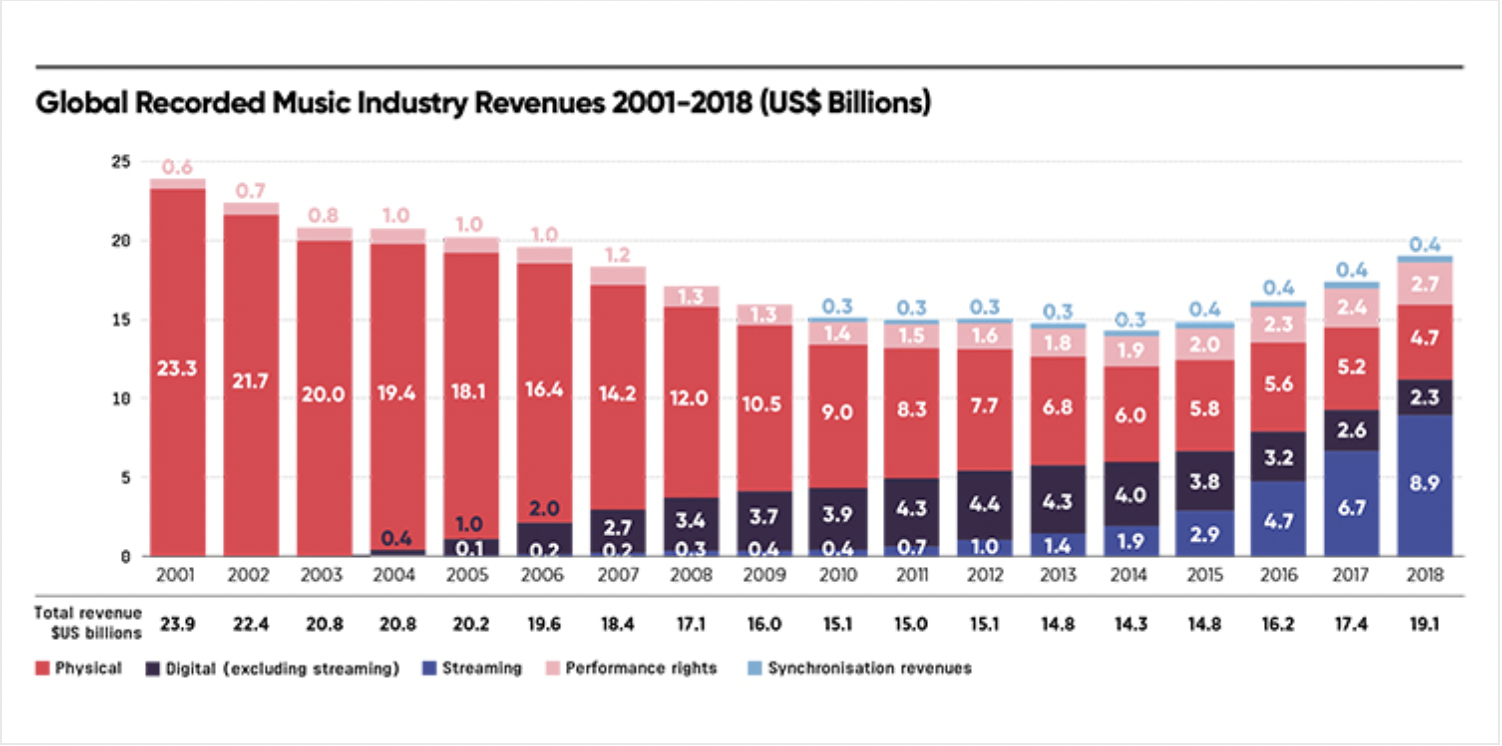

When revenues dropped alarmingly the music industry took long to wake up from the hit. Realising that there would be no way to reverse the onslaught of digital technology from 2004 new players started pushing digital distribution along with ways to monetise it. While revenues are still at 80% of 2001, digital music is finally contributing. 62 percent of the worldwide music revenues comes from streaming services. Paid subscription of streaming music has 443 million subscribers in 2020. Streaming is more profitable as margins are generally higher (50-60%) than physical music products (40-50%).

Format trends

Physical Music

Physical music continues to de-grow, contributing 20% of the total revenue in 2020. It now remains in the realm of nostalgia and collection aficionados who find virtue in the tactile and identity markers they provide.

Live Music

The pandemic impacted the revenue sales dramatically to less than USD 10 billion from an USD 28 billion in 2019. Hopefully, the revenue is expected to bounce back quickly with a vengeance as people forced in the lockdown would want more of it and 2022, should reach the levels of 2019. At the current rate of growth the live music was forecast to reach USD 31 billion by 2024.

Streaming Music

Contrary to Live Music, Streaming continues to grow even during the pandemic, growing by 23 percent over 2019. Streaming revenue of USD 13.4 billion comes from a combination of 443 million paid users and advertising driven by a large number of music listeners on these streaming applications. It is expected to reach USD 21 billion by 2025, accounting for 56 percent of the total recorded music revenue. Businesses providing free streaming are seeing consumption grow at breakneck speeds while they try various means to monetise this large user base. All Streaming music apps continue to be offering both free and paid profiles.

Music Downloads

Ownership has declined tremendously both in the physical format and in the form of digital downloads. It continues to decline hitting revenue of USD 2 billion in 2020 and targetted to drop below USD 1.5 billion by 2025.

Music Distribution Models

1. Ownership Model

Customers acquired music by buying Vinyls, Cassetes, CDs. People perceive immense value in the material and tactile feeling of the medium along with the music itself. It was also an identity marker like vehicle ownership. With the arrival Apple iTunes many of the ownership virtues were transferred to the digital space. The tactile experience was replaced with the stylish iPod along with docking and bluetooth speakers. This also broke the need to buy out a whole album and the owner can choose the singles which they like from a whole album. This ownership model was plagued with piracy and players like Napster and its acolytes reduced the need for legal ownership as digital storage and transfer of music could be done easily and without a trace.

2. Access Model

Access model is very unique to the digital era. In the earlier delivery formats while radio did deliver music access, yet, it was not a hundred percent choice of the listener, but was through the process of curation of an expert. Digitalisation has personalised the whole choice of music a listener wants to without having to own it. While the listener has now an unlimited choice in her hands, businesses are still trying to, find ways to monetise their services. In the rush to capture maximum listeners on their platforms players are still grappling to find an optimal service structure and pricing model that is able to maximise the revenues from subscription fees and advertising. Currently, most of these services are limited by for instance the size of their music catalogues, the number of countries they are available in, how often and with what flexibility it is possible to listen to a certain song, the range of supported mobile devices, etc. The identity marker of hearing music in the owned model is challenged both in the missing component of the physical device a well as the social sharing aspect of playing through a device.

This has been slowly replaced with more of an experiential model similar to sharing the experiences of having used an service than having consumed a product like the physical model. The experience of having listened to music is shared over social media. Sometimes it is even more enhanced by using applications like karaoke, tik-tok and edging to create your own signature music.

3. Context Model

This model is at the early stage of the music listeners pallete. The contexts could be created to reflect the mood and the social occasion, geography, of the listener/s. Personalised playlists, algorithms, nostalgia of radio, DJ led music, celebrity list, curators etc. Technology can play an immense role both in understanding the listener’s music space at a given point of time and curate a playlist by learning song moods through tones, words and pitches. While Technology like remote sensing, location sensing, social setting by the images around the device, motion tracking, etc. can identify the context in which music is being demanded, it can use machine learning techniques like zero-crossing or mel-frequency to cluster human voices etc.

Startups

Music being such a glamorous industry, startups are spawning, dime a dozen across the globe. The uniqueness is, that consumption is agnostic of class and creed and hence has a huge audience yet digitalisation has crashed revenues. Streaming revenues are slowing down as markets mature like Spotify has managed only a 7% growth in 2020 in its home market of Sweden where streaming is 85% of the recorded music revenue contributor. Streaming services are still in the race of market share which means huge marketing spends with limited ideas to push consumers towards subscription. Since the cost of music creation is much lower as compared to films and videos many of these streaming platforms do not have the content leadership like Netflix.

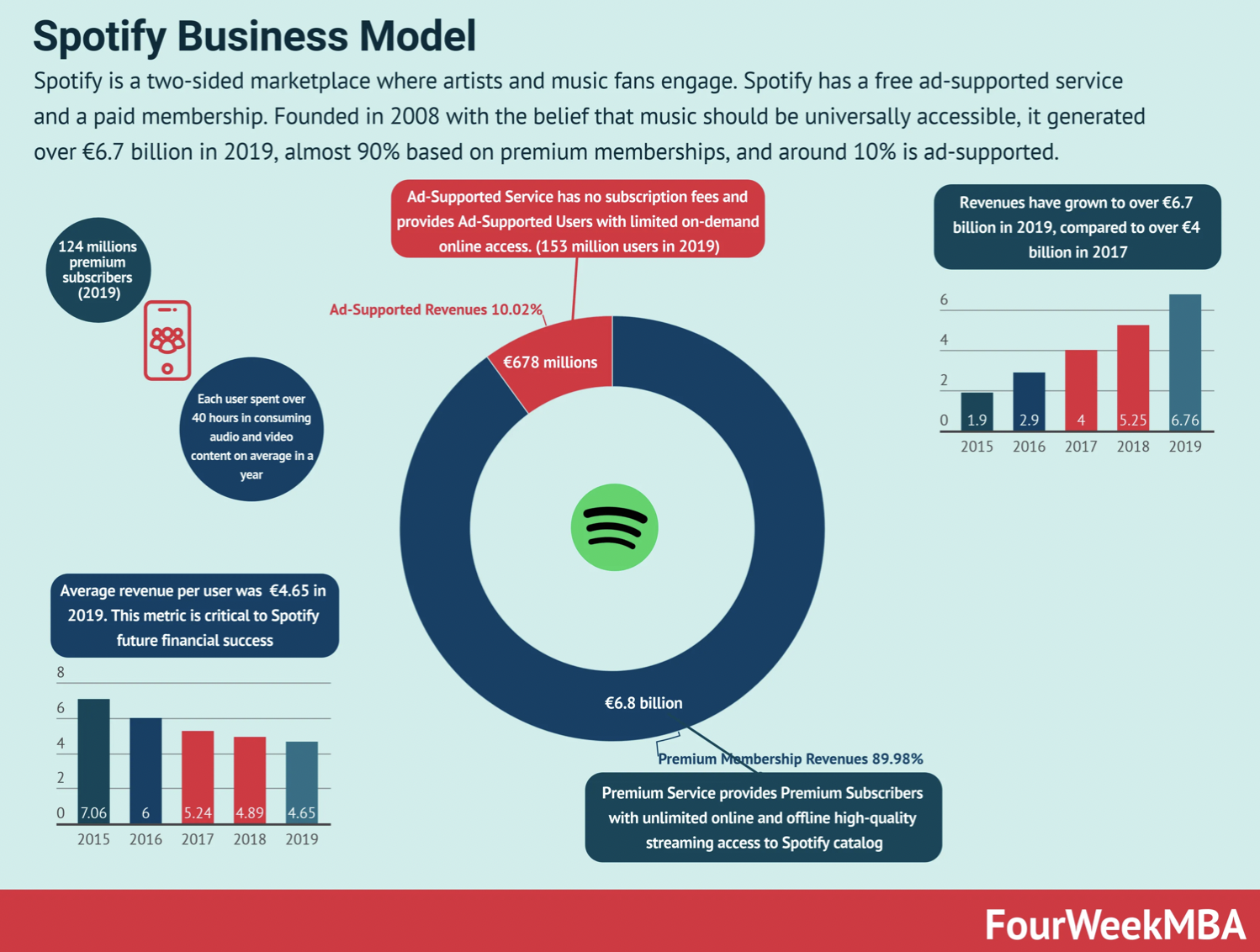

Spotify the leader in this space has been trying its hand at various models and pivots, the latest being podcasts. Spotify monetizes its streaming services through two main business segments: Premium Service and Ad-Supported Service. The company provides segment breakdowns of revenue and gross profit, the latter of which was reported as €2.0 billion in FY 2020, generating a consolidated gross margin of nearly 26%.

My Take

Streaming Apps are in a race to dominate the winner takes it all model like most of the technology startups and finding the right horse to bet on will be extremely tough.

As I said earlier music as a form of leisure, entertainment, therapy and socialization cuts across all class and creed. After story telling, if there is anything which has universal appeal then it is singing, to which all individuals gravitate. With the advent of social media, recording apps like Tiktok, Soundcloud, Youtube, and TV music shows, music making and self publishing has become that much more easier.

I believe that betting on Apps that help create music and self publish without the need for a large record label to publish could be a high potential opportunity.

Businesses like Tunedly, Sound Brenner, and Soundbridge should be the startups of the future. As music has become more virtual, identity markers, and social credibility is being built by being a good musician, singer, composer rather than being just a consumer or a patron.

Rahul is an angel investor in Melopond Music Station Private Limited.

For more extensive analysis and Market Intelligence reports feel free to approach us or visit our website: Venture Capital Market Intelligence Reports | VCBay.

We try our best to fact check and bring the best, well-researched and non-plagiarized content to you. Please let us know

-if there are any discrepancies in any of our published stories,

-how we can improve,

-what stories you would like us to cover and what information you are looking for, in the comments section below or through our contact form! We look forward to your feedback and thank you for stopping by!

Next Article

All data points from IFPI. Cover image attribution: Music vector created by freepik – www.freepik.com