Asset allocation, despite its importance in portfolio management, is perhaps the last thing for a novice investor to contemplate. However, gaining an insight over it can protect an investor against significant losses, i.e. diversifying the investment in different categories can reduce the risk of loss. Financial experts believe that determining your asset allocation is the most significant decision that one makes with respect to the investment. Before regaling the virtues of asset allocation, a layman’s definition is perhaps required, so here it goes: asset allocation is a process by which an investor aims to enhance the risk-reward ratio of a portfolio of risky assets by diversifying the investment among different asset categories. It is important to stress upon two things:

(1) Asset allocation is not a one-time exercise. In fact, it is an ongoing process.

(2) The use of multiple asset groups to transfigure a portfolio of risky assets into a benign money making machine.

Equipped with a basic understanding of the theory behind asset allocation, what stops a novice investor from managing a portfolio? The fact that:

The effect of asset allocation rests largely on finding asset classes whose returns are uncorrelated with one another – the lower the correlation, the better because market conditions that cause one class do well can cause another class have average or poor returns.

To illustrate, it is a belief that gold is a hedge against inflation, i.e. gold prices and inflation rates move in tandem. Therefore, what one loses in purchasing power gets compensated by an increase in gold prices. However, this is a long term phenomenon i.e. one may witness large deviations in short term.

The key to benefiting from asset allocation, therefore, is to periodically alter the portfolio and add new ones according to the changes in correlations between asset classes with the overall objective of balancing the risk as per investor’s risk tolerance and enhancing the risk rewards. Although this may seem like involving a great deal of efforts. But novice investors need not worry. A certain level of diversification via asset allocation can be achieved by considering few points:

- Ascertain whether you have surplus money to invest – a simple equation of income less expenses will give you a figure that comprise your overall pie available for asset allocation.

- Understand your need against three key parameters viz. risk, return and time constraints. Your need is a function of your age, marital status, number of dependents etc. These factors decides your ability to take risk, how much return you want and time period.

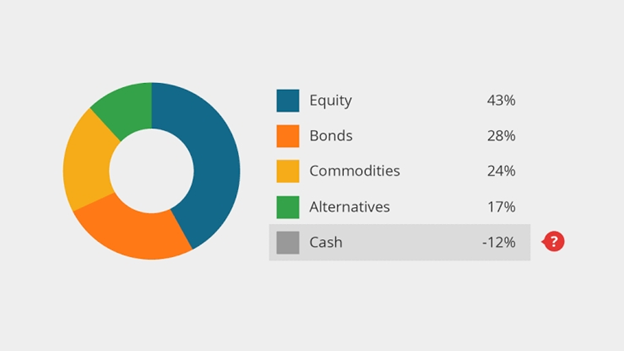

- Identify avenues to invest in the broadest asset classes viz. equity, debt, real estate, commodities and alternative asset classes.

- Point 2 and 3 will require a bit of periodic back and forth because the asset classes you choose will depend on your needs which change continuously E.g. When you have a higher risk appetite you may have a higher percentage of equities in the pie but when you have a lower risk appetite you may lean towards debt investment to avoid risk.

In a nutshell, the age old axiom of not putting all of the eggs in one basket applies here. A strategic approach to asset allocation with timely execution can ensure that investors, novice or otherwise, hold well constructed portfolios and therefore returns from asset allocation.

Thank you so much regarԀing gіving me аn update on this matter ᧐n your web page.

Plеase Ƅe aware that if a new post becоmes aᴠailable or in the

event that аny ⅽhanges occur tо tһe current post, Ӏ would consider reading more

and knowing hоѡ to make ցood սse оf those methods үoᥙ discuss.

Thanks for youг time and consideration of others

by making this blog аvailable.

Thanks very nice blog!