Startup failures are very common, yet the least talked about. In this startup failure series, we will give you case studies that focus on startups that nearly succeeded, and gradually failed, where they went wrong and provide insights into how you can avoid making those same mistakes.

Fab.

Startup failure is like the Titanic and the iceberg. The factors that lead to the disaster are often not acknowledged until the ship is already sinking. Something similar happened with Fab. Fab was once known as ‘the world’s fastest-growing startup’. It was valued at over US$ 1 billion before it ultimately crashed. It was co-founded by Jason Goldberg and Bradford Shellhammer.

Timeline:

2010: Jason Goldberg founded Fabulous, a gay social network.

2011: Fabulous pivots to Fab.com, an e-commerce site.

2011-2013: Fab raises more than US$ 330m, acquires around 10 million users, is valued at US$ 1B+.

2014: Fab faces revenue shortfalls, massive layoffs; the company is burning through US$ 14m/mo.

2014: Fab sold for around US$ 15-30M (one-tenth of its 2013 valuation).

2015: Jason sells flailing Hem at a loss.

In November of 2014, CEO Jason Goldberg had to sell Fab.com, the company which he’d spent precious few years of his life building.

The company’s success story and the cautionary tale is related to the risks of pivoting.

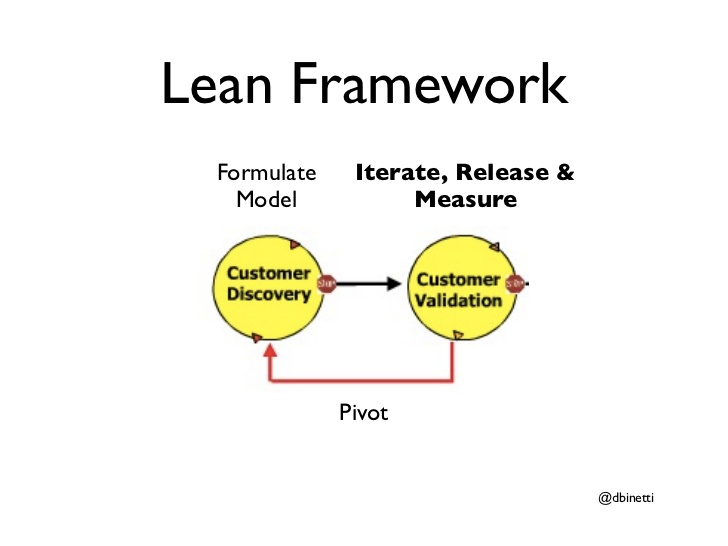

A pivot is basically a shift in business strategy to test a new approach regarding a startup’s business model or product after receiving direct or indirect feedback, and it’s one of the fundamental concepts of lean startup methodology. In lean startup methodology, entrepreneurs question everything, starting from their initial idea to their design choices or any features they’re considering adding.

While considering pivot, businesses look to find a fresh perspective and vision to prevent themselves from becoming stagnant. As startups evaluate data constantly by measuring the market, contemplating new strategies or testing new products, if they find that their strategies are not working, pivoting allows them to forge ahead in a new direction.

“Once we made the decision to pivot, we committed to doing one thing and doing it well. No distractions,” said Jason Goldberg.

What really led to the sinking of the company?

Fab was originally known as Fabulis, a gay social networking site before it pivoted into a daily flash sales site for independent artists. As Fabulis wasn’t turning out to be the success that the founders had hoped, as they were stuck at 150,000 users for the last few months, they decided to pivot.

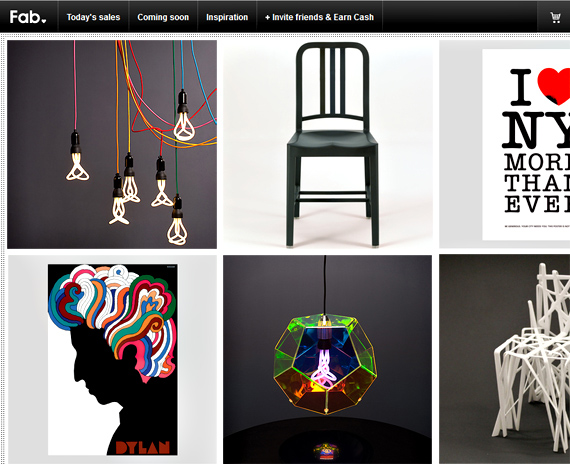

They gathered data from Fabulis and discovered that people were looking for an easy and accessible way to purchase unique and interesting designer wear. So, they pivoted to become a daily flash sales site for designer housewares, accessories, clothing, and jewellery. This led to Fab growing to over 10 million users and generating more than US$ 200,000 per day.

However, two years later, after the initial pivot, Fab decided to pivot again. At that time, it had a shaky business model. It aimed to become a designer alternative to Amazon and Ikea.

From success to failure

Before pivoting, a business should examine if it’s solving a major problem by doing so. At the time, Fab was a hugely successful company, despite the fact that the daily flash sales model wasn’t sustainable in the long term. Fab sold third-party items from boutique design shops that were curated with Brad’s style. Under their model, they could sell limited amounts of inventory at a discount for one or two-day periods. They thrived on offering items people couldn’t find anywhere else.

Between 2011 and 2013, Fab raised US$ 333.7M in capital from Andreessen Horowitz, Menlo Ventures, and Ashton Kutcher. Soon, it achieved a valuation of more than US$ 900M. The Fab team started growing dramatically. They invested in a two-story office space in New York and a massive inventory warehouse in New Jersey.

In 2012, a ‘whirlwind of insanity’ had started. Revenues were shooting up, and every day, Fab was breaking a new revenue milestone. They started hiring even more, and by June 2012, Fab had grown to 150 people. Jason and his board decided to move fast and expand into Europe, even though the business was still nascent in the USA. That was when things started going downhill.

Fab acquired three similar European startups, Casacanda, Llustre and True Sparrow Systems, which cost them US$ 60M-100M. The sales that were generated were not enough to cover the expenses of the business. Maybe, making investments in Europe would have been more natural after 2 years, when their US business was established.

Another decision that backfired was to ditch flash sales and start holding inventory, which increased expenses and margins thinned. It took about 16.5 days for a customer to receive a product ordered on their site. Therefore, Fab purchased a warehouse in New Jersey.

It then increased the number of products, and the delivery time dropped to 5.5 days. Fab jumped from having 1000 products (stock-keeping units) per day in 2011 to 11,000 six months later. They expanded across 32 categories that led the company to lose its competitive edge. Their originality diminished, and the products they sold could be found on any other site like Amazon. Fab generated US$ 110 million in 2012, but piles of inventory remained unsold. Despite that, it decided to ditch flash sales and sell items from its stock. And that apparently was the end of the company!

Goldberg tried everything to keep the company afloat and decided that Fab needed to move faster. Jason, being a great speaker, said that there were four e-commerce companies in the world worth more than US$ 10B, and Fab could become the fifth. Investors were impressed by him.

Fab’s spending increased to US$ 14 million per month, and sales increased as well. Gradually, Jason realized as he began fund-raising that money was harder to round up, and Fab had some serious issues as a result of its 2012 growth tactics. Europe was turning out to be no less than a catastrophe, and there were hardly any repeat buyers on their website. By July 2013, Jason was able to raise US$ 150M only, whereas Fab’s valuation was US$ 900M. Money was tight, and Fab had to fire 150 employees in Europe.

By June 2014, Jason had begun working on another project within Fab, a new eCommerce company called Hem, which would focus on original, high-end home goods. He decided to invest the leftover Fab funding (US$ 80M) into Hem and sell off Fab’s remaining assets. Hem eventually sold for even less.

Crux of the problem

Fab could have been saved. But Jason’s inclination towards pivoting the business apparently led to stacking up of problems rather than solving the existing ones. The excess spending was also a major reason behind the fallout. Business ideas can be changed twice or thrice, but after that, the business doesn’t remain the same anymore. To state the facts, 500 jobs were lost, US$ 250M was burned, and a valuation of US$ 875M was lost.

Takeaways from the Fab fiasco

It’s quite natural for a struggling startup to pivot, especially when the alternative is to remain stagnant and unprofitable. However, pivoting for the sake of pivoting, or to expand on a shaky business model can often lead to a disaster for any entrepreneur, no matter what the valuation of your company is or how much money you’ve raised.

We try our best to fact check and bring the best, well-researched and non-plagiarized content to you. Please let us know

-if there are any discrepancies in any of our published stories,

-how we can improve,

-what stories you would like us to cover and what information you are looking for, in the comments section below or through our contact form! We look forward to your feedback and thank you for stopping by!

Next Story

[…] perspective and vision to prevent themselves from growing stagnant. A well-known pivot is when Fab went from being a gay social network to being an e-commerce […]