US-based Autobooks, a business payment and accounting services platform, raised US$ 25 million in Series B financing on 12 March 2021.

Investors: The funding round was led by MissionOG, with participation from other investors including Renaissance Venture Capital, Detroit Venture Partners, Draper Triangle and TD Bank Group.

Purpose of the funding: The funds raised will be utilized by Autobooks to continue to expand its operations domestically and in international markets. It plans to accelerate its product innovation and engage with large enterprise banks. The startup will also be hiring, especially in the product development and customer success category.

About Autobooks

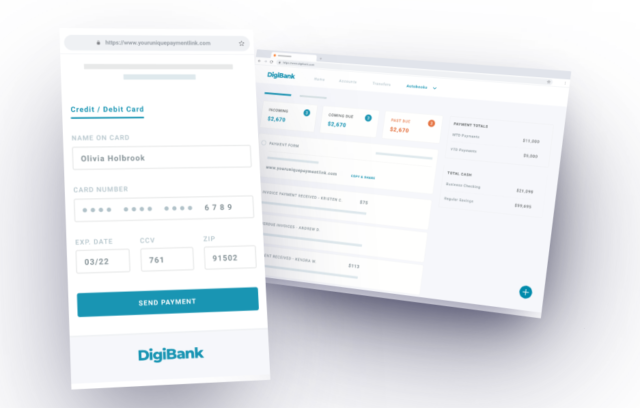

Founded in 2015 by Aaron Schmid, Steven Robert and Vincent Thomas, Autobooks provides small business banking solutions, making it simple to get paid online, manage cash flow and automate accounting. With the help of the platform, financial institutions can provide back-office services, directly embedding small business eCommerce platforms within their existing digital banking channels.

Autobooks allows small businesses to send digital invoices and accept payments from their financial institution’s online and mobile banking channels directly. It works directly with banks and credit unions. It has partnered with some leading internet banking providers to ensure turn-key deployments with a clear and measurable ROI. The fintech startup claims to have experienced a 232% revenue growth and an addition of 46 financial institutions to its customer base.

What the CEO has to say: “Last year was extraordinary for many reasons, filled with new challenges and opportunities in the fintech sector. Our team is humbled and inspired by the perseverance of small businesses – their creativity and resourcefulness to overcome obstacles, embrace technology and modernize their back-office against all odds. We hear these stories every day, recognize their unmet needs and aim to help restore banks and credit union’s role at the centre of their customers’ financial lives, combining modern technology, personalized service and contextual awareness to help businesses realize their full potential.” — said Steve Robert, CEO of Autobooks.

What the investors have to say: “The ability to receive payments online is vital for today’s small business. As we analyzed the market, we were impressed with Autobooks’ unique ability to successfully partner with financial institutions. These partnerships help redefine integrated receivables, bringing immediate and significant value to treasury and cash-management services and the small businesses who most need the help.” — Rob Metzger, General Partner at MissionOG.

For more extensive analysis and Market Intelligence reports feel free to approach us or visit our website: Venture Capital Market Intelligence Reports | VCBay.

We try our best to fact check and bring the best, well-researched and non-plagiarized content to you. Please let us know

-if there are any discrepancies in any of our published stories,

-how we can improve,

-what stories you would like us to cover and what information you are looking for, in the comments section below or through our contact form! We look forward to your feedback and thank you for stopping by!

Next Article

[…] Small business payment and accounting startup Autobooks raises US$ 25M […]