Distrito Federal, Mexico based Bank Fondeadora has raised USD 14 Million on 16th of March, 2021 in Series A funding round led by FinTech Collective, Gradient Ventures and Y- Combinator. The company has raised a total of USD 32.2 Million in funding over 4 rounds.

Investors: The capitalization of USD 14 Million funds took place in Series A funding round led by FinTech Collective, Gradient Ventures, Y- Combinator , Portag3, Google’s Gradient Ventures, an existing investor in the company, Gokul Rajaram and Anatol Von Hahn.

What the funding is for: The new funding would be utilised for the expansion and the growth of the company and recently launched card. According to the sources, the company’s main goal is to create an experience with money that generates joy, the company wants to free the 82M + Mexicans from non- existence or inefficient services.

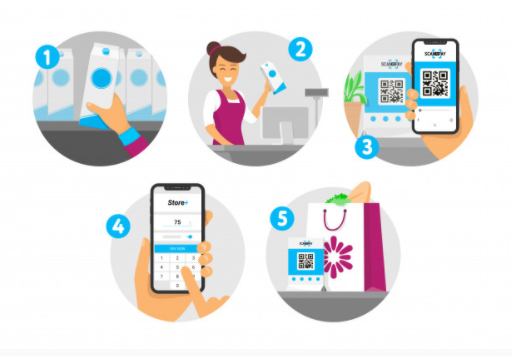

About the company: Fondeadora is a privately held digital banking services company that aims to eliminate the inefficiencies related to the traditional banking system. The company also offers a completely free debit card linked to a powerful app to save, use, and manage money. Its first product is a mobile app and an international MasterCard debit card where anyone can pay, store, and distribute money without complications. They have a work strength of 11-50 employees.They are building the digital alternative to the traditional Mexican banking system.The organisation also deals with various specialties like Neo Bank, Digital Bank, Banking, Credit and Debit

Founders of the company: Gus Alvarez Mareni, Norman Muller and Rene Serrano

Founded year: 2011

What the CEO has to say: “We received an unsolicited and unexpected term sheet three months after our Series A.”

“The company’s valuation has doubled with the round extension as well.”

“As most people still rely heavily on cash in Mexico, creating a challenger bank represents a good opportunity. In addition to customers from legacy banks, Fondeadora can become the first bank account for many people.”

“Fondeadora doesn’t operate any branch for its banking services. When you create an account, you receive a MasterCard debit card a few days later. There is no monthly subscription fee and no foreign transaction fee.”

“Like other challenger banks, your balance is updated instantly. You can choose to receive push notifications for transactions. You can also lock and unlock your card from the app.” — Norman Muller, CEO of the company.

We try our best to fact check and bring the best, well-researched and non-plagiarized content to you. Please let us know

-if there are any discrepancies in any of our published stories,

-how we can improve,

-what stories you would like us to cover and what information you are looking for, in the comments section below or through our contact form! We look forward to your feedback and thank you for stopping by!

For more extensive analysis and Market Intelligence reports feel free to approach us or visit our website: Venture Capital Market Intelligence Reports | VCBay.

Next Article

[…] Mexico based Bank Fondeadora raises USD 14 Million […]

[…] Next Article […]

[…] Next Article […]