The Los Angeles-based fintech startup Credit Key has raised US$ 33.85M in a funding round held in November 2020, from Greycroft, Bonfire Ventures, Loeb.nyc and other undisclosed investors.

Founded in 2015 by John Tomich, Credit Key is a B2B payments platform that works on the buy now-pay later model. For businesses, the startup offers a substitute payment solution that instantly provides financing for purchases at the point-of-sale. It undertakes credit risk and loan servicing, and buyers can avail of a transparent payment plan with competitive interest rates.

The startup said it expects the e-commerce market to reach US$ 1.8 trillion by 2022. More than US$9 trillion in B2B payments is processed in the U.S. each year, of which only US$1.3 trillion of those payments take place online, but the ratio of e-commerce transactions is still growing rapidly.

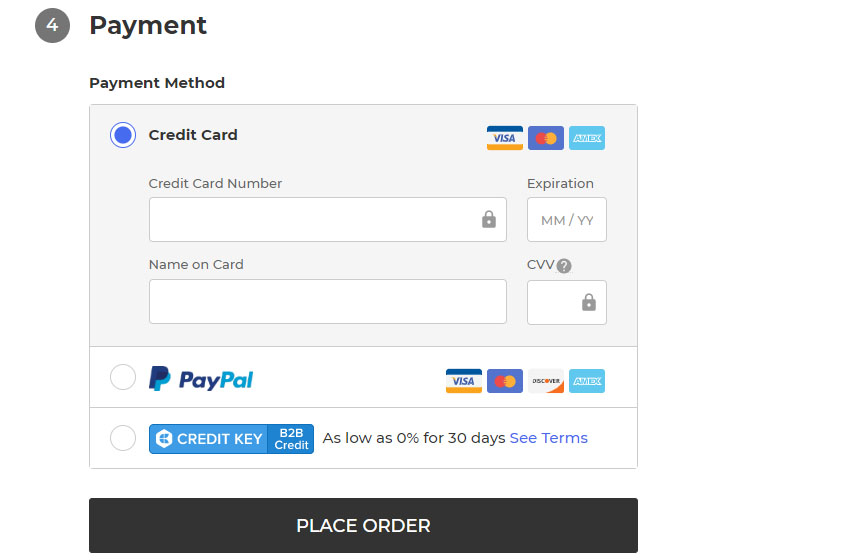

How Credit Key works is explained in the following steps:

- -B2B customer sees Credit Key as a payment option at e-commerce checkout.

- -They choose the Credit Key option, and in just a few steps, they obtain real-time approval.

- -They select the payment plan that is appropriate for them

- -Customers process their order, Credit Key settles the full amount with the e-commerce firm, and the customer pays Credit Key over time.

CEO John Tomich said B2B e-commerce remains to expand at a farfetched pace, but a vast majority of merchants still don’t possess the payment tools that their customers are asking for. As Credit Key equips more and more merchants with its point-of-sale financing option, the startup is continuing to see data that points to larger orders, fewer abandoned carts and enhanced customer attainment.

He further added that as small and medium-sized businesses increase online purchasing, they’re keen to find replacements to the limits of both traditional trade credit and the common credit card. The startup expects continued momentum and is thrilled to help small businesses as they work through the pandemic recovery and position themselves for the future.

About Greycroft

Headquartered in New York City and Los Angeles, Greycroft is a venture capital firm. The firm was founded in 2006 by Alan Patricof, Dana Settle, and Ian Sigalow and manages over US$2 billion in capital with investments in companies such as Bird, Bumble, HuffPost, Goop, Scopely, The RealReal, and Venmo.

Greycroft has invested in over 300 companies located in 45 cities internationally, with the majority of these companies headquartered in the United States.

We try our best to fact check and bring the best, well-researched and non-plagiarized content to you. Please let us know

-if there are any discrepancies in any of our published stories,

-how we can improve,

-what stories you would like us to cover and what information you are looking for, in the comments section below or through our contact form! We look forward to your feedback and thank you for stopping by!

Next Story

[…] Next Story […]