FinTech is the buzzword everywhere. It is not surprising to see that today brick-and-mortar financial institutions are scared of fintech startups. And why not? According to a report by Goldman Sachs, fintech may soon disrupt US$ 4.7 trillion worth of global financial services.

As the face of finance is undergoing a full make-over globally and fintech developments are breaking down barriers, a strategy good would be to consider these trends upfront. Fintech is developing at a fast pace and will be fine-tuned in 2020 to provide more security and satisfaction to customers.

Lets consider some of the major fintech trends to watch out for in 2020 –

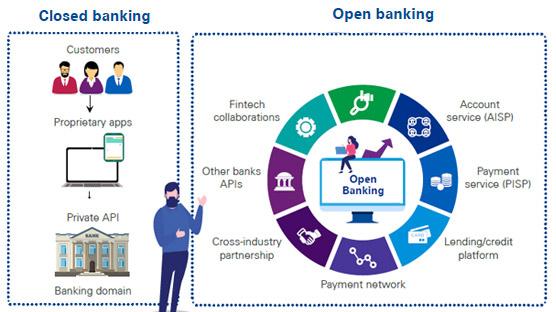

Digital Banking V2.0

Digital Banking refers to the digitalization of various traditional banking processes, from front-end to back-end. Numerous tasks that would take longer time to execute in the traditional system, are automated by processing data as well as administrative tasks with (mostly) the help of Artificial Intelligence. This leads to efficiency and cost-effectiveness.

Some of the main features of Digital Banking –

- Customers can make deposits remotely.

- Personalized money management services and online investment options.

- Customers can easily apply for loans as well as Fixed Deposits, Recurring Deposits etc.

- Less pressure on employees with respect to repetitive and time taking tasks.

Although, many traditional banking institutions are also not lagging behind. They have also started offering online services like account transfer and bill payments.

Digital banks are growing in numbers and revenue all over the world. Mobile banking is even more convenient. All the operations can be completed on a smartphone. Recently, Apple launched Apple Card with Goldman Sachs, while Facebook launched Facebook Pay, a payment mechanism that will work with Messenger, Instagram, WhatsApp and Facebook in selected countries.

The “Borderless” account by TransferWise which comes with a “Borderless Debit Card” that can be used in any country without burning funds in currency conversion or the offerings of Klarna, another European fintech startup to watch out for which has revolutionized the online payments space. Another startup which encourages savings is San Francisco based Chime, a mobile bank that offers no-fee and automatic savings accounts and early payday through direct deposit.

As people avoid going outdoors due to the pandemic, the revenue and profits of these banks are not going to slow down anytime soon. Hence, digital banking will continue to evolve.

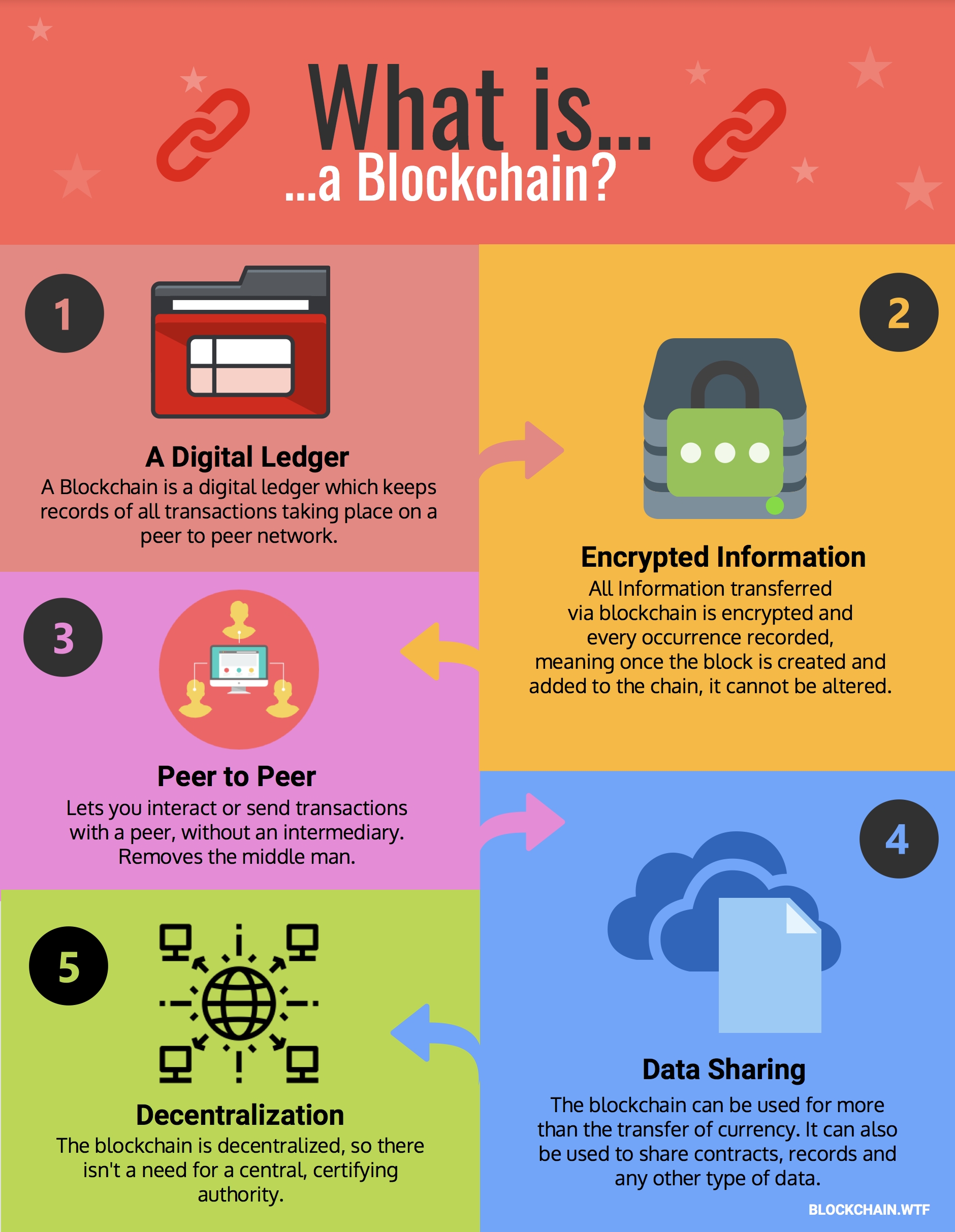

Blockchain

In the simplest words, Blockchain can be defined as a decentralized distributed ledger technology (DLT) that records the provenance of a digital asset. The DLT can help organizations do away with huge amounts of tedious record-keeping and hence, save money, streamline supply chains and disrupt the IT scene altogether.

Blockchain is quite promising as it reduces risks related to frauds and brings about transparency in operations. It has countless number of applications in almost every sector. It can be used to track financial frauds, automate trading processes, share medical records securely, track intellectual property of artists, to name a few.

Many companies in the finance sector are moving towards investing in blockchain innovations. Blockchain has disrupted the payments industry already and in no time, it will become a run-of-the-mill thing. Full-fledged integration of Blockchain in fintech is set to revolutionise the transactions and payments without the intervention of any intermediaries who often charge sky-high fees.

Some top blockchain technology companies are- Consensys (Develops enterprise blockchain applications and developer tools that are secure and efficient), ChromaWay (A blockchain platform delivering smart contract solutions for industries like real estate and finance), Accubits ( A leading blockchain development company providing services like blockchain blockchain maintenance, smart contract development and cryptocurrency wallet development).

Thus, companies must start researching, testing and finally start implementing blockchain technology if they want to remain at the top of the game.

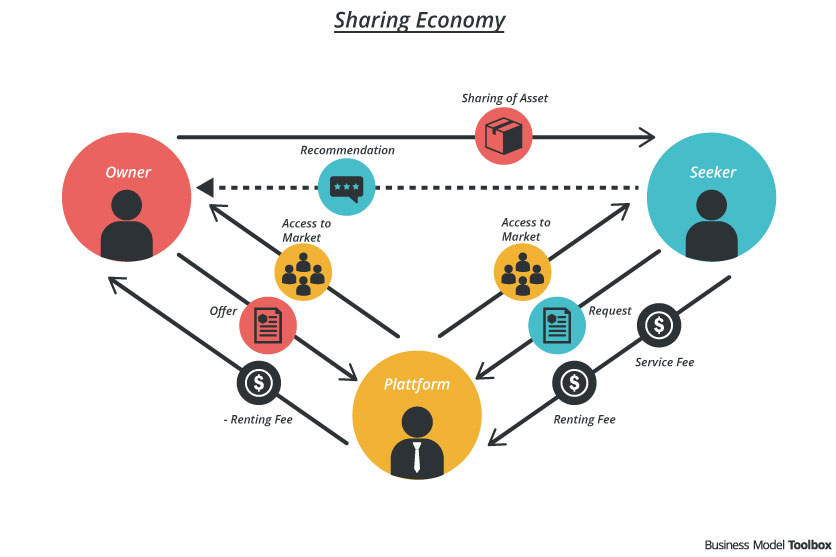

Sharing Economy

You rent a bicycle to go to work, you hire an Uber or Ola to go home, you order food from Zomato, you rent clothes from Tulerie. This is all because of your compassionate values, or ‘sharing’.

We are living in an expensive world. Everybody wants to save money. Because, who knows when a pandemic is going to hit us? People have become smarter and they need smart solutions. Thus, many startups have emerged offering a solution based on sharing.

The sharing economy is peer-2-peer economic model that includes acquiring, providing, or sharing access to goods and services that is facilitated by a community-based online platform that connects buyers and sellers. It involves the use of idle assets and services or facilitates collaboration. The sharing economy is continuously evolving with new ideas and innovations.

There is a huge potential for sharing economy in fintech, especially in investing and lending. Small investors and emerging businesses can be brought together with an alternative to the traditional issue of stocks and bonds. Peer-to-peer lending can extend to consumer finance. According to PwC reports, the sharing economy is expected to grow in excess of US$ 300 billion by 2025. Some fintech companies in the sharing economy include AirBnB, Lending Club, Rent the Runway among others.

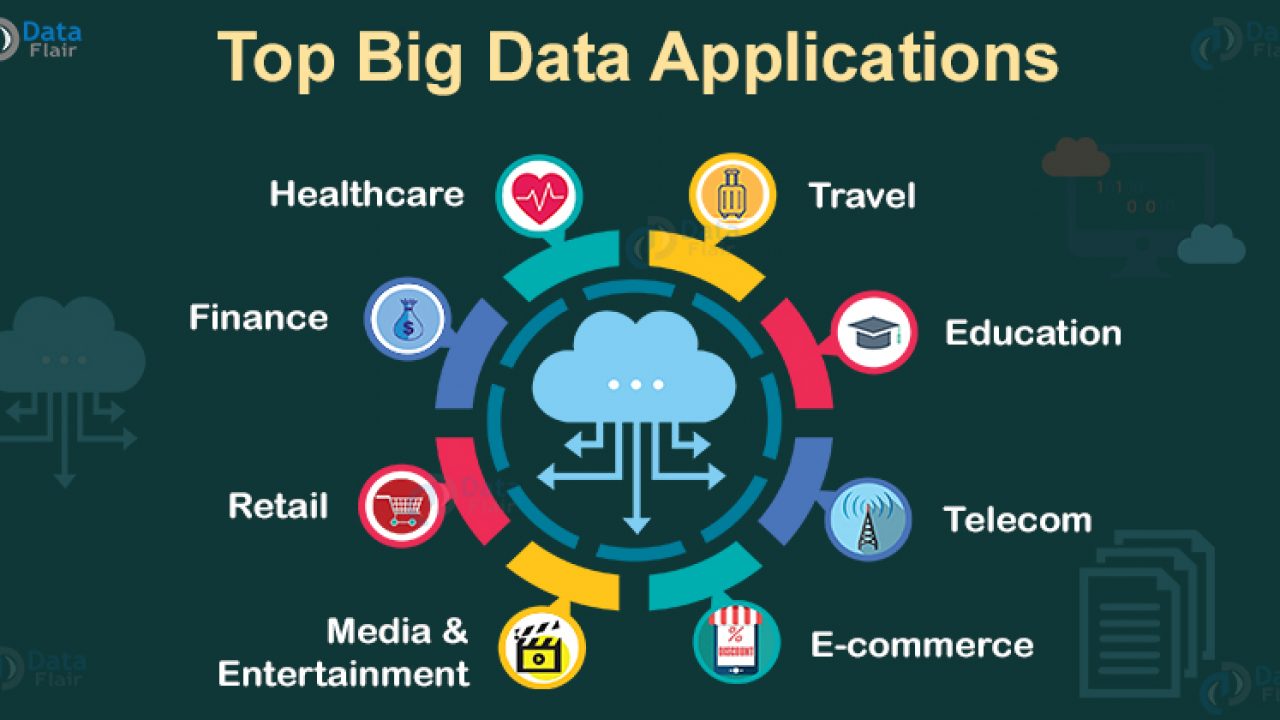

Big Data

The world of big data is enormous and also endless. Big Data refers not only to the quantity of structured and unstructured data that is available, but also the technology that helps in the analysis of certain patterns in the data. It has enabled the availability and access to the analysis and processing of data using a pay-per-use system rather than an upfront investment.

Big data has helped organisations to adopt better decision-making techniques and given them better insights on various issues or strategic moves. Some tools that are used to manage huge data are – OpenRefine, WolframAlpha, Import.io, Tableau.

Financial sector uses big data for various purposes- collecting and managing data of customers, one-to-one targeting, detect fraud, reduce business risks, achieve customer loyalty etc. It is expected that by 2025, big data revenue will rise to more than US$ 123 billion.

We try our best to fact check and bring the best, well-researched and non-plagiarized content to you. Please let us know

-if there are any discrepancies in any of our published stories,

-how we can improve,

-what stories you would like us to cover and what information you are looking for, in the comments section below or through our contact form! We look forward to your feedback and thank you for stopping by!