The real-time risk detective platform for ACH payments, Nivelo announced on 6th October 2020 about receiving US$ 2.5m seed funding in a round that closed in mid-August. The funding round was led by FirstMark, Anthemis, and Barclays with the help of Dash Fund and some other investors.

The funding and future plans

With this funding, Nivelo has taken its first step as a company and is all set to come up with an alpha product and in-future plans of new services and products. Along with the funding announcement, they also launched a private beta version of a Risk Scoring API for payments. The co-founder of the enterprise, Eli Polanco, says that ACH (Automated Clearing House) payments are a big business in today’s world. Still, most of these are not yet updated for having fast and secure digital transactions. Digital payments are protected in real-time, but they aim at ACH payments, which are most commonly used in the US.

The importance of ACH transactions

Annually, transactions worth US$ 55 trillion are moved through the ACH channel but are still stuck in the inherited technology. With Nivelo, they want to update the associated risk component by developing an API set that enterprises can tap and understand the underlying risks for any particular transaction. They are trying to unbundle the risk assessment service and delivering it in the easiest way possible, i.e., in the form of APIs. These API’s can be embedded in the cases of critical payments. The company is already live with a few thousand present customers, although the number of paying customers is not yet specified.

Nivelo-protecting your transactions

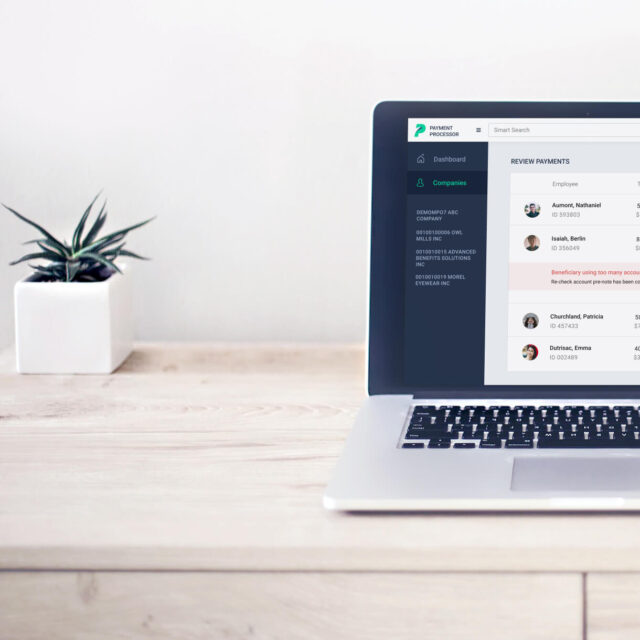

Nivelo is a newly founded company headquartered in the US focused on managing credit and debit payment risks with real-time and threat detection adaptive technology. Founded by Philippe Legault and Eli Polanco, it is designed to protect digital payments. Its restful API can be implemented just in a few lines of code to refine precise threat detection and avoid any penalties from ACH returns.

Nivelo API works in a four-step process, transaction initiation, transaction transmission to validate and provide spontaneous reviews, transaction scoring for the associated risks, and transaction validation. These steps are powered by Machine Learning techniques to identify cybercrime threats. The API bundle of Nivelo is built to avoid cyber threats and payment frauds, eliminate time-taking reconciliations, enable faster transaction processing, and increase the speed of funds availability. The model of Nivelo is concentrated on the basis of your historical data so it can provide the most accurate protection.

We try our best to fact check and bring the best, well-researched and non-plagiarized content to you. Please let us know

-if there are any discrepancies in any of our published stories,

-how we can improve,

-what stories you would like us to cover and what information you are looking for, in the comments section below or through our contact form! We look forward to your feedback and thank you for stopping by!