A Trillion Dollars

The Indian mobile payments market has rapidly evolved in the last decade and has become a battleground for Fintech firms trying to scale up and disrupt multiple industries. With Big Tech pouncing on the opportunity to have a piece of the pie, startup giants PhonePe and Paytm are bringing out the big guns to dominate India’s mobile payments industry, set to be worth $1 trillion (USD) by 2023, according to a report by Credit Suisse.

The industry got its first boost in Nov 2016 due to demonetization when Prime Minister Narendra Modi announced that Rs 500 (~USD 7) and Rs 1000 (~USD 14) notes were invalidated, millions turned to digital payments as an option. Introduced in 2016, Unified Payments Interface, an instant real-time payments system developed by the National Payments Corporation of India to facilitate inter-bank transactions, already has over 100 million users with over 800 million monthly transactions valued at approximately $19 billion (USD).

The pandemic has further cemented the position of digital payments as more people order online as they are cautious about venturing out. Nearly 75% of all Indian consumers reported increased usage of digital payments since the outbreak.

Uncharted Territory

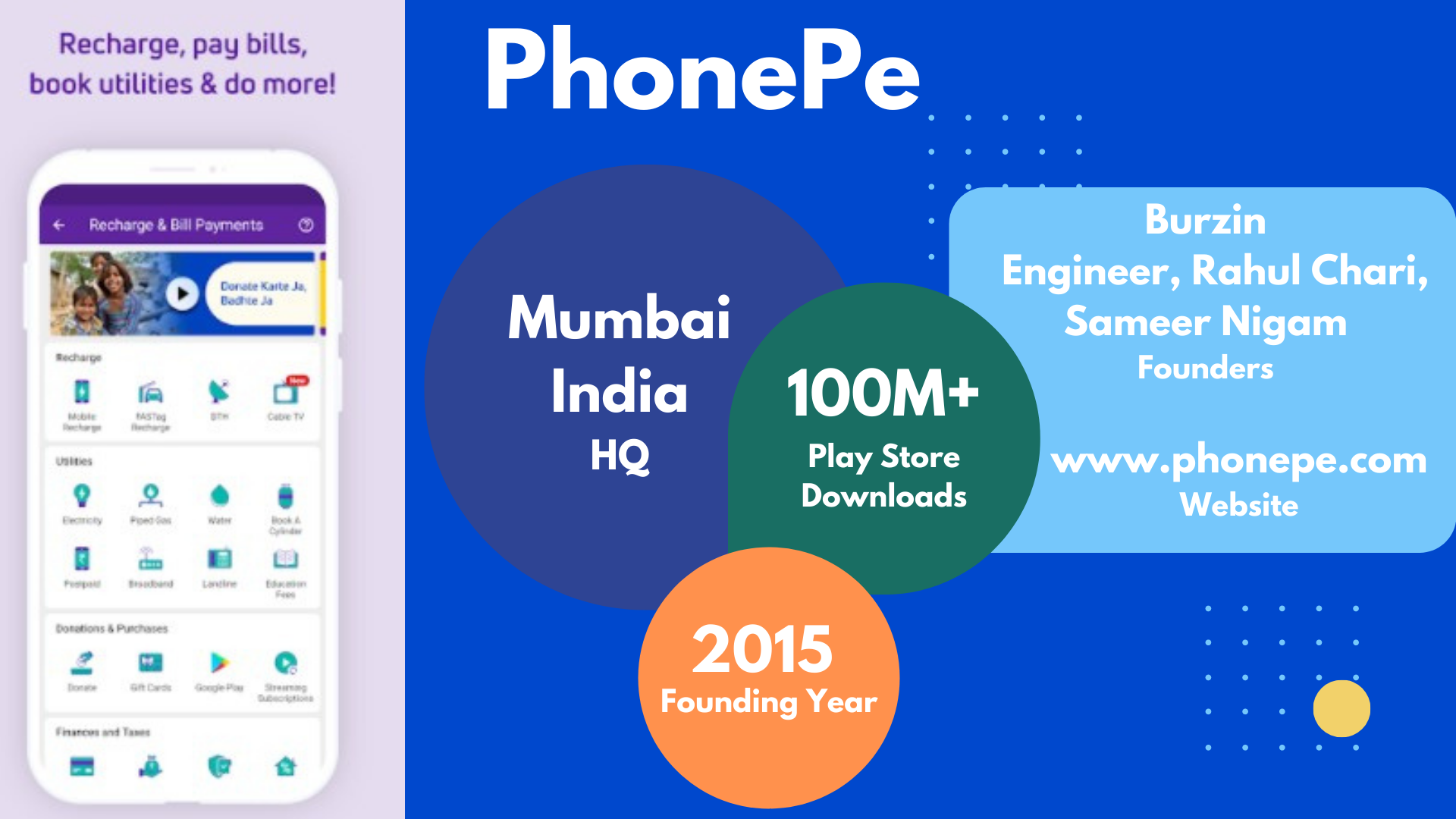

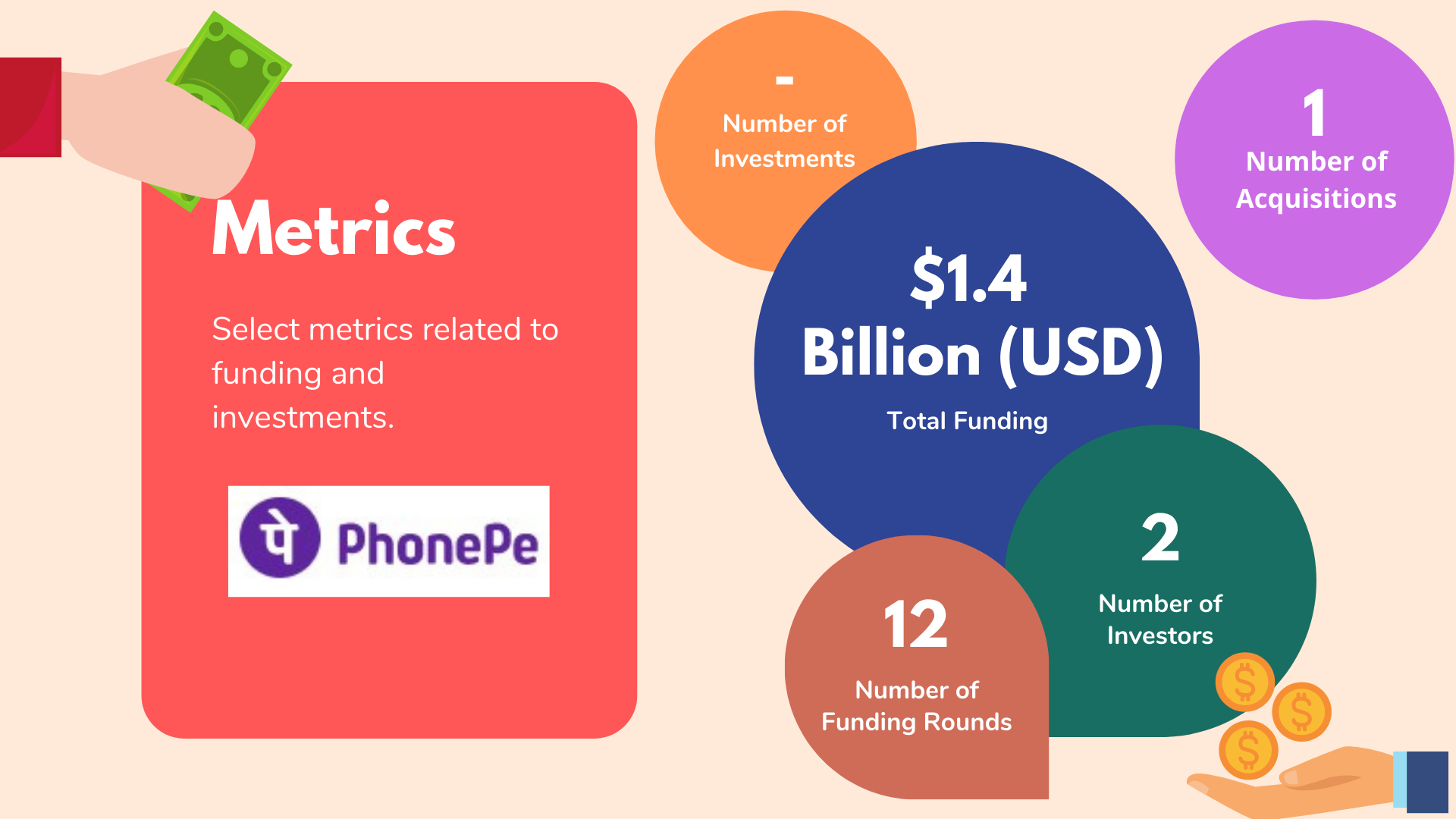

Flipkart led PhonePe, which has raised over $1.4 billion (USD) to date, is setting new records, with over 250 million registered users and a hundred million monthly active users (MAU) generating approximately a billion digital payment transactions in the month of October 2020.

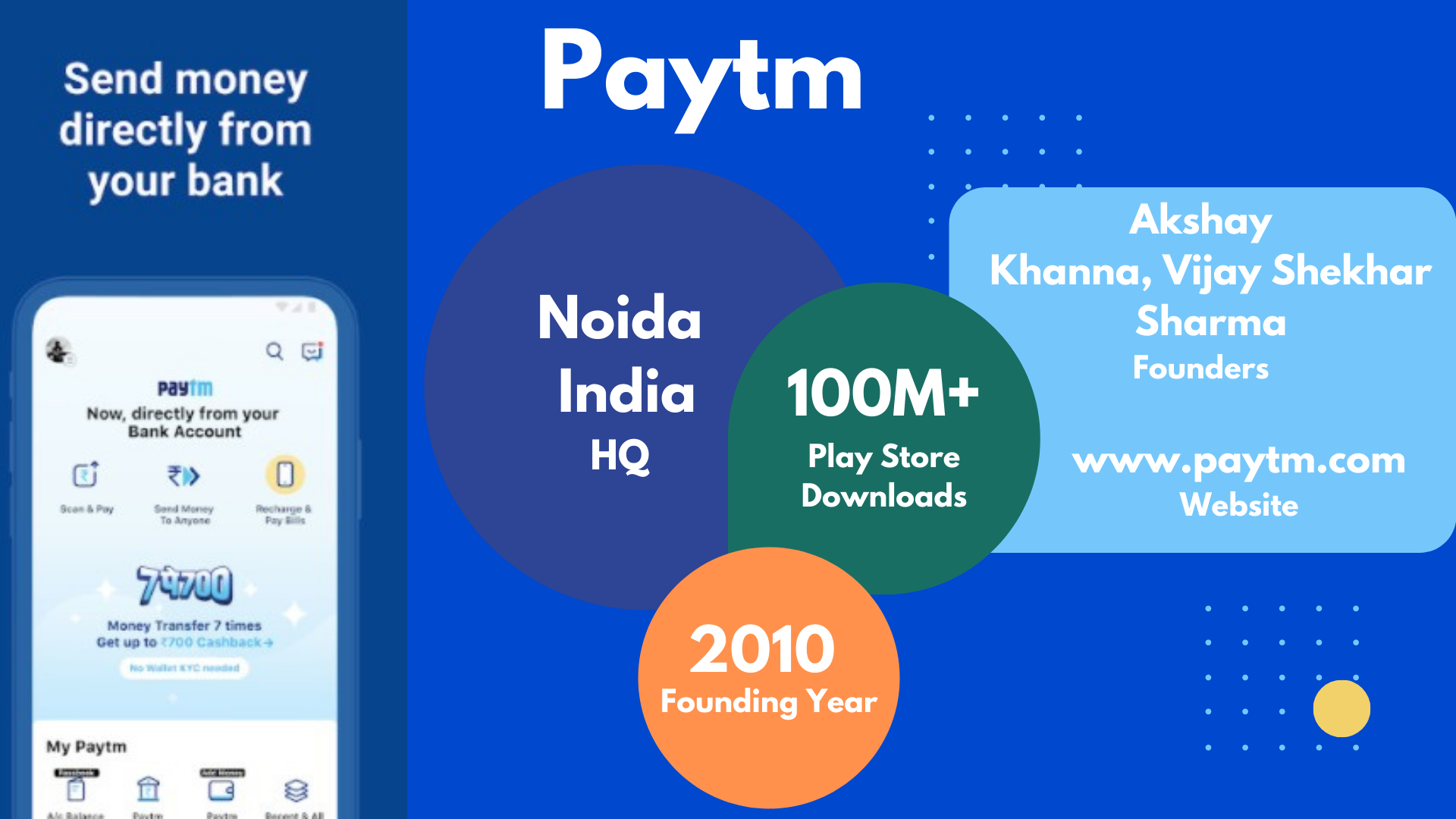

Noida based Paytm leads the way when it comes to daily active users with its 39 million daily active users (DAU), which is more than PhonePe and Google Pay which are reported to have 17 million and 19 million DAU, respectively.

The entry of Google Pay has changed the status quo in the thriving payments industry, with Google Pay and PhonePe together accounting for 83% of all UPI transactions in India for the month of May 2020. Figures from NPCI indicate that around 120 million UPI transactions occurred on Paytm in the month of May 2020, while similar figures for Google Pay and PhonePe stood at 540 million and 460 million, respectively.

Paytm with its reported revenue of around Rs 3000 crores (~USD 400 million), dwarfs PhonePe’s revenue of approximately Rs 200 crores (~USD 27 million), but still, the payment giants are not yet profitable, with Paytm reporting a net loss of Rs 3959 crore (~USD 549 million) for the financial year ended March 2019.

As the competition in the industry intensifies, the payment startups have to find new avenues for generating profit, both PhonePe and Paytm have ventured into a host of new areas aiming to gain a first-mover advantage.

Digital Gold

Aiming to revolutionize the way consumers buy gold, both PhonePe and Paytm are wooing customers to buy 24k gold on their platform on an instalment basis with investments starting at just Rs 1 (~USD 0.01) and with added doorstep delivery.

Digital gold has multiple advantages such as assured purity, safety, convenience and flexibility to invest as much as possible with an option to convert it to physical gold at the end of the investment period.

PhonePe has claimed to be the leader in this space, with over 35% market share with customers from 18,500 pin codes across India ordering gold through its platform. Paytm has seen a 50% increase in new users and a 60% increase in the average order value with total transaction volume on the platform surpassing 5000 kg of gold. The company has launched a new high-value transaction feature where users can buy gold worth Rs 1 crore (~USD 130K) in a single transaction on Paytm Gold, whereas previously, the limit was set at Rs 2 lakhs (~USD 3K).

Mutual Funds and Insurance

SEBI (Securities and Exchange Board of India), the regulator of the securities and commodity market in India, recently proposed that firms that can continuously maintain Rs 100 crore (~USD 13 million) of net worth should be allowed to start Asset Management Companies (AMC), with the higher net worth requirement applicable till these entities register five years of continuous profits. This is a welcome move for the payment firms which can enter a relatively untapped industry despite there being 40 AMCs currently operating in this space. A majority of the household financial savings are still held as cash or bank fixed deposits. As of the end of November, this year individuals held around Rs 15.6 trillion (~USD 200 billion) in fund assets [around Rs 10.45 trillion (~USD 149 billion) in equity-oriented schemes and Rs 3.7 trillion (~USD 50 billion) in debt funds] which represents about 8-9% of all household financial savings.

Paytm Money which offers services such as insurance and investing, has over three million users. PhonePe has over 20 categories under insurance and wealth management and claims to be the fastest Insurtech distributor within a record 9 months since it launched the insurance category. The company has various insurance products like car and two-wheeler insurance, hospitalisation insurance policy, domestic travel insurance and also plans to launch SIP (systematic investment plan) and insurance products in the form of sachets.

Other Features

PhonePe

- Pay at Stores: Allows users to find nearby mom-and-pop stores to buy essentials, pay remotely and get them delivered.

- Switch: An in-app service that allows users to access their favourite apps across different categories such as groceries, travel and food without the need to download them.

- ATM: Users can collect physical cash from nearby mom-and-pop stores up to Rs 1000 (~USD 14) a day and transfer an equivalent amount to the store owner. The service is aimed at reducing the distance travelled by users in search of ATMs and is currently available in 300 cities across the nation.

Paytm

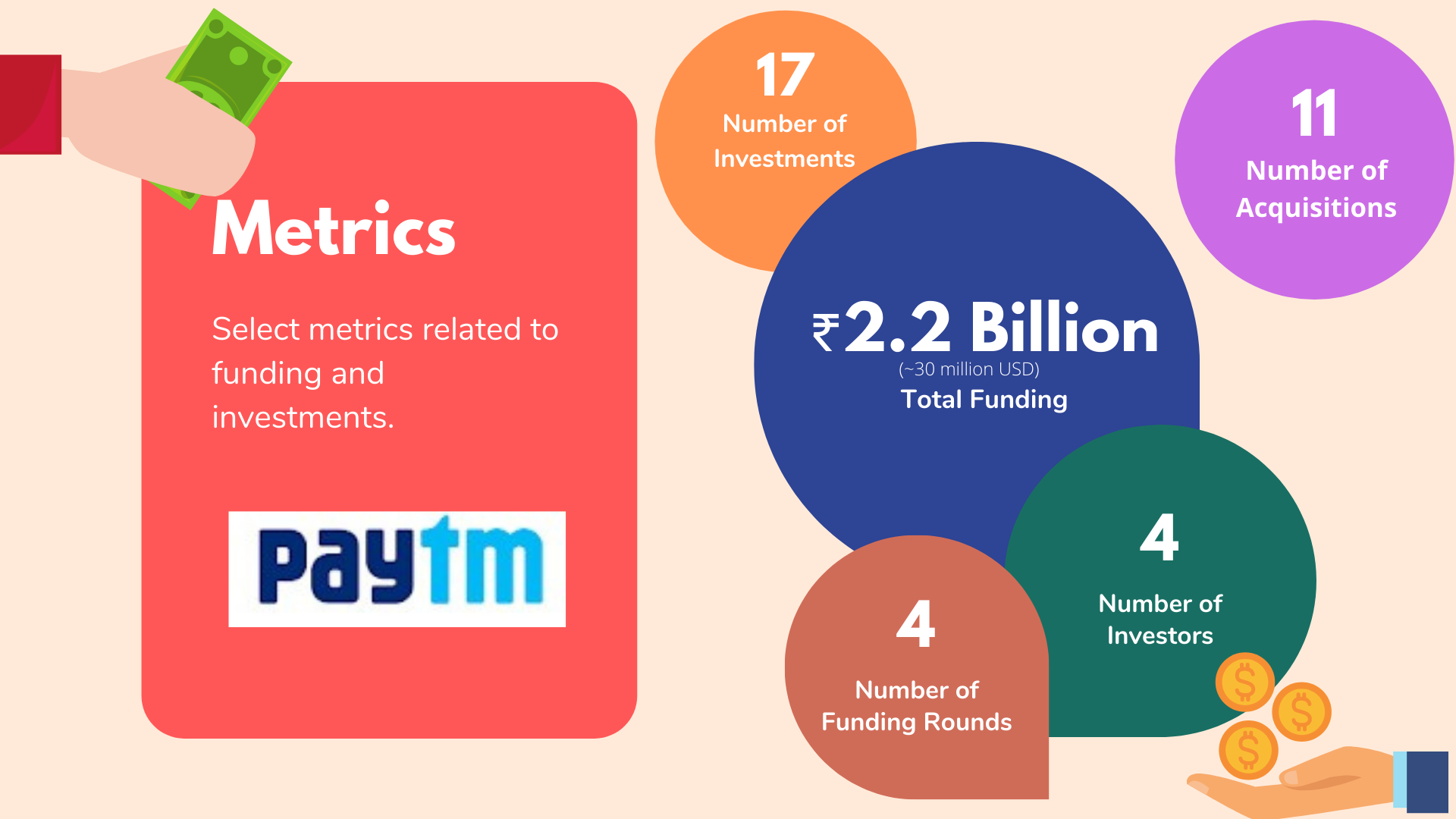

*Total funding includes only the capital raised by Paytm and

not of other ventures like Paytm Money.

**Paytm’s parent company One97 Communications Ltd

has raised 4.4 billion USD till date

- Postpaid: It offers its users an instant credit line for certain types of payments. It can be availed for the purchase of groceries and other essentials from nearby stores and from large players like Reliance Fresh and Apollo Pharmacy. The service has 7 million users, which are projected to more than double by the end of the current financial year. Credit is offered in 3 slabs- Postpaid Lite with a credit limit up to Rs 20,000 (~USD 300), Postpaid Delite and Elite offer credit limits ranging from Rs 20,000 to Rs 1,00,000 (~USD 1500) in monthly spends.

- Mini App Store: Similar to PhonePe’s Switch, Paytm offers users a way to access apps without the need to download them and plans to list around 300 services in the near future. With an aim to help small developers and businesses, the company offers a whole host of services such as a dashboard for analytics, marketing tools and free payment avenues like Paytm Wallet.

- POS Device: The pocket-sized Android POS (Point of Sale) device aimed at SMEs (Small and Medium Enterprises) costs Rs 499 per month (~USD 7) (30% lower than existing solutions) and comes with an inbuilt camera to scan QR codes. It is loaded with features including cloud-based software for payments, billing and customer management.

- Business-Khata (meaning accounts): A free to use service within its business app, helps merchants manage transactions, avail financial services and facilitates digital book-keeping.

Trials and Tribulations

Google Saga

In September 2020, Google removed Paytm from the Play Store, citing violations relating to its gambling policies. The tech giant said that its Play Store policy prohibits online casinos and other unregulated gambling apps that encourage sports betting in India and Paytm’s fantasy sports offering- (users choose their favourite players and win if their players play well) First Game (available as a standalone app too) was pulled from the store. It is important to note that sports betting is banned in India, but fantasy sports is not illegal in most states. The move was criticized by the founder-Vijay Shekhar Sharma, and the app was promptly restored in a few hours after Paytm made the necessary changes. Google also faced severe backlash when it decided to enforce a 30% commission on all payments made within the apps on the Play Store.

Yes Bank Saga

In March 2020, the Reserve Bank of India (India’s central bank) seized control of the fourth-largest lender in the country- Yes Bank, superseding the board of Yes Bank, citing deteriorating financial position and governance issues. RBI also imposed a moratorium on the bank, limiting the amount of withdrawals. This severely affected the startups that relied on the bank to process QR codes and to facilitate transactions through UPI. PhonePe was one of the startups affected, with its service being inaccessible to its users. The UPI services on the app were back online after 24 hours.

Conclusion

India’s digital payments industry, with its innovation and cutting edge technology, is democratizing the access to financial services to millions of individuals, empowering their dreams and safeguarding their future with a whole host of services, but the industry is overcrowded with dozens of players all vying for market share, so it remains to be seen as to who will be standing once the dust settles.

We try our best to fact check and bring the best, well-researched and non-plagiarized content to you. Please let us know

-if there are any discrepancies in any of our published stories,

-how we can improve,

-what stories you would like us to cover and what information you are looking for, in the comments section below or through our contact form! We look forward to your feedback and thank you for stopping by!

Next Story

[…] Next Story […]