US-based Donut, a mobile app to save and earn high yield with DeFi, raised US$ 2 million in a new funding round on 22 June 2021.

Investors: The round was led by Redalpine, with participation from Inventures, Compound founder Robert Leshner, Entrepreneur First and a group of enthusiastic users, including the owners of the Washington Nationals baseball team. Donut’s total funding to date stands at US$ 3.8 million.

Purpose of the funding: The funds raised will be utilized to drive rapid user growth and product development ahead of planned additional funding in early 2022.

About Donut

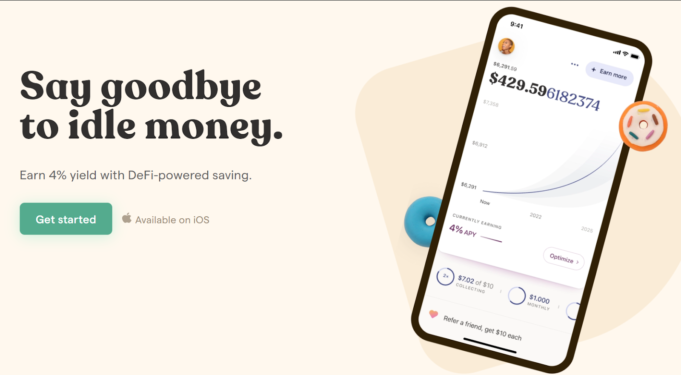

Founded in 2018 by Neel Popat, Donut is a user-friendly mobile app that helps you save & earn high yield with DeFi. Its mission is to build a more inclusive financial world by empowering anyone to grow their wealth with digital assets. Donut is dual headquartered in Los Angeles and Berlin.

Donut released its high-yield interest generating product in September 2020, after which its early user base and assets under management have seen 40% monthly growth, as per the claims of the startup. Donut aims to bring back an incentive to save that has been missing for decades. It believes in the future of decentralized finance (DeFi), a set of banking tools built on the Ethereum blockchain. Donut is also a mobile-first DeFi app that provides an elegant, simplified and easy experience that does not require technical know-how.

What the founder has to say: “Today, many people earn less than 0.1% in interest in their bank account. This simply is not acceptable. DeFi lending offers a new way to work your money harder, but a significant time investment is required to understand which services to trust. We’re making DeFi accessible to a broader audience, giving them the opportunity to earn 4-10% APY via three simplified options.” — Donut’s founder Neel Popat.

What the investors have to say: “DeFi needs an app like Donut where anyone, regardless of their crypto knowledge, can start investing in digital assets. Donut has become the essential next step in this industry and as a partner and investor, I’m thrilled that they are bringing DeFi to the masses.” — Robert Leshner, founder, Compound.

“DeFi is brimming with new solutions. However, it is still very disconnected from the traditional world of finance. Financial solutions in the future will be an eclectic mix of both traditional and DeFi. It will require trust, curation and ease of access to DeFi for a new financial paradigm. The Donut team is at the forefront of bridging this gap, building that additional layer and establishing that new financial paradigm.” — Harald Nieder, General Partner, Redalpine.

For more extensive analysis and Market Intelligence reports feel free to approach us or visit our website: Venture Capital Market Intelligence Reports | VCBay.

We try our best to fact check and bring the best, well-researched and non-plagiarized content to you. Please let us know

-if there are any discrepancies in any of our published stories,

-how we can improve,

-what stories you would like us to cover and what information you are looking for, in the comments section below or through our contact form! We look forward to your feedback and thank you for stopping by!

Next Article