An Israel-based FinTech and social trading investment network, eToro, has just announced, on March 16, 2021, its intention to go public through a merger deal worth US $10.4 billion. The merger will be carried out with SPAC FinTech Acquisition Corp. V and is expected to be completed sometime during the third quarter of this year. The transaction includes commitments for a US $650 million common share private placement from leading investors SoftBank Vision Fund 2, ION Investment Group, Fidelity Management & Research Company LLC, Third Point LLC, and Wellington Management. The overall US $10.4 billion implied equity value of the merger arrangement includes an implied enterprise value for eToro of US $9.6 billion.

A rival to the popularly-known Robinhood, eToro has had an impressive record (both financial and otherwise) so far in the industry. Upon the close of the deal, the combined company will be known as eToro Group Ltd and is expected to be on the Nasdaq exchange list.

Growth and Trends in the industry

eToro was built on a “vision of opening up capital markets.” Having launched its platform in the U.S. just over two years ago, it has witnessed rapid growth as of late. According to them, eToro gained 5 million new registered users and generated revenues of US $605 million, a 147% year-on-year growth.

In January, the company gained more than 1.2 million new registered users and facilitated over 75 million trades on its platform. A significant growth compared to 2019 when it averaged 192,000 monthly registrations and 2020 when the numbers rose to 440,000.

eToro plans to capitalize on several secular trends such as growing retail participation, the rise of digital wealth platforms, and mainstream crypto adoption. The organization benefited greatly from the recent increase in retail investment interest and consumer investment apps and services.

According to FinTech V chairman Betsy Cohen, “eToro has effective controls, outsized growth, and top-notch management teams, all requirements of the Fintech Masala. For some years now, eToro has solidified its position as the leading online social trading company outside the United States, highlighted its plans for the United States market, and diversified its income streams. eToro is now at an inflection point of growth, and we are positive that the company is conveniently positioned to capitalize on this perfect set of circumstances.”

Company Profile

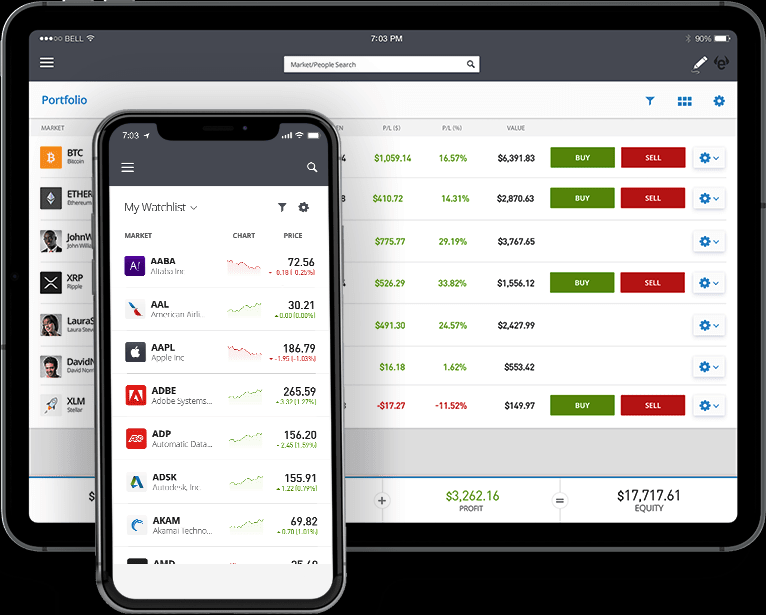

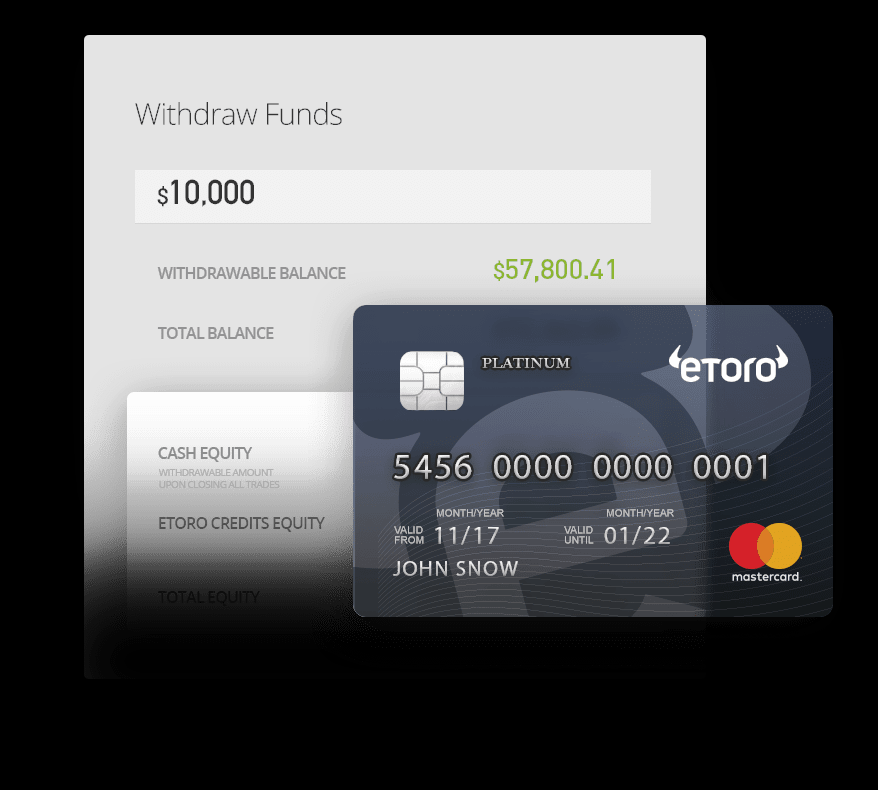

eToro is a multi-asset social trading investment network that allows customers to watch the financial trading operations of other customers, duplicate them, and carry out their own trades. Their products, WebTrader and OpenBook, empower merchants to share live trading information, learn from one other, and capitalize on their collective strength. Launched in 2007 by David Ring, Ronen Assia, and Yoni Assia, the company has its headquarters in Tel Aviv, Israel, and has registered offices in Israel, Cyprus, and the United Kingdom.

We try our best to fact check and bring the best, well-researched and non-plagiarized content to you. Please let us know

-if there are any discrepancies in any of our published stories,

-how we can improve,

-what stories you would like us to cover and what information you are looking for, in the comments section below or through our contact form! We look forward to your feedback and thank you for stopping by!

Next Article

[…] Trading Investment Network, eToro, to go public through SPAC merger in US $10.4B deal […]