Coinbase, which is set to go public on April 14th is one of the most highly anticipated IPOs of this year. Founded in 2012, Coinbase is the largest consumer-facing cryptocurrency exchange in the US. The startup, which is expected to be valued at a staggering $100 billion (USD), offers a plethora of services ranging from crypto wallets for retail investors to its own stablecoin backed by the US dollar. Coinbase brought in $1.27 billion (USD) in revenues last year with a profit of $332 million (USD).

Quick Facts

- Coinbase is a regulated cryptocurrency exchange in the US that facilitates the buying and selling of Bitcoin and supports 45+ cryptocurrencies.

- The startup will offer 114.9 million shares with the ticker ‘COIN’ in a direct listing on the Nasdaq exchange.

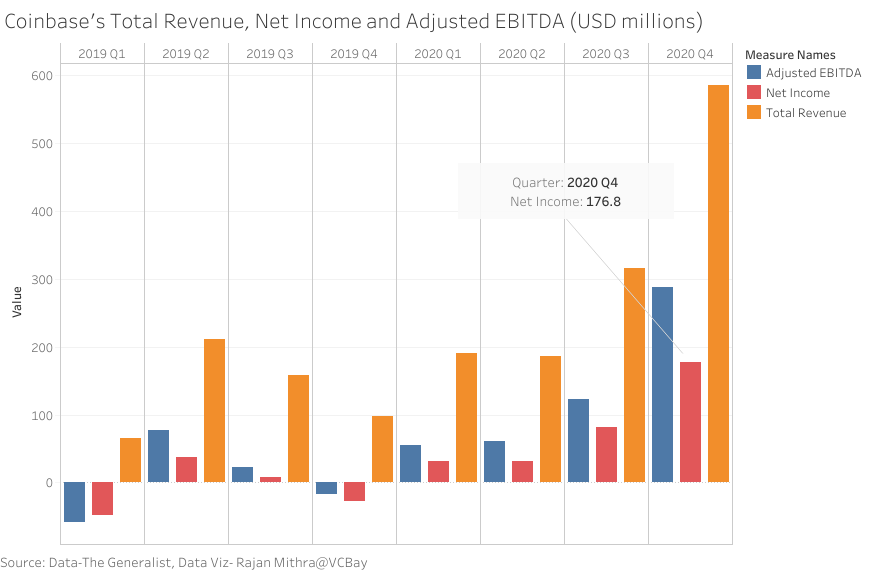

- On April 6th, Coinbase released its Q1 earnings, which further strengthened its future outlook. In Q1, the number of verified users grew 30% Q-o-Q from 43 million to 56 million. The startup raked in $1.8 billion (USD) in revenue in 2021 Q1 alone, more than the revenue for the whole of last year, with a net income of approximately $730 million (USD) to $800 million (USD).

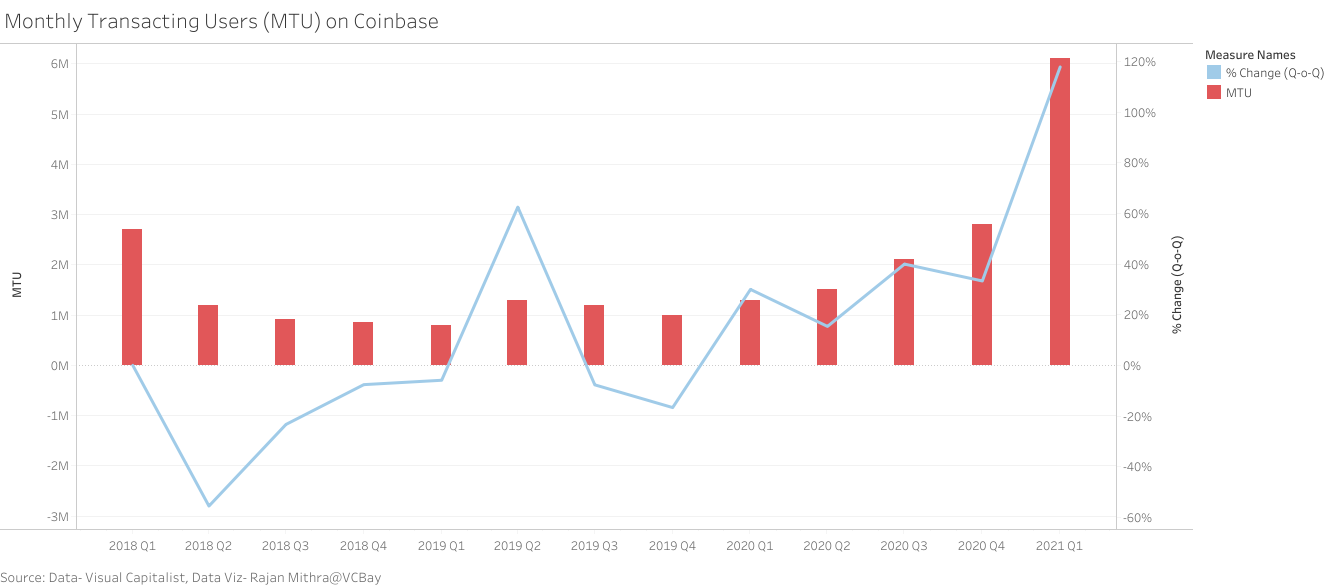

- Monthly Transacting Users exploded in 2021 Q1, which increased by 117% Q-o-Q, from 2.8 million to 6.1 million.

- Assets held on Coinbase increased by a whopping 147% Q-o-Q rising from $90.3 billion (USD) in 2020 Q4 to $223 billion (USD) in 2021 Q1. Trading volumes increased by 74% Q-o-Q to $335 billion (USD), up from $193.1 billion (USD).

- The startup has raised $847.3 million (USD) in funding in over 14 funding rounds and is backed by prominent investors such as Andreessen Horowitz and Tiger Global Management.

Market

The combined market value of all crypto assets is close to $2 trillion (USD). The first two months of this year alone has witnessed $2 trillion+ (USD) worth of crypto-asset trading volume and $700 billion (USD) in dollar-denominated transaction volume on public blockchain networks. The NFT craze resulted in $500 million+ (USD) in sales volume of digital token-based art and collectables. The increased acceptance and interest in cryptos has transformed the market in three key ways-

- The investments of Tesla and Square have paved the way for Bitcoin to be seen as a potential treasury asset by corporate America.

- The Office of the Comptroller in 2020 said that chartered banks in the US could service the crypto industry and use stablecoins and public blockchains for settlement. This can result in financial institutions exploring new business models in crypto in the near future.

- Given the potential of cryptocurrencies to provide high returns, the asset management industry will try adding cryptos to institutional portfolios.

Business Model

Coinbase primarily has two sources of revenue-

- Transaction revenue from institutional and retail exchanges. Most of this is through bid-ask spread on trades and other fees related to funding and withdrawing from a cash account.

- Subscription and services revenue from staking and custody services.

Most of the transaction revenue comes from retail investors, but the institutional clients contributed the highest amount of trading volume to the platform. Therefore Coinbase at the core is a consumer-driven startup. This could be potentially problematic in the following ways-

- The startup could be extremely sensitive to the price movements of cryptocurrencies as indicated by Coinbase’s S1 which states that revenue growth and Bitcoin prices are correlated. A repeat of the crypto winter of 2018 could hurt Coinbase’s revenue.

- Due to transaction revenue making up 85% of the revenue, Coinbase could be affected by other crypto exchanges that provide similar services at more competitive rates. Exploring alternate sources of revenue could help alleviate this problem. Other sources of revenue, also known as subscription and services revenue, are a function of the assets held on the platform.

- The crypto giant’s expenses are primarily independent of revenue, indicating that Coinbase has more fixed costs leading to higher operating leverage.

Conclusion

Coinbase has chosen the perfect time to go public with interest in FinTech, cryptocurrencies and retail trading hitting all-time highs. Cryptos are poised to be the next big thing and can be as revolutionary as the internet. The listing of Coinbase serves as a stamp of validation for the crypto industry and paves the way for mainstream adoption of cryptos.

For more extensive analysis and Market Intelligence reports feel free to approach us or visit our website: Venture Capital Market Intelligence Reports | VCBay.

We try our best to fact check and bring the best, well-researched and non-plagiarized content to you. Please let us know

-if there are any discrepancies in any of our published stories,

-how we can improve,

-what stories you would like us to cover and what information you are looking for, in the comments section below or through our contact form! We look forward to your feedback and thank you for stopping by!

Next Article

[…] Next Article […]