What if you could check for cholesterol, diabetes and a multitude of other ailments with a single drop of blood? What if a zero-emissions truck could haul 80k pounds with only 15 minutes of downtime and had a range of 1000 miles?

Sounds fascinating, isn’t it? Almost too good to be true, even?

It really was too good to be true. Theranos and Nikola Motor, which were worth US$9 billion and US$34 billion, at their peaks, respectively, have turned out to be era-defining scams that have sent shockwaves among the investor community.

So how did Elizabeth Holmes, who was once the youngest female self-made billionaire and Trevor Milton, the visionary entrepreneur who was once compared to Elon Musk, pull off such an elaborate scam? Who invested in these fraudulent startups? Will these events have any impact on Silicon Valley going forward?

Theranos

Elizabeth Holmes was just 19 years old when she founded Theranos in 2003. Holmes wanted to create a cheaper, less intrusive, and more convenient way to scan for hundreds of diseases and health issues by taking just a few drops of blood with a finger prick instead of inserting a needle in a vein.

Holmes, with her seemingly revolutionary device named Edison, aimed to disrupt an industry dominated by giant testing companies such as Quest Diagnostics and Labcorp.

Investors soon bought the story, and media tycoon Rupert Murdoch was one of Theranos’ earliest investors.

American pharmacy store chain Walgreens and supermarket chain Safeway believed in Holmes’ vision. Safeway signed a contract with Theranos in 2010 and spent close to US$400 million on the deal, the majority of which went into remodelling 900+ stores to build patient service centres.

Walgreens entered into a partnership with Theranos in 2013 to bring Theranos’ tests into Walgreens’ pharmacies and invested more than US$140 million, of which US$100 million was an “innovation fee.”

Theranos’ raised close to 90% of US$1.4 billion in total funding after it announced its partnership with Walgreens. FOMO induced investors wanted a piece of the success story before it became the next Apple.

Other prominent investors include former US education secretary Betsy DeVos and Tim Draper. Theranos also had high profile board members such as former National Security Advisor and alleged war criminal Henry Kissinger, Former United States Secretary of State-George Shultz, Former United States Secretary of Defense- William Perry and former Wells Fargo CEO Richard Kovacevich.

With such an illustrious line-up of companies and investors, how was Holmes able to deceive them?

Smoke and Mirrors

[Holmes] has sometimes been called another Steve Jobs, but I think that’s an inadequate comparison. She has a social consciousness that Steve never had. He was a genius; she’s one with a big heart.

– William Perry, Theranos Board Member, Former Secretary of Defense, and Stanford Professor

Holmes forced comparisons with that of Steve Jobs by donning black turtlenecks and is also known to have used a faux-deep voice to appear serious. Holmes’ gender also added to her aura and made her a subject of fascination. Holmes was also said to be an incredibly persuasive person. And the idea of Theranos in itself garnered a wide appeal, and people genuinely wanted her idea to work.

Unknown to many at that time, Theranos’ blood-testing technology kept producing misleading results, forcing patients to undergo regular blood draws instead of the promised finger prick. Later, Theranos secretly tested those samples in a traditional laboratory setting using conventional machines.

Both Safeway and Walgreens consulted experts from Johns Hopkins University and the University of California, San Francisco, who were convinced about Theranos’ idea but did not get their hands on the device to see if it actually works.

Holmes used “trade secrets” as her trump card to avoid disclosing critical information whenever investors, reporters, or regulators came snooping around. The reality was that there was nothing behind the curtain; Theranos didn’t have any trade secrets because its machines didn’t work.

Holmes is known to have lied about purported deals with Pfizer and the U.S. military. The Stanford dropout is also accused of forging due diligence reports from pharma giants like Pfizer and Schering-Plough, which she used to lure Walgreens.

Another major red flag was how noticeably light Theranos’ 12-person board was on medical and tech experts. Health care companies usually recruit people with significant health care experience to serve on their boards. So by having high ranking former U.S. government officials on her board, Holmes effectively utilised ‘borrowed credibility’ to perpetuate the fraud.

House of Cards

Holmes’ elaborate house of cards came tumbling down when John Carreyrou published his story in the Wall Street Journal in October 2015.

The WSJ’s expose was followed by extensive government investigations into Theranos and its disgraced founder. That same year, Safeway ended its US$400 million deal with Theranos while Walgreens ended its partnership in 2016.

Fast forward to March 2018, the SEC charged Holmes for defrauding investors and stripped her of control of the company, and the company finally shut down in Sep 2018. Within a span of 15 years, Holmes went from the world’s youngest female self-made billionaire to an infamous fraudster. In Jan 2022, jurors convicted the former Theranos CEO on four of 11 counts of conspiracy and fraud. The disgraced founder faces fines of up to US$250,000 for each count and a maximum of 20 years in prison.

Nikola

Trevor Milton founded Nikola Motor Company in 2014, with the aim of building semi-trucks powered by batteries and hydrogen. Milton was initially seen as a visionary and forward-thinking entrepreneur who was on par with Elon Musk, at least in terms of ambition.

The rise and fall of Nikola is intricately tied to Trevor Milton and the increased adoption of EVs over the past decade.

The meteoric rise of Tesla from a company with a US$3 billion market cap in Jan 2012 to an earth-shattering US$ 1 trillion in Nov 2021 has forced traditional carmakers such as GM and Ford to adapt fast or face extinction.

But Tesla is not the only reason for the increase in EV adoption; over the years, increased support for plug-in vehicle purchases, improvements in technology and benefits of scale and stricter regulations against internal-combustion cars have all improved the appeal of EVs. At the time of Nikola’s founding, EV sales in the U.S. had already reached 100K+ while Tesla’s market cap had increased 50% from US$18.52 billion on Dec 31st, 2013 to US$27.95 billion on Dec 31st, 2014.

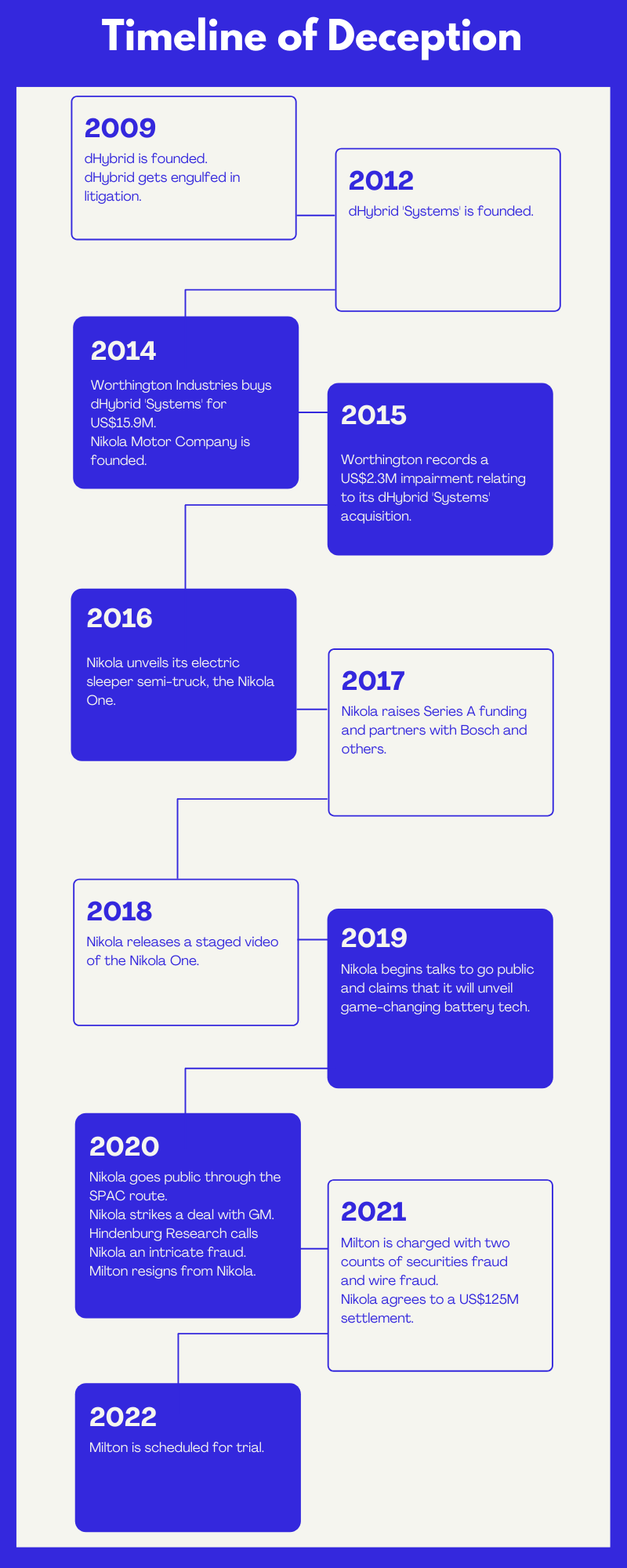

Timeline of Deception

How did Trevor Milton go from a Utah Valley University drop out to a billionaire aiming to disrupt the trillion-dollar global trucking industry?

2009

November: Milton made his initial foray into alternative energy vehicles with a company called dHybrid Inc, which specialised in compressed natural gas (CNG) conversion technology for diesel engines. Trevor brought his business experience while his partner, Mike Shrout, brought his tech expertise.

Shortly after launching the company, Milton struck a deal with Swift Transportation for the conversion of an initial batch of 10 trucks with an additional commitment to convert 800 trucks thereafter. Later, Swift Transportation sued dHybrid, alleging that the company delivered only five trucks that didn’t work and that dHybrid’s personnel misappropriated capital for personal use.

2012

With dHybrid engulfed in litigation, Milton started a new company with his dad, choosing an almost indistinguishable name, dHybrid Systems. Given the similarity of the names, Milton falsely claimed to prospective partners that ‘dHybrid’ had been in operation for years.

2014

Within two years, Milton found a buyer for dHybrid Systems. Worthington Industries, which specialises in industrial manufacturing, paid US$15.9 million for a 79.59% stake in the company.

That same year, Milton founded Nikola Motor Company.

2015

December: Around a year after the deal, Worthington Industries, upon identification of problems with its dHybrid Systems acquisition, recorded a US$2.3 million impairment in Q4 2015.

2016

Trevor spent two years lining up supplier deals to get the pieces together to assemble the company’s first truck with third-party parts.

May: On May 9th 2016, Nikola emerged from ‘stealth mode’, announcing that it had developed a product that would revolutionise the transportation industry.

August: Nikola claims to have engineered “the holy grail” of hydrogen technology for trucking. But despite such lofty claims, there was no in-house hydrogen capabilities and no hydrogen partners.

December: On December 1st, 2016, Nikola Motor Company unveiled its electric sleeper semi-truck, the Nikola One. During multiple points throughout the presentation, Milton can be heard saying that the Nikola One was a fully functioning truck, a fact he would later deny when Bloomberg exposed his lie.

2017

January: Riding on the success of the event, Nikola raised funds as a part of its Series A round. In the next few months, Nikola joined forces with companies like Bosch as well as other fuel cell and hydrogen partners.

All development work on the prototype stopped immediately after the show, given that the prototype helped the company raise funds and court larger partners who would actually be able to build them a working model.

2018

January: Given that it had already been more than a year since the Nikola One event happened and the company made no real progress on the development of the truck, Nikola posted a staged video where the Nikola One appeared to be cruising down a road whereas in reality it was simply filmed rolling down a hill.

2019

November: On November 19th, 2019, the day after Nikola began private negotiations to go public, Nikola proudly claimed that it had solved one of the greatest challenges facing the EV industry; a high-density battery. But as usual, Nikola didn’t develop the tech in-house but instead wished to acquire the tech from a battery company named ZapGo.

2020

March: Upon learning that ZapGo’s technology was vaporware, Nikola sued the company.

June: On June 4th, Nikola skipped the traditional IPO route and went public through a reverse merger with a special purpose acquisition company (SPAC). With rising investor appetite for EVs, shares of Nikola spiked.

On June 17th, Bloomberg published an article stating that, despite Trevor’s claims, the truck shown in the 2016 Nikola One event was not complete and was missing components. Milton admitted the fact that it was not complete but then claimed that he never said it was complete, despite stating the contrary. He later threatened to sue Bloomberg.

September: On September 8th, in order to stave off the pressure from analysts to spin off its electric vehicle business, General Motors (GM) struck a deal with Nikola, announcing a strategic manufacturing partnership. With GM bringing almost everything to the partnership, Nikola was just providing the brand value.

On September 10th, activist short-seller Hindenburg Research released a damning report calling Nikola an intricate fraud.

Soon an investigation by the Securities and Exchange Commission (SEC) and the U.S. Department of Justice followed.

On September 21st, Milton resigned from Nikola.

2021

July: The grand jury charged the disgraced founder with two counts of securities fraud and wire fraud.

December: Nikola agreed to a US$125 million settlement over charges that it defrauded investors after misleading them about its technical advances, products, and financial prospects.

2022

April: Milton is scheduled for a trial on April 4th.

Conclusion

Based on the fraudulent tactics of Theranos and Nikola, we can arrive at some of the red flags that investors can look out for when dealing with emerging startups with unproven technology:

- Obsession with secrecy.

- The frequent threat of legal action or retaliation against anyone who speaks out.

- The Board of Directors is light on people with actual expertise in the relevant field.

In both cases, investors burnt their hands because they failed to conduct proper due diligence. And even when due diligence is conducted, it is often not tailored to specific circumstances and is often done too late. Each new investor assumed that the earlier investors would have done their homework.

As far as Silicon Valley is concerned, Theranos is not a major topic when it comes to funding conversations, according to the Wall Street Journal. There’s no sign that the failed blood-testing startup has broadly changed how investors choose companies to fund or how those companies share their research. Holmes and Milton have laid bare the repercussions of Silicon Valley’s deeply flawed “fake it till you make it” approach, and while nothing is expected to fundamentally change the Valley’s culture, we’ve at least established a limit to faking it.

We try our best to fact check and bring the best, well-researched and non-plagiarized content to you. Please let us know

-if there are any discrepancies in any of our published stories,

-how we can improve,

-what stories you would like us to cover and what information you are looking for, in the comments section below or through our contact form! We look forward to your feedback and thank you for stopping by!

Next Article

[…] & Blogs Are Digital Business Cards the Future of Networking? Opinion & Blogs Lies, Deceit, and the Silicon Valley: Theranos and Nikola Opinion & Blogs Income tax on Bitcoin in India explained Opinion & Blogs […]