On Monday, Wefox, a German insurtech startup, announced that it raised USD 650 Million in a Series C funding round. With this massive fundraising, the company reached a valuation of USD 3 Billion.

The list of investors who participated in this round was OMERS Ventures, Horizons Ventures, Merian, G Squared, Mountain Partners, CE Innovation Capital, Salesforce Ventures, Speedinvest, Eurazeo, Mubadala Capital, GR Capital and Seedcamp, CE Innovation Capital, Salesforce Ventures, and Speedinvest, who were the existing investors.

The round also saw the participation of some new investors like FinTLV, Partners Group, EDBI, LGT and its affiliated impact investing platform Lightrock, Jupiter, Ace & Co and Decisive.

“Not only have we raised a super large amount but also in a very fast time. It took us a total of four weeks to get all commitments in,” – co-founder and CFO Fabian Wesemann.

About Wefox –

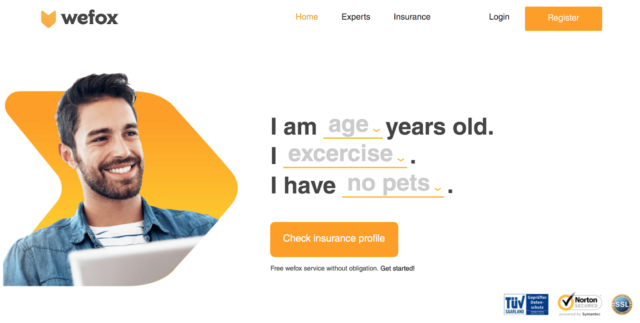

Wefox is a licensed insurtech company. It was founded and established by Dario Fazlic, Fabian Wesemann, Jonathan Seoane, Julian Teicke, and Teodoro Martino in October 2015, having its headquarters in Berlin.

The company focuses on selling insurance through intermediate and non-direct channels. It uses analytics by which it can achieve loss ratios better than the market. Wefox has gathered and developed a network of digital advisors across the boundaries of Europe which expands cross-selling, decreases churn, reduces acquisition costs and increases customer satisfaction.

Wefox believes that it can repeat and produce more revenue as it extends the business, all it needs capital to reach that goal. “We’re tackling that $5.2 trillion industry that has been stuck in the pre-internet era. We nailed how to disrupt it in our core market,” Julian Teicke, CEO, Wefox, said.

The company has 700 agents selling its products. It also has partnered with nearly 5000 brokers who can distribute its products. “While the rest of the industry seems to say that human agents are dead, we think they’re more relevant than ever,” Teicke added.

Wefox has progressive plans for decreasing administrative costs. The company has lately been focused on handling common processes by the algorithm by investing in automation. Currently, 80% of its process is handled automatically. According to the company, automation is a never-ending process as you have to adapt your work as you launch new products in the market.

Wefox has put together an AI team to prevent miscellaneous things from happening, and the team is seated up in Paris. For an insurance company, it is always about optimising every layer and steps of the customer’s journey and building a product that stands out from the one already available in the market.

We try our best to fact-check and bring the best, well-researched, and non-plagiarized content to you. Please let us know

-if there are any discrepancies in any of our published stories,

-how we can improve,

-what stories you would like us to cover and what information you are looking for, in the comments section below or through our contact form! We look forward to your feedback and thank you for stopping by!

.