Amsterdam-based omnichannel platform as a service (OPaaS), MessageBird has bagged US$ 200M in a Series C funding round held in October 2020. The round was led by Spark Capital along with participation from Bonnier, Glynn Capital, LGT Lightstone, Longbow, Mousse Partners, and NewView Capital. Following the investment, Spark Capital general partner Will Reed will join the startup’s board.

MessageBird is now valued at US$ 3 billion. Proceeds from the funding round will be used to increase the size of its global team by three-fold. Further, expand into its main markets in Europe, Asia, and Latin America.

The MessageBird

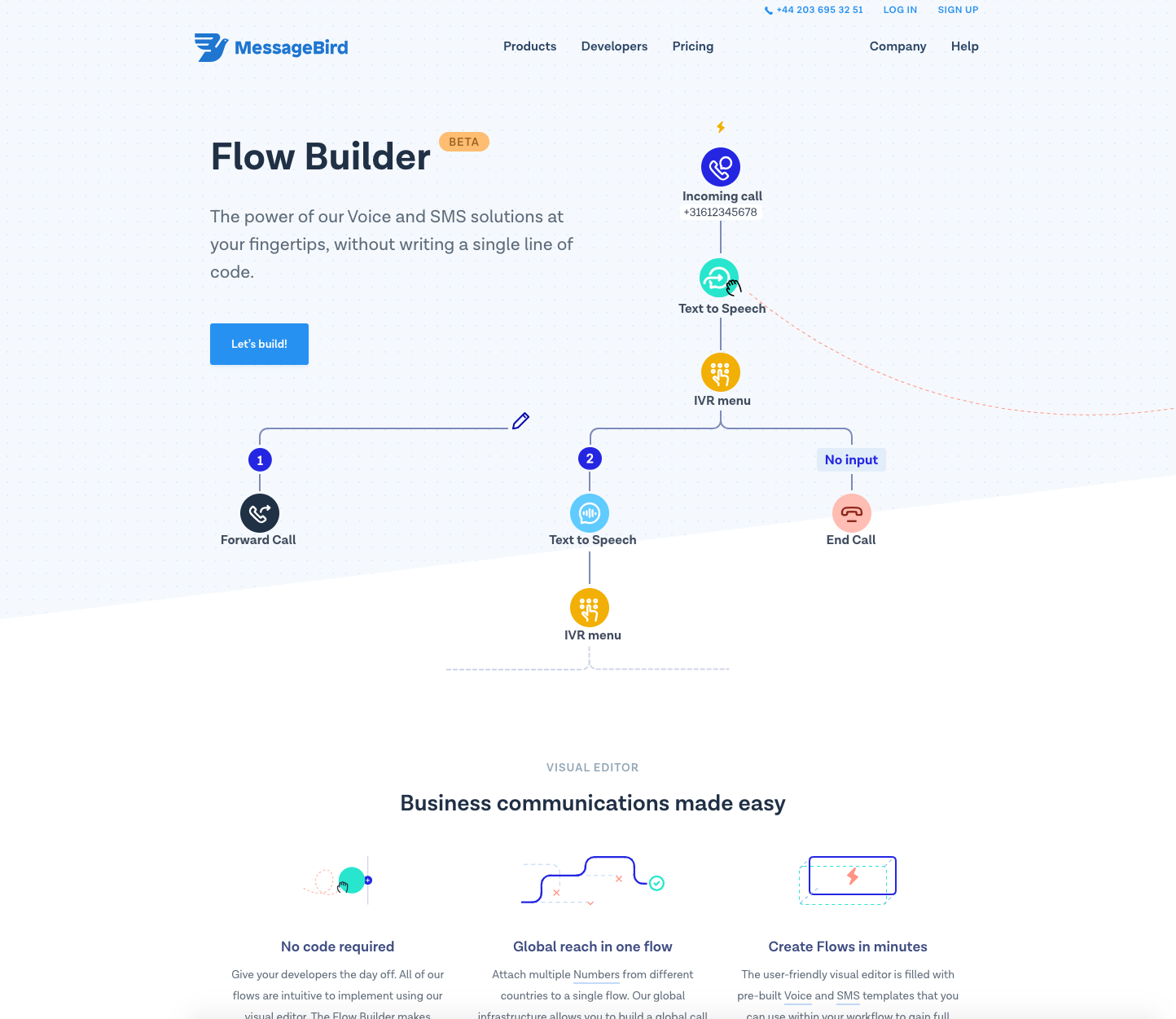

Robert Vis founded MessageBird in 2011. It offers a collection of both wide-ranging products and cloud communications application programming interfaces (API) to allow developers and businesses to communicate with customers. The startup has a range of solutions, including Inbox, to help businesses communicate and share media with customers; Omnichannel Chat Widget, enabling customers to communicate with their teams; as well as Flow Builder, a robotic process automation platform that empowers businesses to create personalized and extensive experiences.

The startup is developing from a communications platform-as-a-service company to an omnichannel platform as a service company.

It currently has over 15K clienteles including Lufthansa Airlines, Heineken, Hugo Boss, Uber, Deliveroo, and Facebook Messenger. In the Asian region, it also serves Tokopedia, Alibaba, Tencent, Shopee, ByteDance, WeChat, and Line.

CEO Robert Vis was quoted to say, “I think Asia is an exciting market, and one of the largest messaging-first markets in the world. So I think we have a unique role to play in helping businesses there make the transition to seamless omnichannel communications with their customers who are already using these messaging platforms at scale to talk to their friends.”

The startup has previously secured US$40 M in a Series B round held in 2019 from Atomico and Accel. It had also raised US$60 M in a Series A round held in 2017 from Accel, Atomico, and Y Combinator.

About Spark Capital

Spark Capital is a United States-based venture capital firm responsible for early-stage funding of multiple successful startups. Some of them are Twitter, Tumblr, Oculus, Warby Parker, and Slack. It has offices in Boston, San Francisco, and New York City.

The venture capital firm’s success can be credited to the fact that it maintains focus explicitly on technology startups in the media, entertainment, and mobile sectors. Additionally, data-sharing within the company happens in an organized and systematic manner so that all partners can work with a portfolio company, not just the partner allotted to that company.

We try our best to fact check and bring the best, well-researched and non-plagiarized content to you. Please let us know

-if there are any discrepancies in any of our published stories,

-how we can improve,

-what stories you would like us to cover and what information you are looking for, in the comments section below or through our contact form! We look forward to your feedback and thank you for stopping by!

Next Story.